Welcome to another lesson from navigationtrading.com! In this lesson, we want to show you the difference between a Short Call Vertical and a Long Put Vertical.

Platform Example

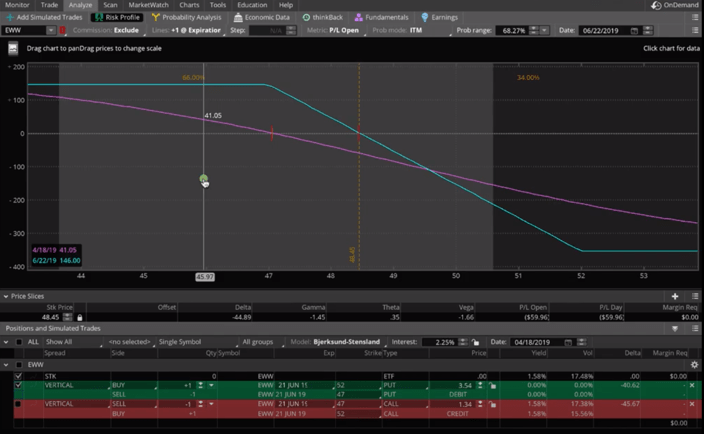

We’ll be looking at the ticker EWW. This is the Mexican ETF.

Two of the different trade strategies you could use to benefit from a move lower would be a Short Call Vertical or a Long Put Vertical. So how do you know which one to choose? Let’s take a look!

Setting Up Long Put Vertical

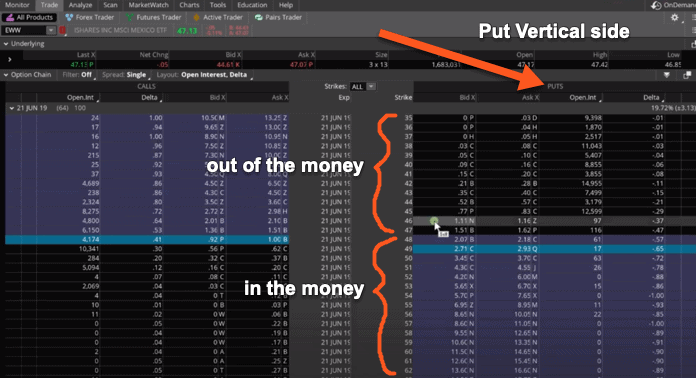

On the Put side, we like to start by choosing a strike in the money, and then the other strike we’d choose would be a little bit out of the money.

Setting Up Short Call Vertical

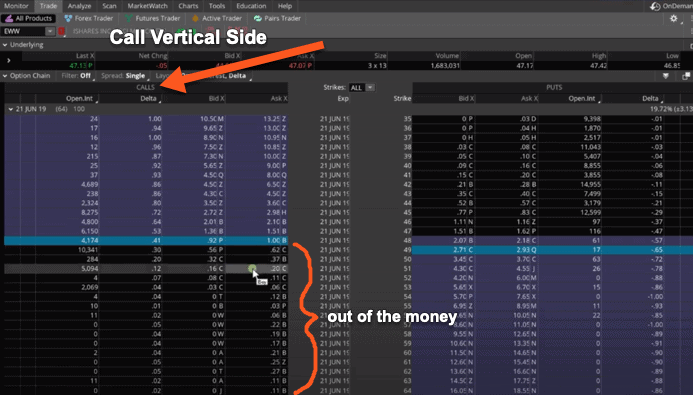

On the Call side, we’d choose a strike somewhere a little out of the money, and then buy a further out of the money strike.

Short Call Vertical Example

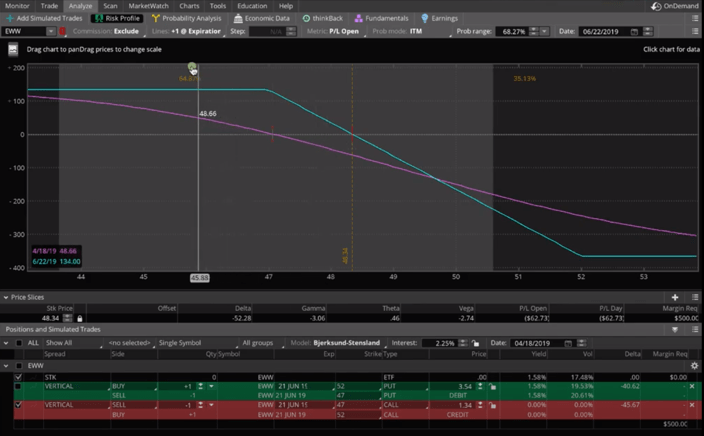

We’ve already set up some examples, with strikes five points wide. Let’s start with the Short Call Vertical spread. We sold the 47 and bought the 52 strike. Here’s what that looks like from a risk profile standpoint.

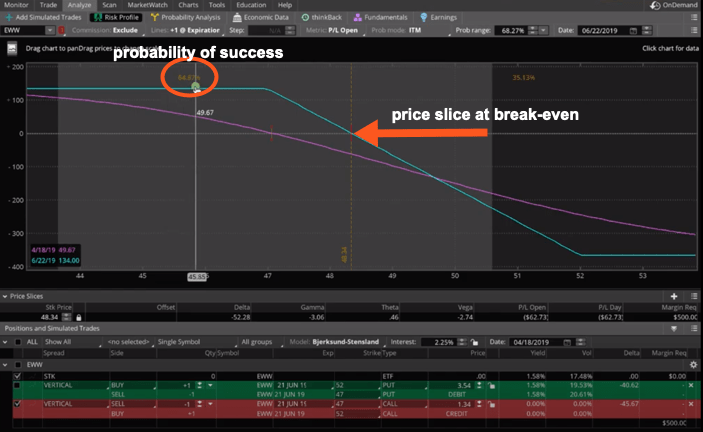

We like to set these up so that they have at least a 60% probability of success and we want to make sure that our max loss is no more than three times that of our max profit. In this case, with one contract, we’ve got a max profit of $134 and a max loss of $366, so that fits the criteria. You can see if we set our price slice to break even, we’ve got a probability of over 60%, so that works, as well.

That’s the Short Call Vertical.

Long Put Vertical Example

If we look at a Long Put Vertical, what you’ll notice is that the graph looks exactly the same. You actually get a little bit better probability of success on this trade. Max profit is at $146 and the max loss is at $354, which is just a little bit better than the Short Call Vertical example.

Summary

When we set these up, sometimes we’ll look at both of graphs to determine which one we like better. In this case, we would like the Long Put Vertical. It gives us a slightly better max profit and a slightly lower max loss.

The other thing that we’d look at, is the impact of implied volatility? Typically, if stocks go down, implied volatility goes up. That would benefit the Long Put Vertical. If we sell the Short Call Vertical, we’re selling premium, and so an expansion in implied volatility actually goes against us slightly.

These are just a few of the variables you’d want to look at when deciding which strategy to choose. It’s not a bad idea to set both the Short Call Vertical and the Long Put Vertical up on your Analyze tab, check out the slight differences between them, and then make sure you understand the impact that implied volatility will have on that trade.

Sometimes it makes sense to do one, sometimes it makes sense to do other, but in this case, we would choose the Long Put Vertical because if price moves down, implied volatility is going to expand, most likely, and that’ll benefit the position.

We hope that this lesson was helpful!

Happy Trading!

-The NavigationTrading Team

Follow