Hey NavigationTraders!

Welcome to another video lesson from NavigationTrading!

In this tutorial, I want to discuss the difference between a Short Strangle and an Iron Condor.

They are very similar trades, and many of our members want to know when to trade the Short Strangle, and when to trade the Iron Condor. That’s what I want to break down. We’ll start with a little bit of a comparison, and then we’ll jump onto the trading platform and show some actual examples.

Similarities

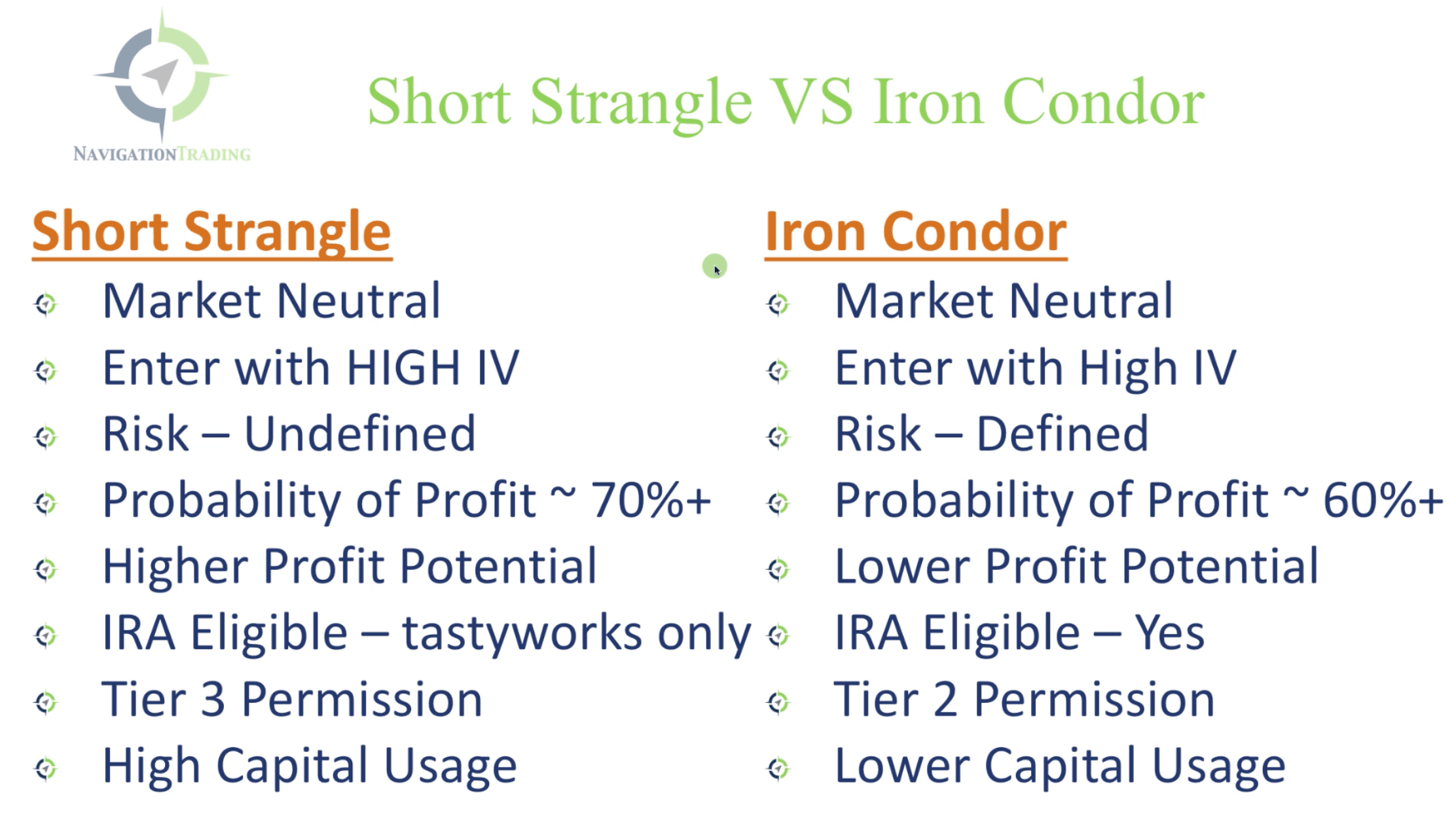

Market Neutral

When we put on either a Short Strangle or an Iron Condor, we do both in a market neutral situation. Meaning, we don’t care if the underlying stock goes up or down, we just want it to stay in a specific range.

Enter with High Implied Volatility

When we enter a Short Strangle or an Iron Condor, we’re entering with high implied volatility. We want to sell both strategies when implied volatility is high, and the options are expensive.

Next, let’s get into some of the differences.

Differences

Risk

In a Short Strangle, the risk is undefined. We’re using naked options, which sometimes can make people nervous. But, I’ll show you what the difference is and why that’s important.

With an Iron Condor, the risk is defined. So you know exactly what you’re risking on the trade when you enter it.

Probability of Profit (POP)

When you enter a Short Strangle based on the way we teach in our courses, the probability of profit is typically around 70% or higher.

Whereas the probability of profit is a little bit lower with the Iron Condor, at about 60%.

So, you have a higher chance of making money with a Short Strangle than you do with an Iron Condor.

Profit Potential

When you sell a Strangle, typically you’re collecting more credit, giving you a higher profit potential.

With an Iron Condor, you’re collecting less credit, so your profit potential is a little bit lower.

Account Restrictions

Short Strangles traditionally have been only eligible in a margin account, and ineligible for IRAs. However, tastyworks now provides the capability to trade naked positions in your IRA..

Iron Condors can be traded in a margin account or IRA with most brokers.

Permission Levels

When you apply and open an account at a brokerage, you have to get permission to trade certain levels of options. With a Short Strangle, you have to get what’s called “Tier Three Permission” to trade naked options.

With Iron Condors, you just have to get Tier Two Permission, so that you can trade defined risk spreads.

Capital Usage

Short Strangles, are going to use a larger amount of capital.

Whereas with an Iron Condor, you can place smaller trades that use less capital.

SPX Example

Let’s go to the platform and tie this all together.

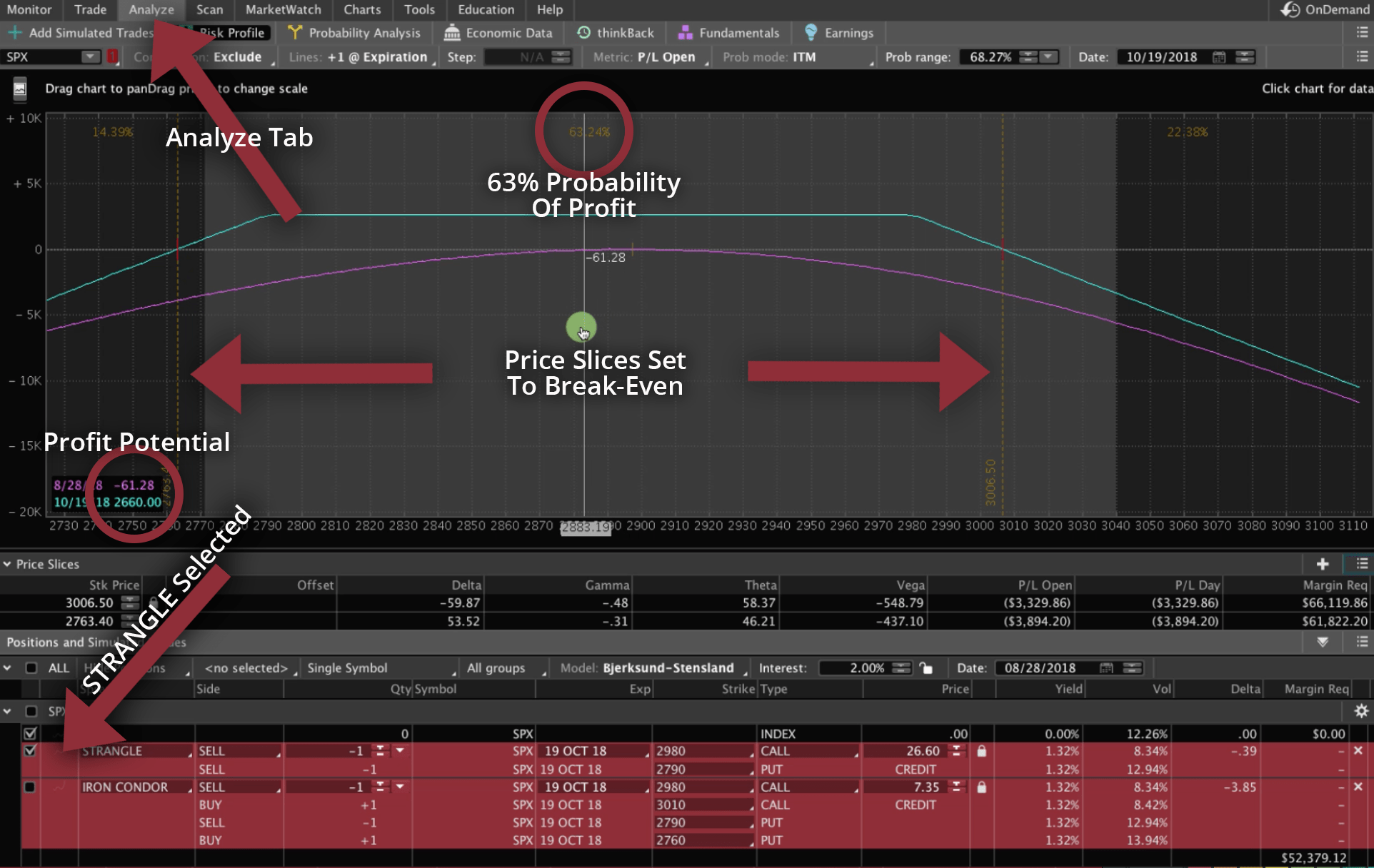

I’m going to look at two different underlying symbols. The first one we’re looking at is SPX. And if you’re in the thinkorswim platform, I like to use our Analyze tab because I’m a very visual person, and I know a lot of our members are as well. The Analyze tab just helps to introduce the concepts, so you can grasp them a little better.

I’ve entered a short strangle on the trading platform. You can see down below, in the “Positions and Simulated Trades” area, that I’ve checked on just the Short Strangle box. So, that’s what we’re looking at in the Analyze tab.

We moved the price slices to the break-even points of the zero line. In this case, the probability of profit, if you held it all the way to expiration, is a little over 63%. It’s a little lower than the 70% that I mentioned earlier. But, what I want you to take away from this, is that you’ve got a profit potential with one contract of $2,660, which you can see in teal in the little black box over on the bottom left of the chart.

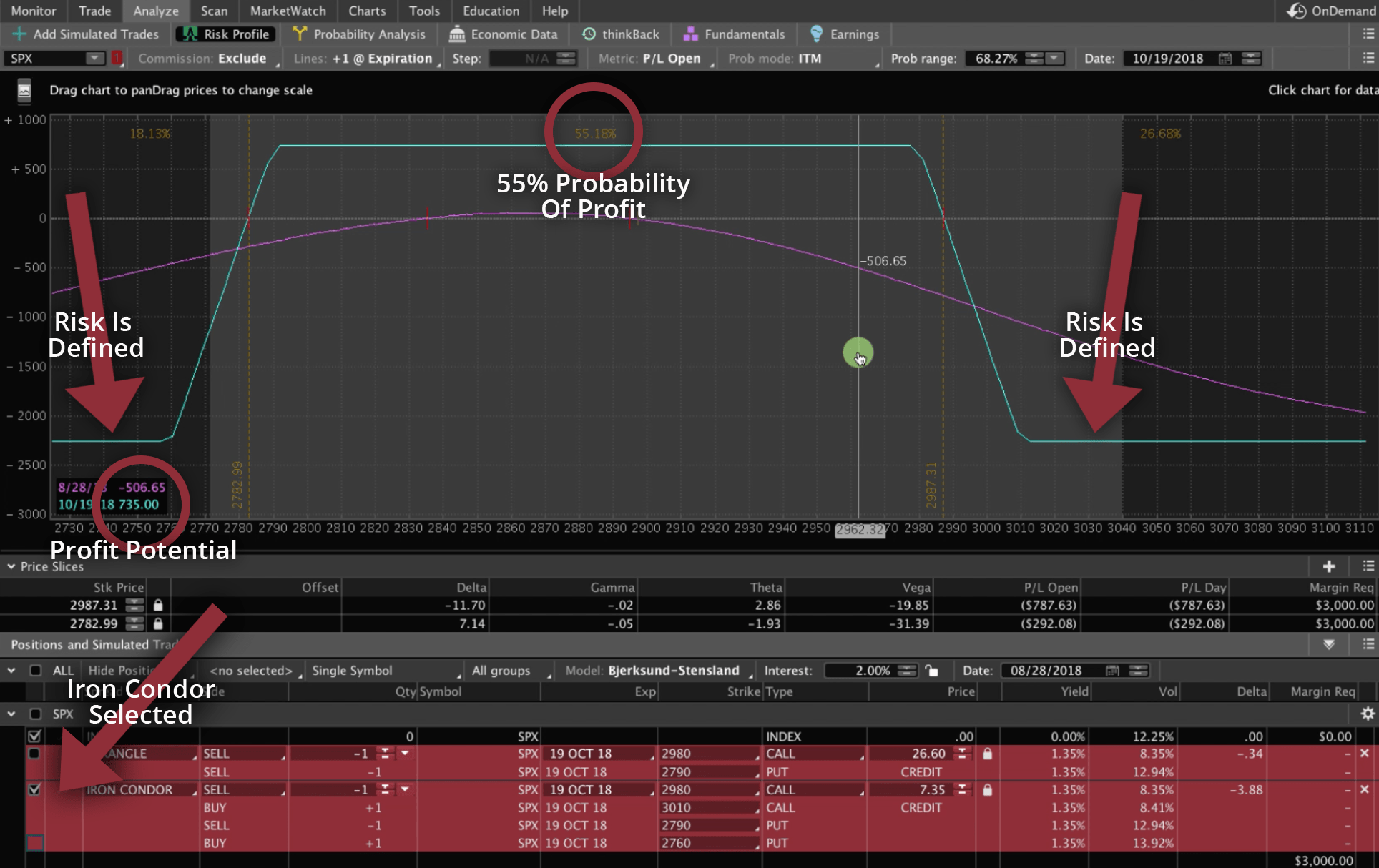

So, $2,660 is our max profit. Now, if we uncheck the Strangle box, and we check the Iron Condor, you’ll see a couple of things happen. One, we’ve got defined risk. You can see the wings on either side. If price explodes to the upside, or crashes to the downside, we have this defined risk amount.

The profit potential, as you can see, if you’re still looking at that teal number down in the bottom left of the chart, is $735. So, our profit potential is less than a third of the Strangle. But, what we get in return is the ability to define our risk. If you’re nervous about undefined risk, you can define the risk by buying these wings and trading an Iron Condor.

I moved the price slices to the break-even points for the Iron Condor. You can see what it did to our probability of profit, it went from over 63% probability down to 55%.

Remember, you have a lower probability of profit with an Iron Condor, whereas the Short Strangle has a higher probability and a higher profit potential.

There’s always a tradeoff between risk and reward, and it’s not that there’s one that’s better than the other. A Short Strangle is not better than an Iron Condor. It just depends on what you are looking to trade from a capital usage standpoint, from a defined risk standpoint, the type of trading account you have, and so forth.

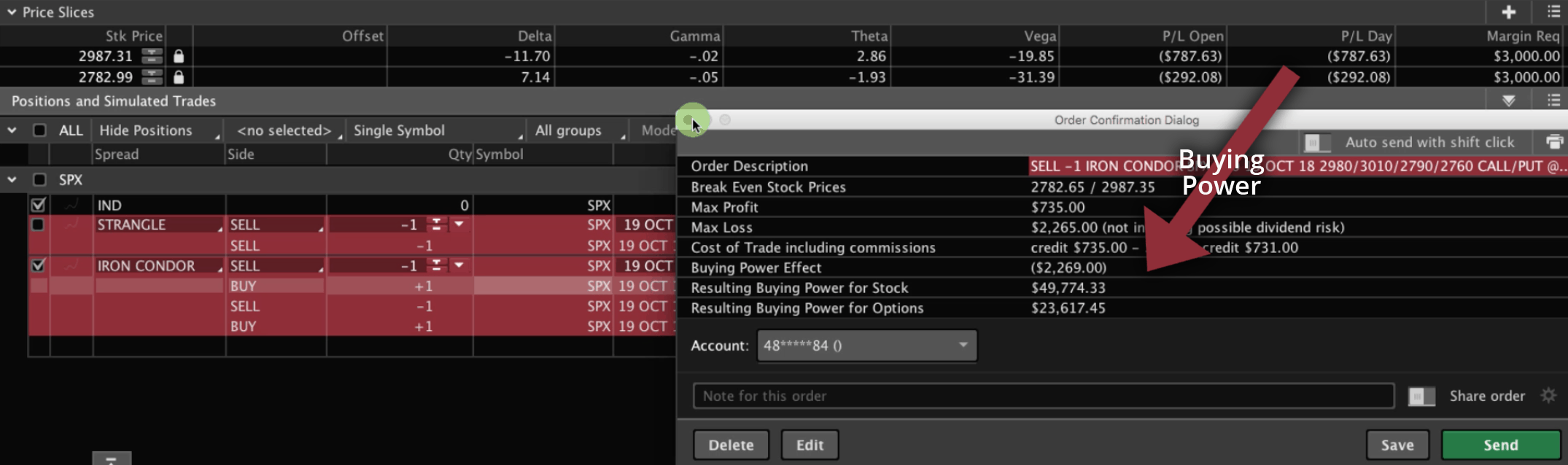

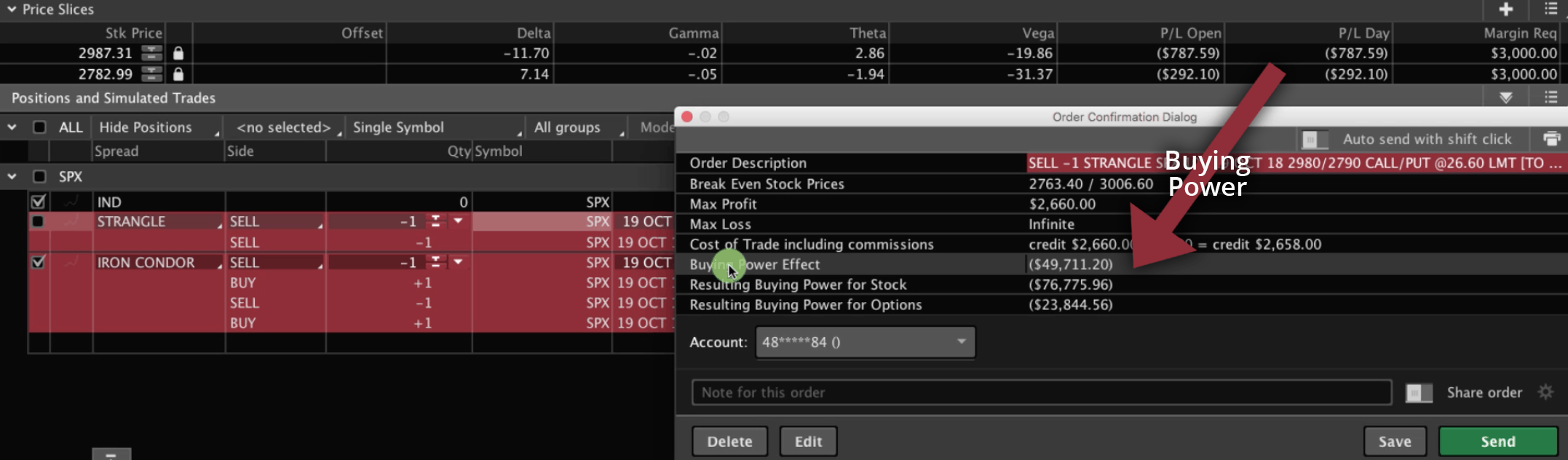

There’s one more thing I want to show you on this example. If we right click on the Iron Condor, and hit “confirm and send”, it will bring up a box showing what our buying power effect is. It is going to cost us $2,269 of buying power to put on the Iron Condor trade.

Let’s exit out of the Iron Condor, and look at what the difference is with the Short Strangle. If we right click, and hit “confirm and send”, with one contract for a Short Strangle, we would have to put up over $49,000.

I don’t care if you’re trading a six figure or seven figure account, trading a Short Strangle in SPX, which is currently trading at nearly $2,900, is just not an efficient use of your capital. If you’re trading extremely high priced underlying symbols like SPX, then you’re typically going to trade an Iron Condor. You’ll get to define the risk, and it’s just a more efficient use of your capital.

Remember, the things that you want to take into consideration when choosing which strategy to trade.

The price of the symbol, your trading permissions, the probability of profit, your max potential profit, and your defined versus undefined risk.

EWZ Example

Let’s go to one more example, and take a look at EWZ, which is the Brazilian ETF. SPX is trading at nearly $2,900 at the time of this post, and EWZ is trading at a little over $32 a share. That’s a massive difference, right?

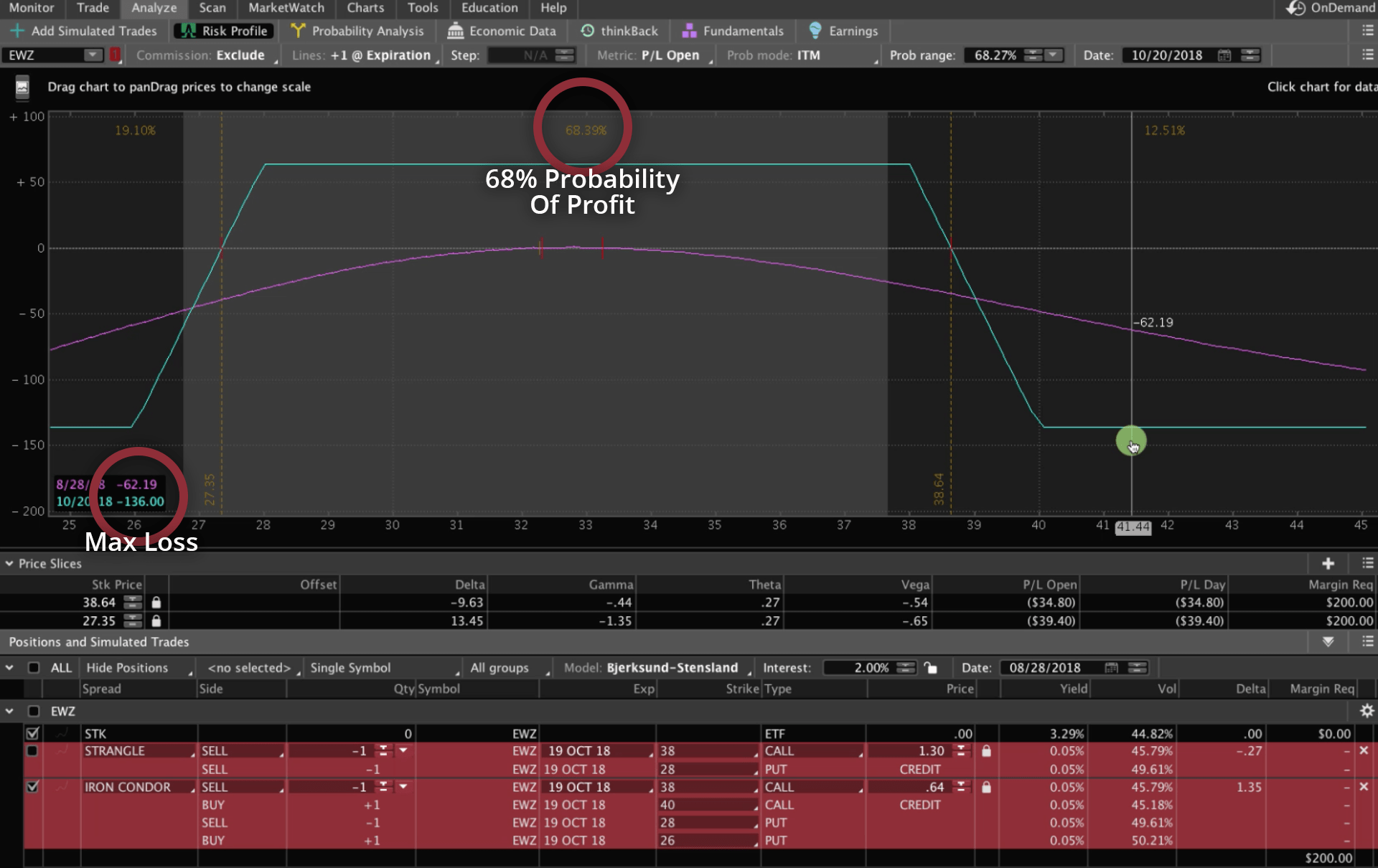

I’ve updated the “Date” field on top of the analyze tab to match our expiration date, which is 10/20.

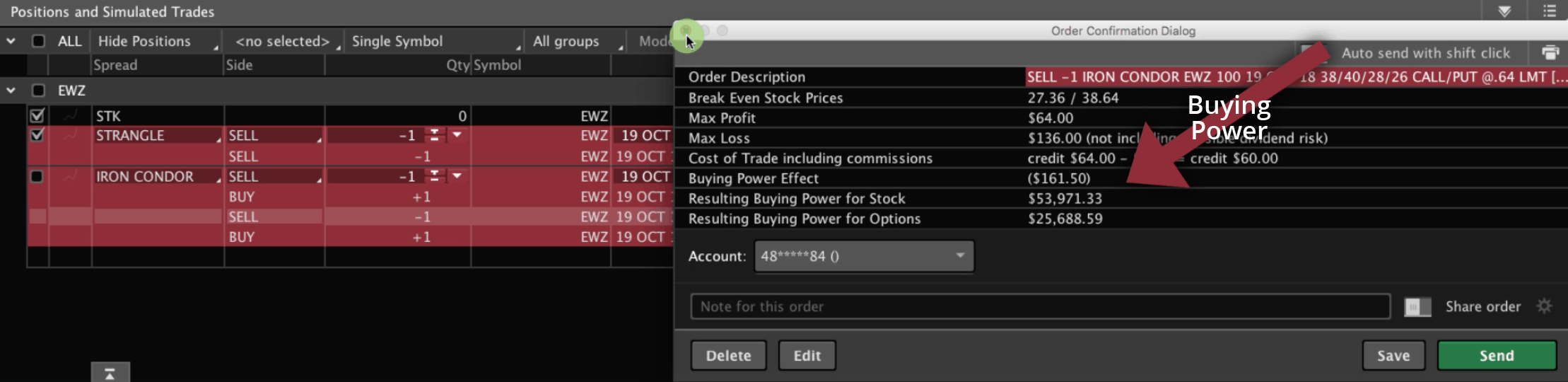

Let’s look at the Iron Condor first. What you’ll see, is that we’ve got a probability of profit of about 68%. We’ve got our defined risk wings. The max risk with one contract is just a $136. This can be done in really any size account, small accounts, large accounts, it doesn’t matter.

And again, we’re just looking at one contract. We’ve got a defined risk max loss of $136, and a max potential profit of $64. So, the lower the price of the symbol, the less capital you’re going to use, and the lower potential profit you’re going to get as well.

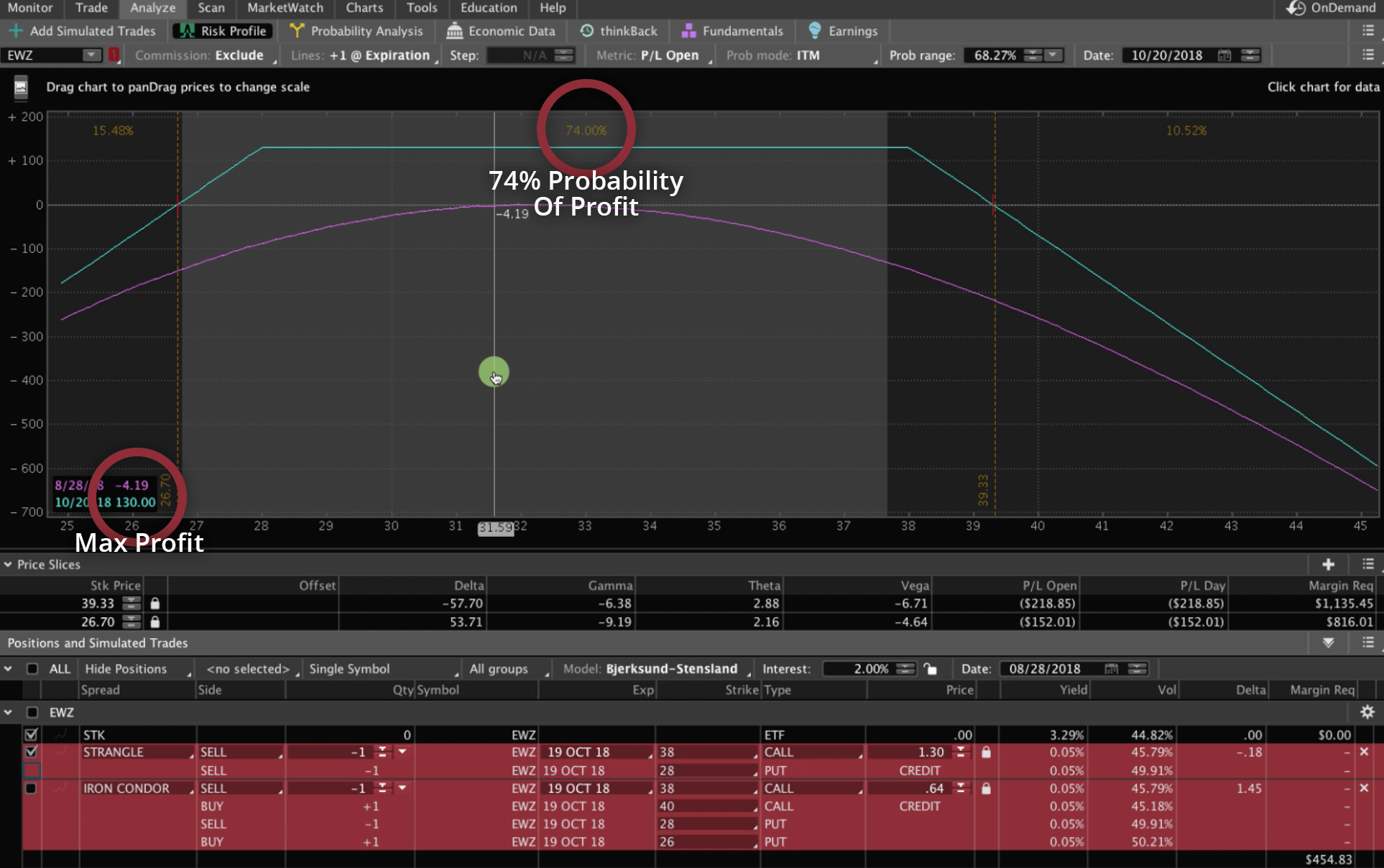

Now, let’s look at the Short Strangle.

Look at what moving those price slices to break-even did to our probability of profit. It jumped up to 74%.

Remember, on a Short Strangle, you have a higher probability of profit.

Now, look at our max profit potential. It’s at $130. Now we have a much higher profit potential of about three times the profit potential, with the Short Strangle versus the Iron Condor.

And of course, with that comes undefined risk. Which, if you’ve taken our courses, you know that there are ways to minimize that risk even when you’re trading undefined strategies.

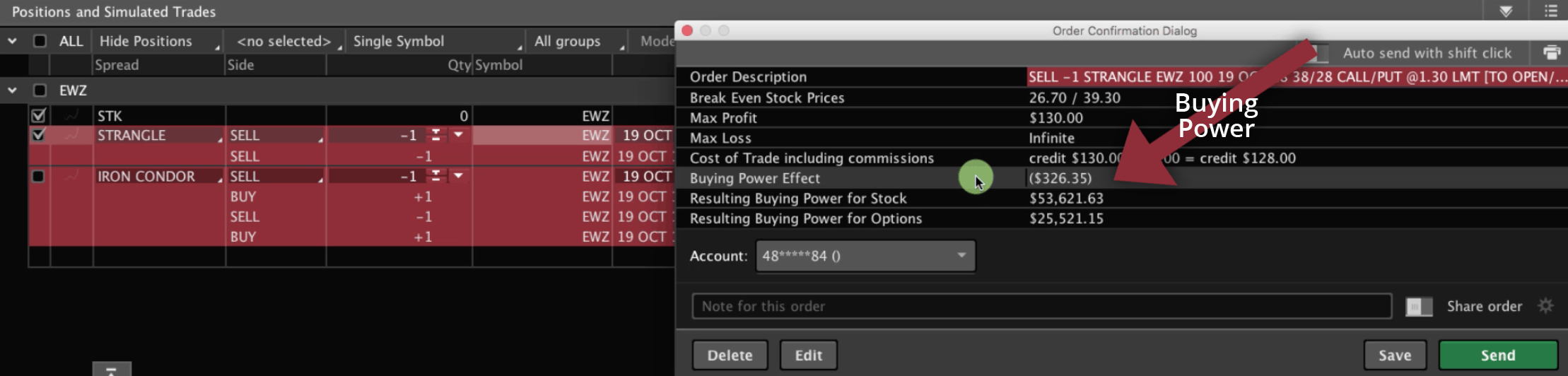

Let’s take a look at what the buying power would be.

Starting with the Short Strangle. We can right click, hit “confirm and send”, and you’ll see, even for a Short Strangle with undefined risk, the buying power effect (the amount of capital it takes to put this trade on), is a little over $326.

If we go to the Iron Condor, we know buying power is going to be even less. Just right click and hit “confirm and send”. The buying power is at $161.50.

There’s not a right way or a wrong way to do this. The only thing you’ve got to make sure of, is that it’s an efficient use of capital.

Are you collecting the amount of credit that you want to trade? For example, one of the things that we shy away from, is trading Iron Condors on these low priced symbols like EWZ, because the max profit for one contract is only $64.

Remember with an Iron Condor, it has four different legs. You’ve got four different options you’re trading. So you’ve got to pay commissions on each one of those as well. So, for Iron Condors, it’s a little bit higher transaction costs, whereas a Strangle is only two contracts, so you’re paying less transaction costs entering the trade and exiting the trade. You’ll want to take that into consideration.

Understand, if you’re going to trade an Iron Condor, just make sure the amount of credit you’re receiving is worth the risk, and the transaction costs involved with the trade.

So those are two different extreme examples. One of a very high priced symbol at $2,900, and the other at a very low priced symbol at $32.

Short Strangle & Iron Condor Takeaways

Let’s recap! I’ll give you some takeaways from this tutorial and give you the decision making criteria for choosing a Short Strangle versus an Iron Condor

1. Do you prefer defined or undefined risk?

Are you okay with that unlimited risk component, or are you more comfortable with defined risk?

If you’re more comfortable with defined risk, you want to go with the Iron Condor.

With undefined risk, you want to go with the Short Strangle.

2. Is it the best use of capital?

If you’re trading a high priced underlying like SPX or Amazon, you’re probably going to use an Iron Condor. It’s just a better use of capital. But on lower priced symbols, you may opt to use a Short Strangle, because you’re not using too much buying power, and you’re getting a better credit.

3. What type of account are you trading?

Do you have the capability to trade undefined risk if you’re in an IRA versus a margin account?

If you’re in an IRA, most brokers only allow you to trade Iron Condors, and you can’t trade undefined risk or Short Strangles.

I hope that this tutorial was helpful in determining which is better for you, a Short Strangle or an Iron Condor.

Talk to you in the next lesson.

Happy Trading!

-The NavigationTrading Team

Follow