Hey NavigationTraders!

In this lesson, I want to talk to you about the top five reasons to trade options versus stocks.

First, I’ll review the five advantages, then we’ll jump onto the platform and take a look at a real life example.

Top 5 Reasons to Trade Options Vs. Stocks

- Leverage – You can use much less buying power and achieve very similar results with options versus stocks.

- Lower Your Risk – Options were actually designed to limit, or hedge against risk. And you can define the exact amount of risk that you want to take with options before you even place the trade.

- Trading stocks is a 50/50 bet – No matter what support and resistance lines you use, or which technical indicators you think give you an edge, trading stocks outright as a 50/50 bet.

- With options, we don’t need to focus on market direction – We don’t have to bet whether the stock is going to go up or down, we can make money regardless if it goes up, down, or trades sideways.

- Options can create a very high winning percentage – Not only does that benefit you mentally as a trader, but it also gives you that consistency, those consistent profits, so that our profit and loss doesn’t look like a roller coaster ride.

Example in Apple Stock

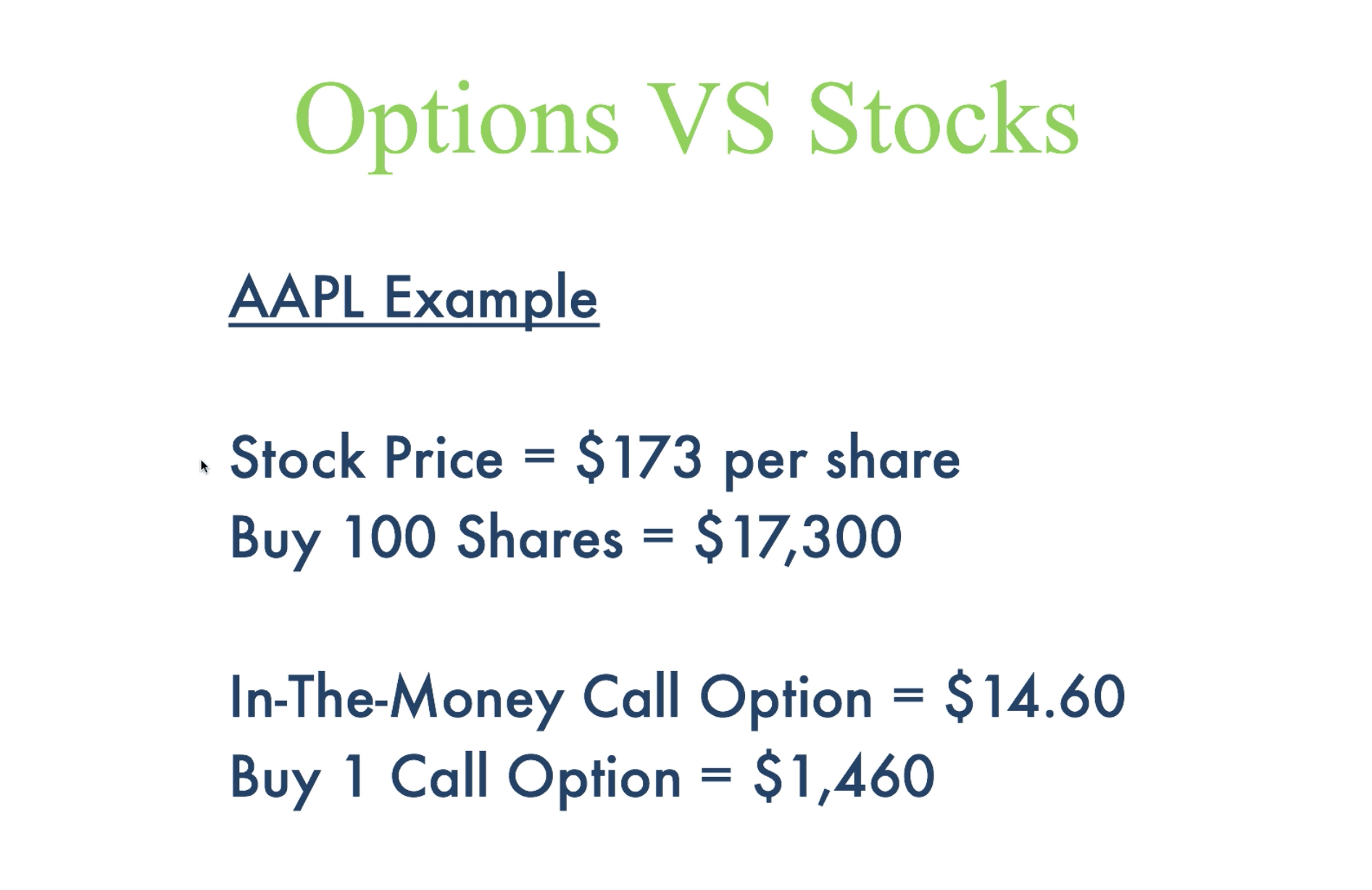

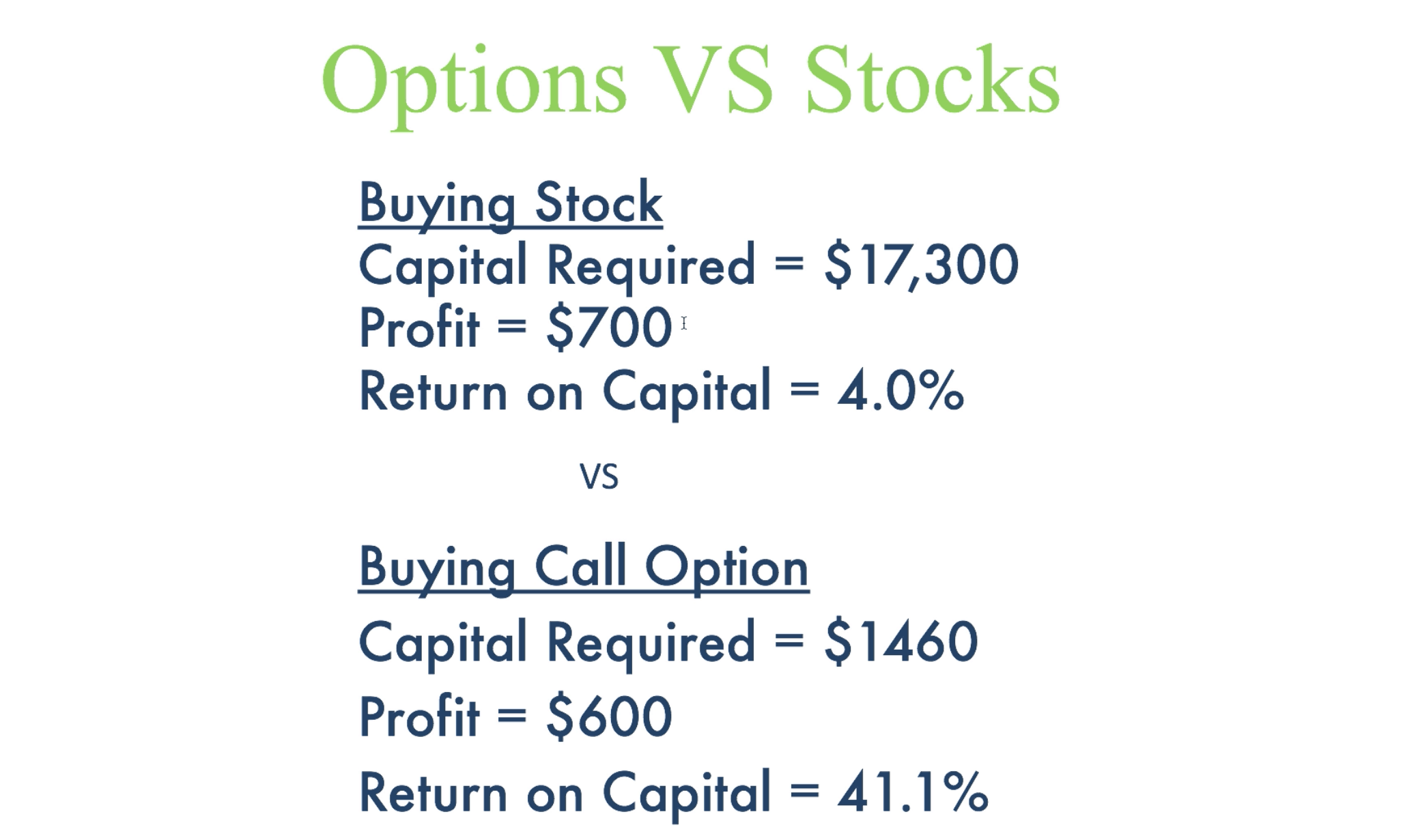

Let’s look at an example in Apple stock. It’s one of the most widely traded and liquid stocks available. At the time of this recording, Apple is trading at about $173 per share. So, if you were to buy 100 shares of Apple, it would cost you about $17,300. Now I’m not talking about buying 100 shares on margin or anything like that, I’m talking about buying 100 shares with no leverage, in an IRA, or some type of non-margined account.

Conversely, if you were to buy one in-the-money call option, where it’s currently trading at $14.60, that one call option would take $1,460 in buying power. Remember, one option controls 100 shares of stock. As you can see with options, you’re controlling the same amount of stock, with far less capital.

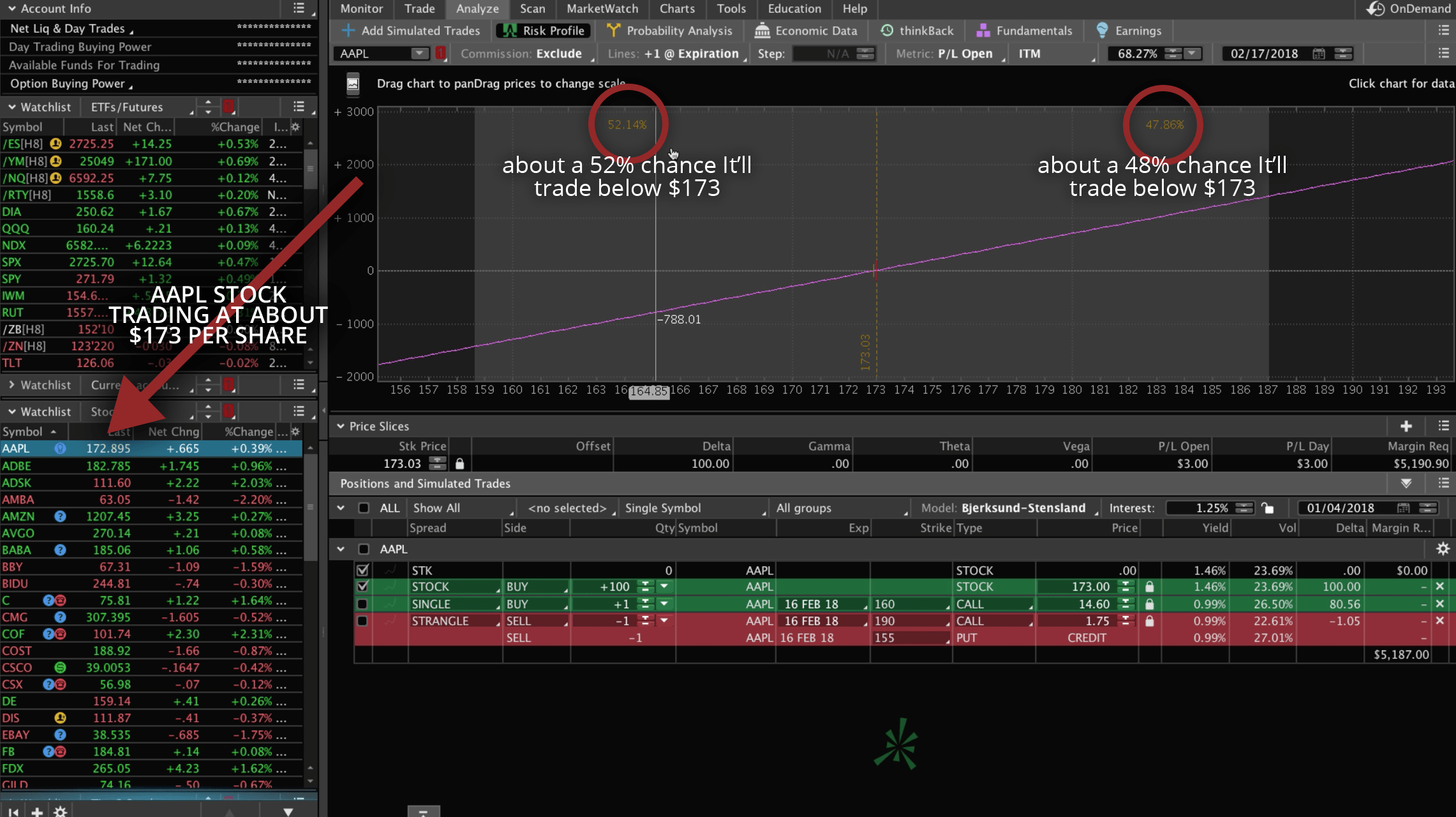

Let’s go to the platform to take a look at this example. Here’s Apple stock, and it’s trading at about $173 per share. When you view the analyze tab on the thinkorswim platform, what you’ll notice right away is that it gives you the probabilities automatically. We like to set up our trading strategies between 30-60 days away. So at the time of this recording, 2/17/18, is about 43 days away. So, it’s right in our wheelhouse for how we like to place trades.

Again, the platform automatically gives you these probabilities so you can see there’s about a 52% chance that it’ll trade below $173 and there’s about a 48% chance that it’ll trade above $173. Basically, it’s a 50/50 bet. Now from a standpoint of risk, remember, you’re putting up $17,300 to buy 100 shares. So theoretically if Apple went to zero, you could lose the entire $17,300.

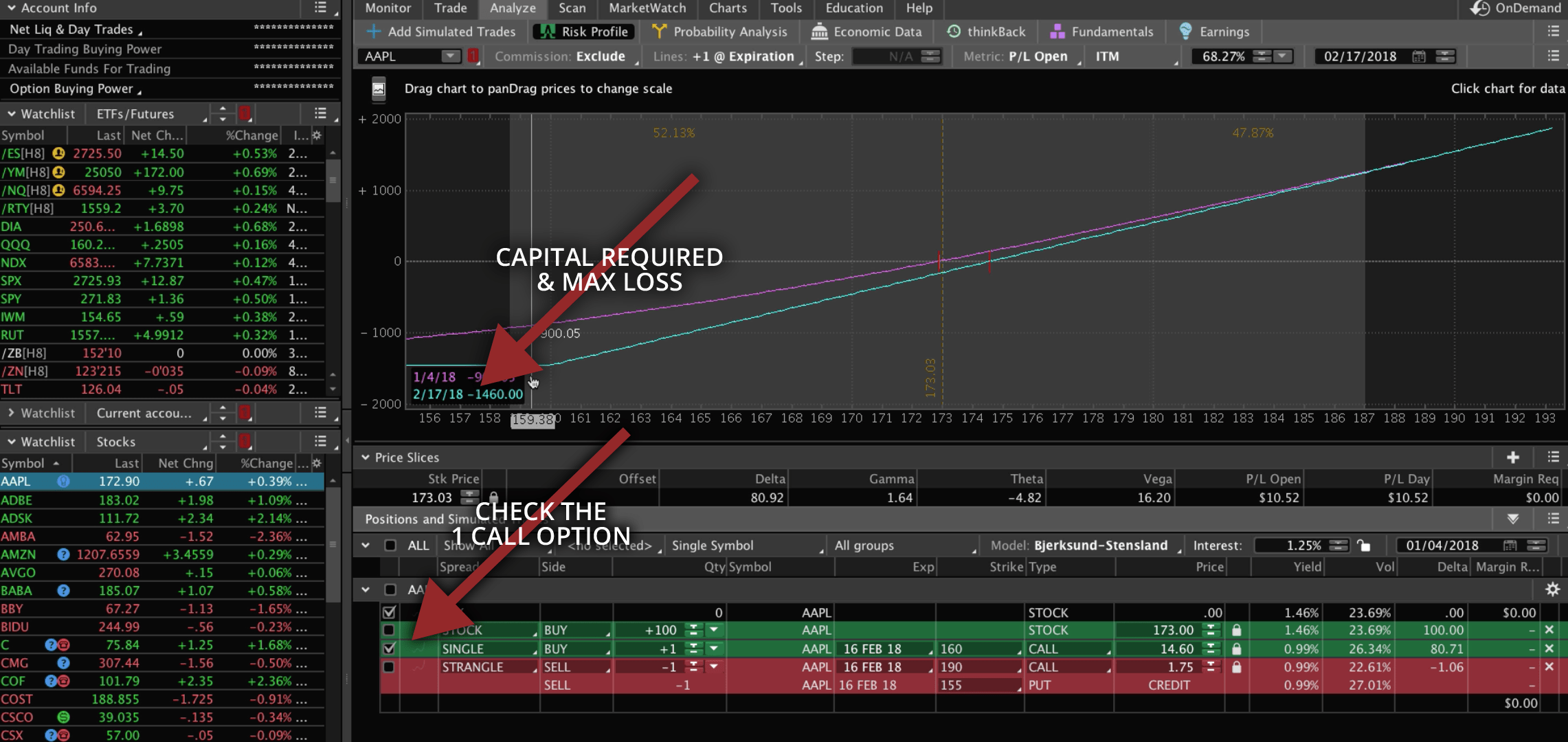

Let’s take a look if you were to buy that one call option instead of the 100 shares of stock. So we uncheck the box next to “stock” at the bottom of the platform, and check the box next to “Single”, the one call option. This brings up the 160 call option, which like I said, is trading at $14.60. So in this case, you would put up $1,460 of capital to buy the call. You can find that number amount in the little black box that sits in the bottom left-hand corner of the chart. Not only is that the amount of capital required to put on the trade, but that’s also the max loss that you could incur on this trade.

If Apple traded all the way down to zero, the most you could lose is $1,460. Now these are both bullish positions, meaning we would benefit if the stock went up in value.

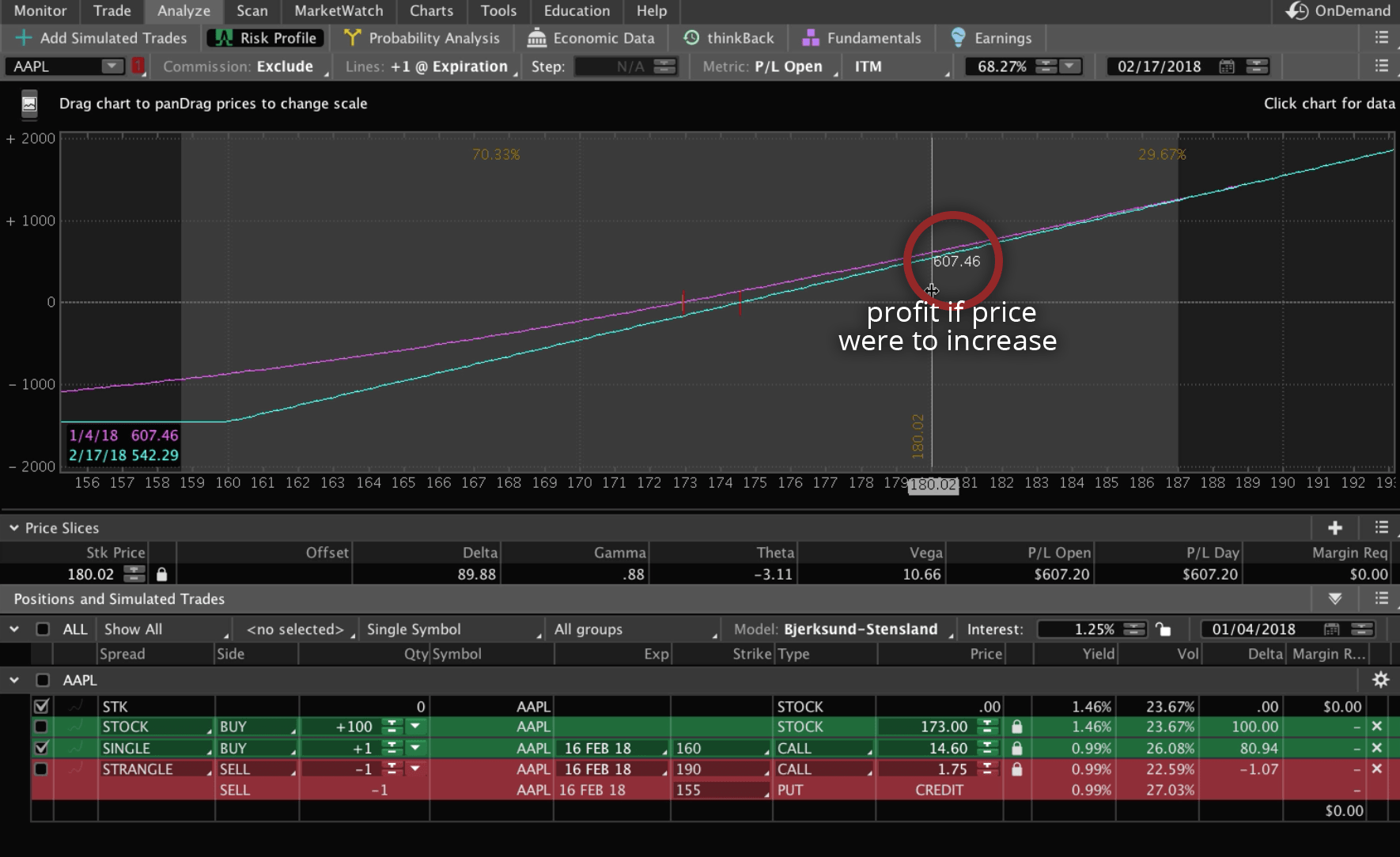

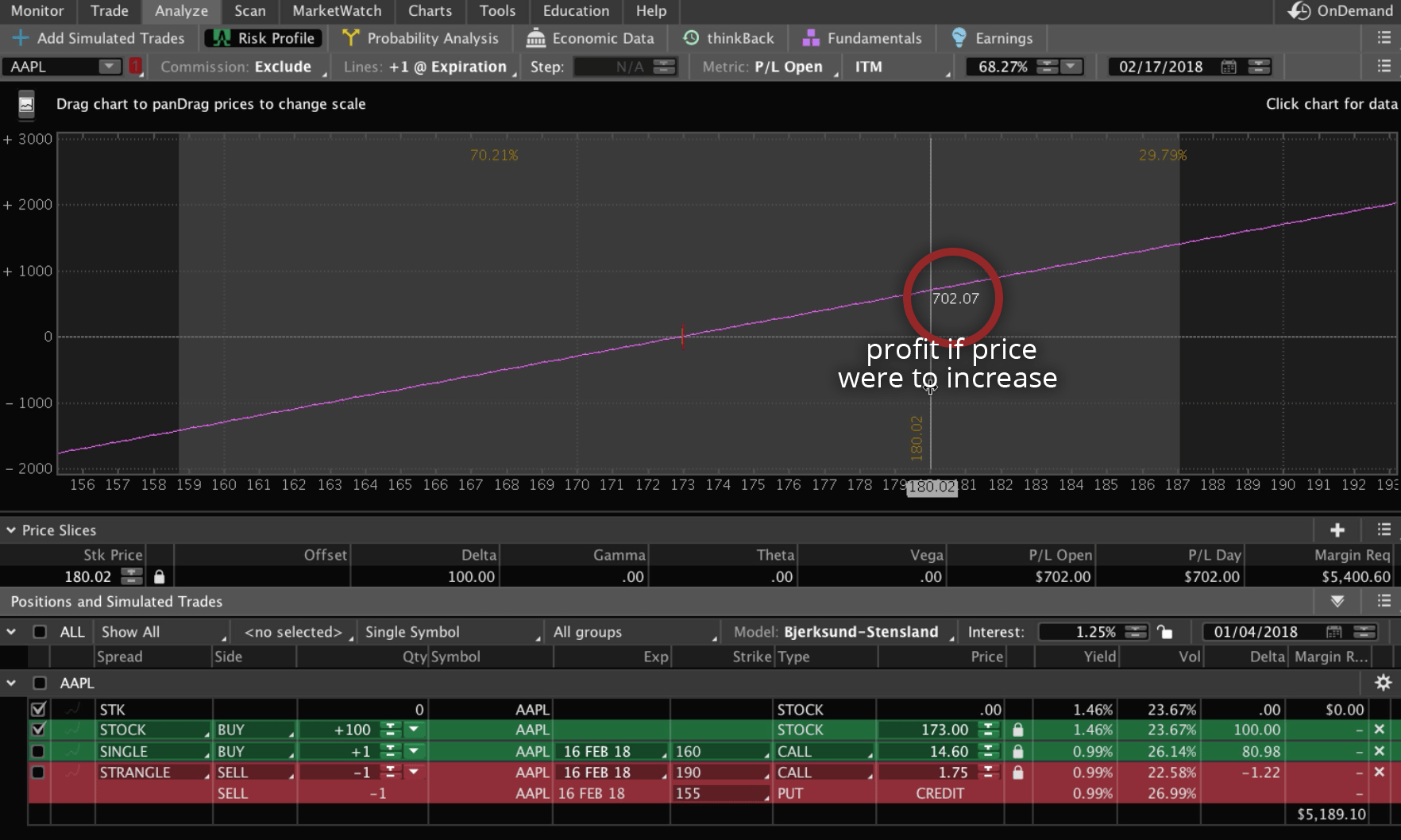

Let’s take a look at a theoretical increase in value if the stock went from where it is currently trading at about $173 up to $180.

With the call option, you can see that your profit on this trade would be about $600.

Let’s go back to the stock example, and see what the difference would be. So if the stock traded up to $180, your profit would be about $700. So your gain would be about $700 on the individual stock, but it would be about $600 on the option.

Return On Investment

Let’s take a look at what that means from a return on investment. If you’re buying the stock, your capital required is $17,300, and you get a profit of $700. That gives you a return on capital of 4%. Now, if you bought the call option, the capital required was $1,460, your profit was $600, giving you a return on capital of over 41%. So that’s what we mean when we say options use leverage. You can control the same amount of stock with far less buying capital.

Now, don’t go out and start buying call options on everything that you think is going to go up, there are some disadvantages as well. For example, the profit on the stock was $700 versus $600, that’s the cost of carrying the leverage and also the time decay involved with buying options. The point of this was simply to show you the power of leverage using options versus stocks. Let’s go back to the platform, and take a look at one other example.

Option Strategy Example

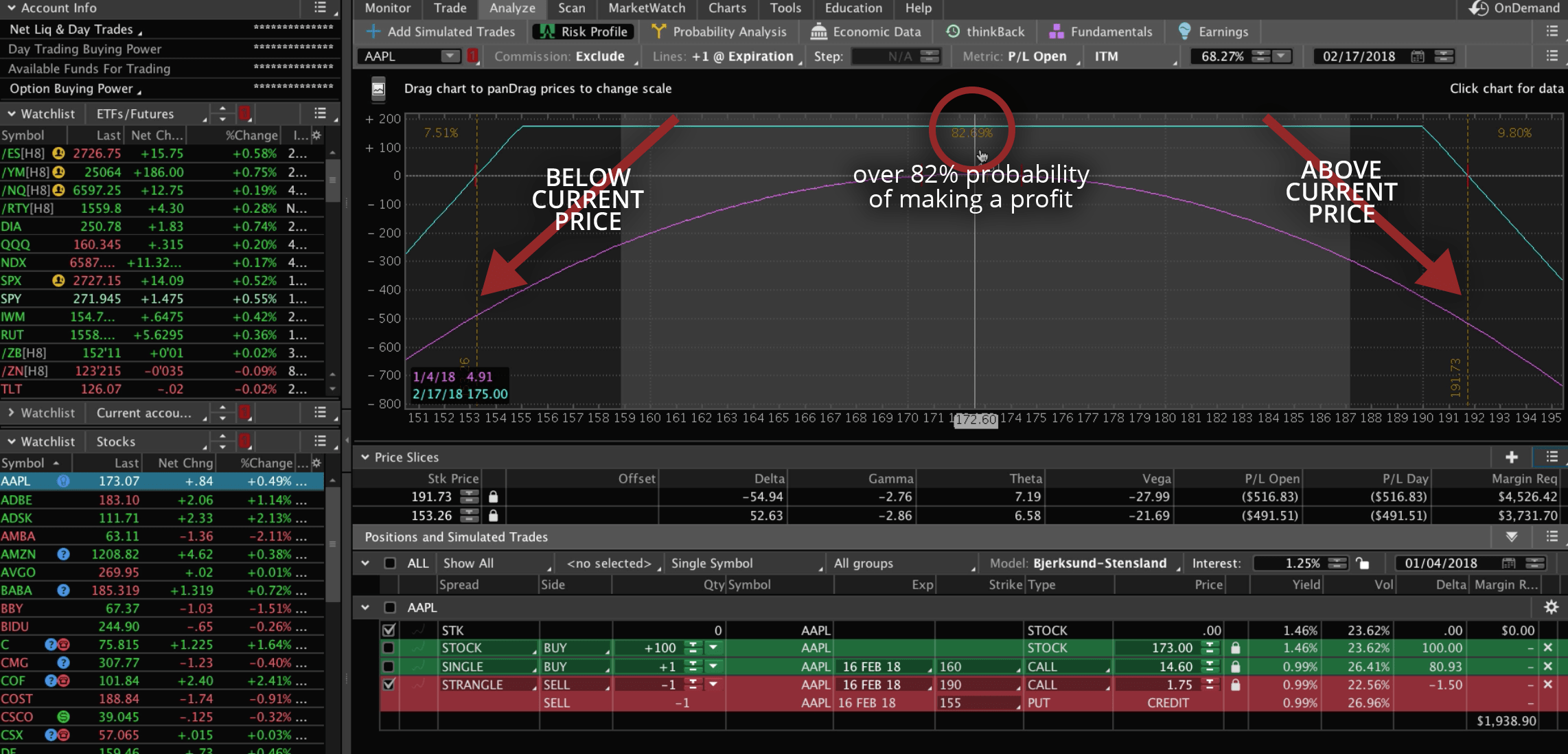

Remember what I said before, we don’t have to pick market direction, and we can place trades that are extremely high probability. This is still the Apple example, and as you can see, the stock price is still trading at $173. The difference is, this is an option strategy that we utilize where we’re trading options above the current price and below the current price. By doing that, you can see at the time of entry, we have over an 82% probability of making money on this trade. With the way that we manage trades, we can actually get that winning percentage up over 90%.

I hope this helps you understand the power of trading options. Just to recap, the five main reasons that we trade options versus stocks is leverage, less risk, trading stocks is a 50/50 bet, you don’t need to focus on market direction, and you can create an extremely high winning percentage.

If you have any questions at all, feel free to email us at info@navigationtrading.com, and we’ll talk to you again soon.

Happy trading!

-The NavigationTrading Team

Follow