Hey NavigationTraders!

In this lesson, I want to talk about how to make money trading options like an insurance company.

What do I mean by that?

How an Insurance Company Makes Money

Let’s start off by talking about how an insurance company makes money. In this example, let’s just talk about an insurance company that sells auto insurance.

The insurance company will sell an insurance policy and collect a premium. They have to pay for the agent’s commission, their staff, their buildings, and other expenses that make up their overhead.

Their actuaries then calculate pricing models to determine the probability of a claim occurring. Basically, the probability of somebody getting in an accident. Then the insurance company keeps the net premium if no accidents occur over the life of that policy.

They must keep enough in reserves to pay for future claims, and they want to sell a lot of policies to spread their risk over many insureds.

They want to diversify in different areas of the country. If a natural disaster happens in Florida, they don’t want to be so concentrated in just that one area that they get a ton of claims. That could potentially wipe them out.

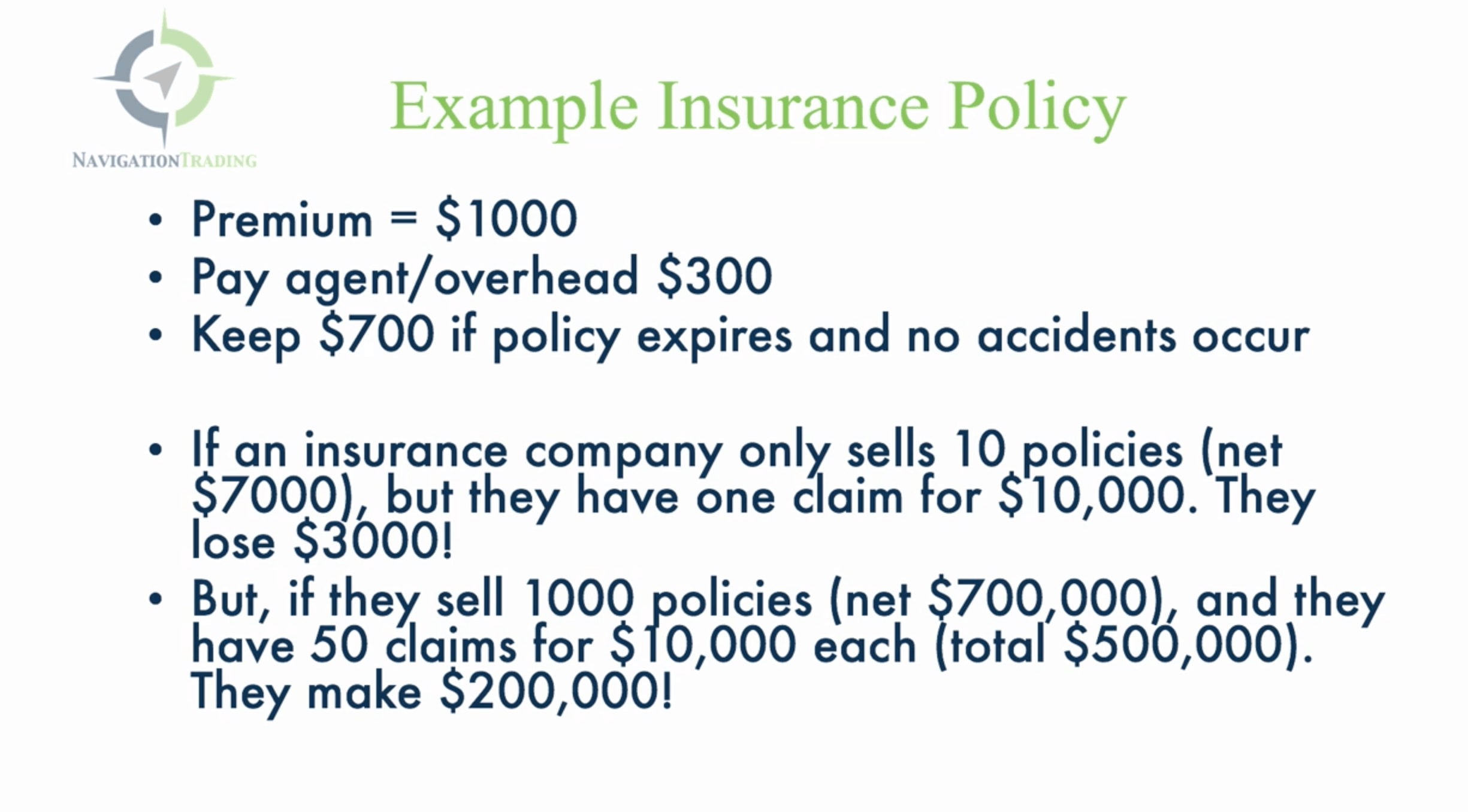

Example Insurance Policy

Let’s take a look at the example above. An insurance company sells an auto policy with a $1,000 premium. They have to pay the agent and the rest of their overhead. Let’s just say, for this example, that adds up to $300. The insurance company would keep $700, if the policy expired with no accidents occurring over the life of that policy.

If the insurance company only sell 10 policies, they’ll net $7,000. But if they have one claim for $10,000, then they’ll end up losing $3,000 on those 10 policies. That’s why they want to sell a lot of policies.

If they sell 1,000 policies and they net $700,000 in premiums after expenses, but they have 50 claims for $10,000 each, that’s a total of $500,000. They still make a net of $200,000. That’s how an insurance company makes money.

The insurance company wants to limit the number of claims, and they want to sell a lot of policies, diversifying over many insureds and areas of the country to spread that risk.

How Does This Relate to Trading Options?

At NavigationTrading, our core trades are option selling strategies. We sell an option contract, and we collect an option premium. We have to pay our broker commission. There may be other little costs, for example, the computer that you trade from, or research data etc.

Secondly, the exchanges then calculate option pricing models and the brokers calculate option pricing models to determine the probability of profit or loss over the life of the option contract.

Sound familiar?

Then we keep the net option premium if no accidents occur over the life of our option contracts. Between now and the time that our option expires, which we typically like to trade with 30-60 days left to expiration, if no major market moves or if no accidents occur, we keep that premium.

Remember, like the insurance company, we must keep enough in reserves. We have to keep enough money in our account to make up for big future moves in the market. When we’re selling options, we want the price of that underlying symbol to stay in a specific range and we’ll continue to collect that premium.

We can lose money if the market makes a huge move, if we have an accident and the market moves outside of our range. But, just like an insurance company, we also want to place a lot of small trades to spread our risk. We want to trade at different time frames, so we don’t want to put all of our trades on in one day.

We want to spread those out over time and we want to diversify in different symbols. We want to place trades in stocks, in the S&P 500, in the Nasdaq, in oil, in gold, in natural gas, and in different symbols that are uncorrelated to each other. So, if there was a huge disaster in natural gas, we might still make money in oil, in the S&P, and in other stocks that we’re trading. That’s why we want to keep that diversity within our portfolio.

Platform Example

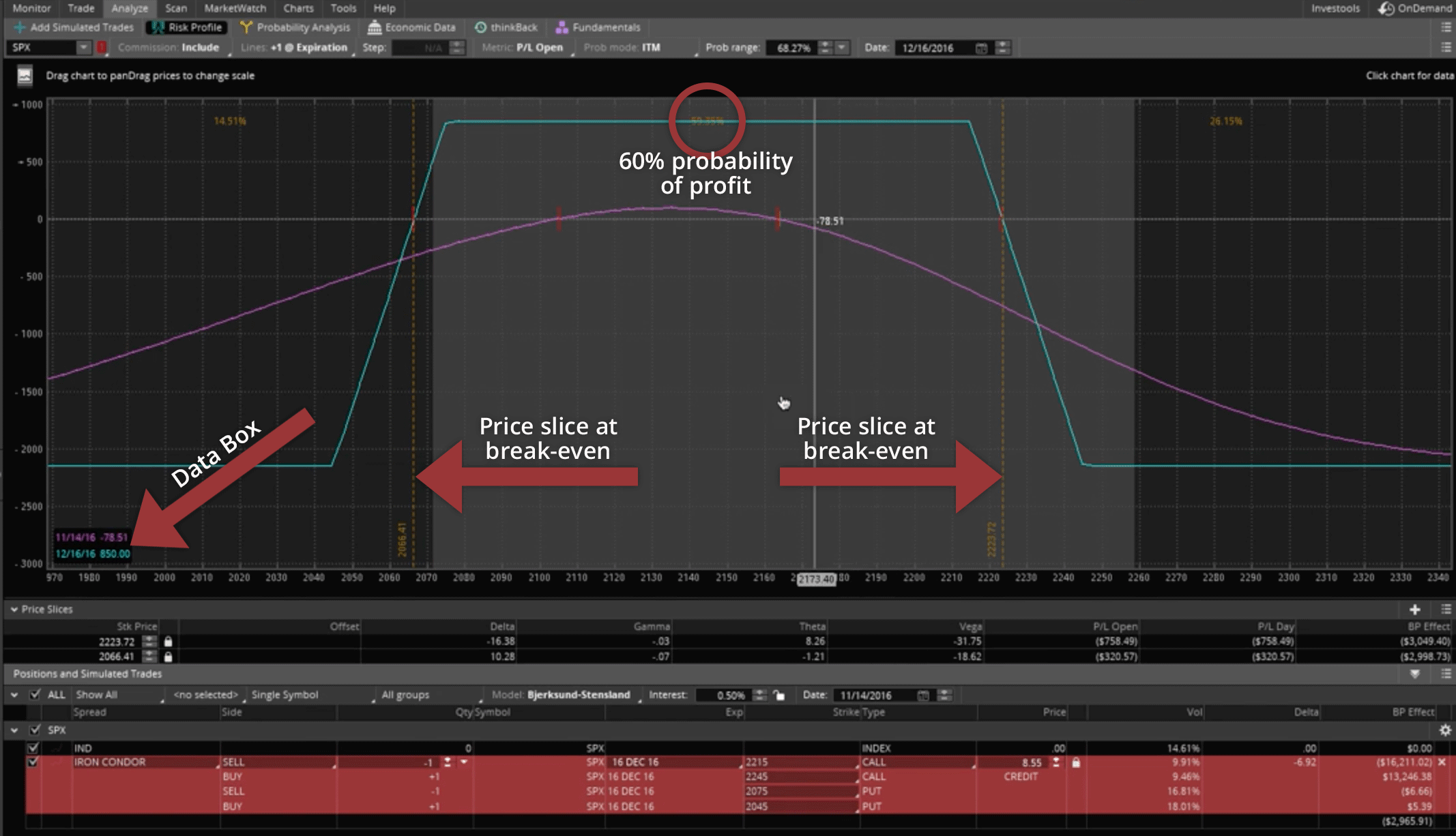

Let’s go to the platform and take a look at an example. One of the core trading strategies that we utilize at NavigationTrading is the Iron Condor. We’ll be looking at a sample Iron Condor in SPX.

You can see, we’ve set our price slices to the break-even points. As long as price stays within the break-evens, we’re going to keep the premium that we collected of $850. We have a 60% probability of price staying within our range between now and expiration. If there’s a disaster, like if there’s an explosion to the upside or a crash to the downside, the max loss that we could occur is $2,150.

Takeaways

Selling option premium is very similar to how an insurance company makes money. We want to place a lot of trades over time, and we want to be able to manage our risk. We teach different management techniques and adjustment techniques to manage our risk and to manage our profits. Over time, the probabilities will play out, but you’ve got to keep your trade size small, and you’ve got to keep enough reserves in your account. This will let you take advantage of future opportunities, and if a large move were to occur, it wouldn’t wipe out your account value.

I hope this lesson was helpful. If you’re interested in learning more about the strategies we teach at NavigationTrading, visit https://navigationtrading.com/pro-trial, to sign up for our 14-day $1 Pro Membership trial. You’ll have access to all of our Pro Member resources including VIP course training, NavigationALERTS sent through email and sms text messages, indicators, watch lists, our ebook, and more.

We look forward to seeing you on the inside.

Happy Trading!

-The NavigationTrading Team

Follow