Hey NavigationTraders!

Welcome to another lesson from navigationtrading.com! In this lesson, we’ll discuss how to trade pairs on the tastyworks platform.

At the time of this recording, tastyworks just released a new feature called “Pairs Trading”, a one click pairs trading feature.

What is a Pairs Trade?

Today, the NASDAQ is down a little over 1%, but the Russell 2000 is down almost 3%. That is a pretty significant difference. These two symbols are fairly correlated, and when you’re making a pairs trade, that’s typically what you’re looking for. You’re looking for two symbols that are fairly correlated and you want to profit between the spread of those two symbols.

Let’s say for example, you thought the Russell was over sold compared to the NASDAQ. You could buy the Russell and sell the NASDAQ, and essentially you’d be taking a lot of the “directional risk” out of the trade and simply try to profit from the spread between the two.

You can trade pairs on any two symbols, but typically we like highly correlated symbols. For example, Bonds and Notes are highly correlated. You could sell Bonds, buy Notes or buy Notes and sell Bonds.

An example of a stock pair would be Walmart and Target, which are very similar big retail stores. If you think Walmart is going to outperform Target, you could buy Walmart and sell Target. So those are just a couple of examples.

Platform Example

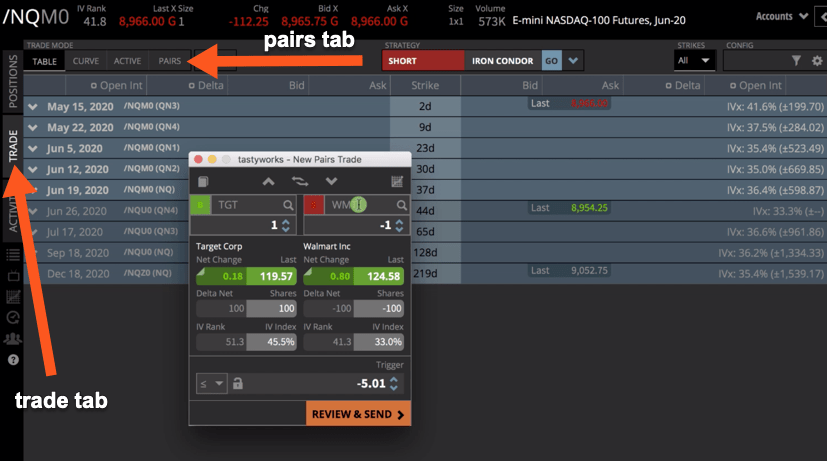

If you click on the Trade tab in the Tastyworks platform, you’ll see there’s a new tab that pops up labeled “PAIRS”. Just click on that and a dialogue box will pop up. Then just type any symbols that you want to trade. For example, if you want to go with Target versus Walmart, you could populate that.

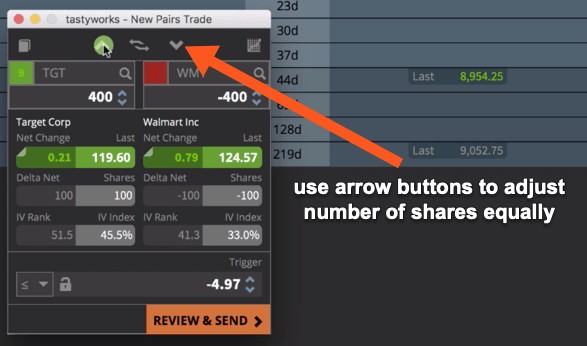

Then you can choose the number of shares that you want. If you use the arrow buttons up at the top of the dialogue box, you can adjust the number of shares in the pair equally.

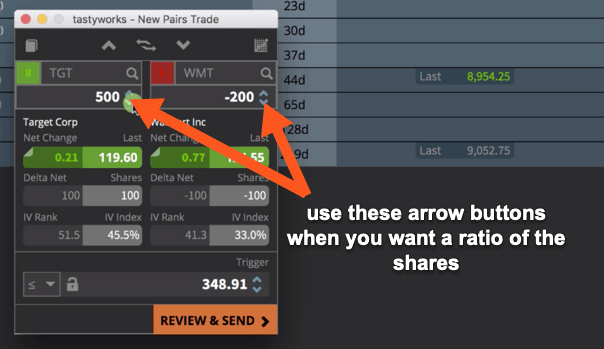

If you wanted to do a ratio, let’s say you wanted to do 500 shares of Target versus shorting 200 shares of Walmart, you could do that.

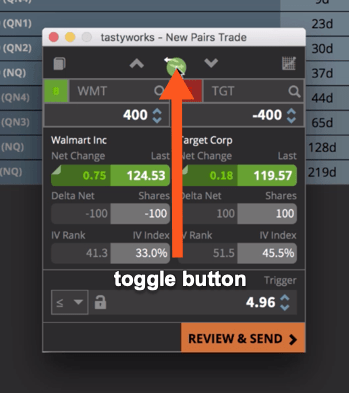

Keep in mind, the symbol on the left is always the one that you buy. The symbol on your right is the one that you are going short. If you decide you want the opposite of this, you could type them in again. Or simply use the toggle button and it just flip flops them. It makes it very easy to switch around.

Chart Feature

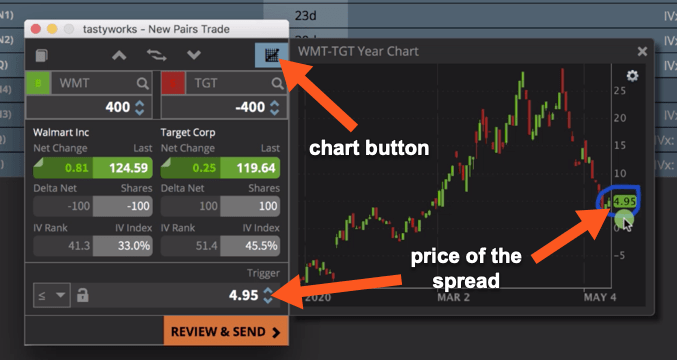

Another cool feature that tastyworks has included in their pairs trading capability is a chart button. If you click on the chart button, it pops up a one-year daily chart, and this gives you the actual price of the spread.

In this case, if we are buying Walmart at $124.60 a share, and we’re shorting Target at 119.63, you’re just subtracting 119.63 from 124.60, and that’s what gives you the price of the spread.

Setting a Limit Order to Enter Trade

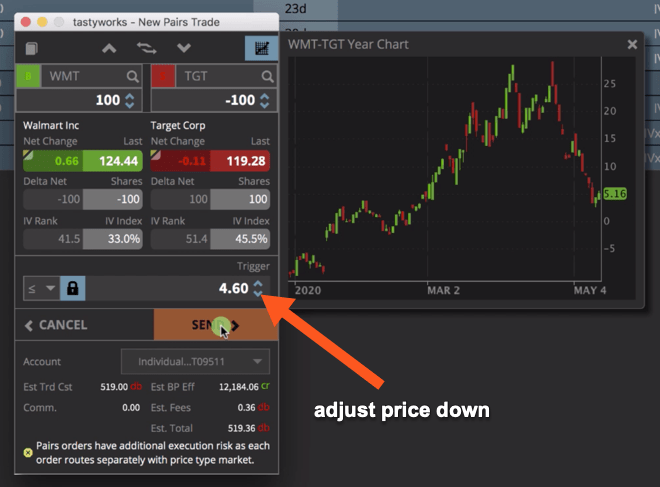

You don’t necessarily have to enter right at the price that is currently trading. You can do it just like any other order on a single symbol. If you said, “I don’t want to buy this at $5, but I want to wait until it gets down to $4.60. I want to set a limit order to enter this trade.”, you could do that.

We’re actually going to place this order. We’ll bring price down to 4.60 so we don’t actually get filled, hit “Review and Send” and then “Send”. Now that order is placed.

Saving Pairs

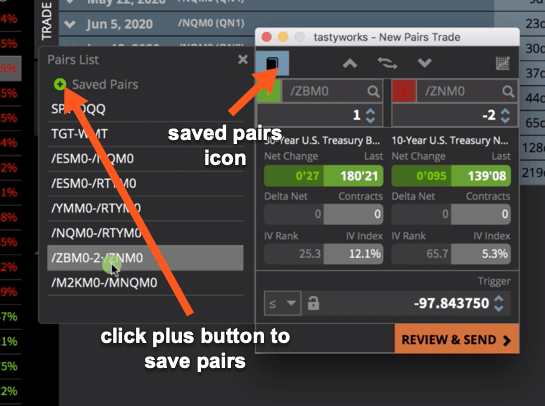

On the left hand side is another icon, you pop that out and this is where you can save all your pairs. You can see I’ve got SPY and QQQ, Target and Walmart, S&P and NASDAQ, S&P and Russell, Dow and Russell, NASDAQ and Russell, and Bonds and Notes. Once you’ve added your specs, all you have to do is click the plus button, and your pair is saved. So next time you log in, just click the pairs icon button and you can choose from the different pairs you’ve saved and it will automatically populate in your pairs trader.

How to Manage Existing Orders

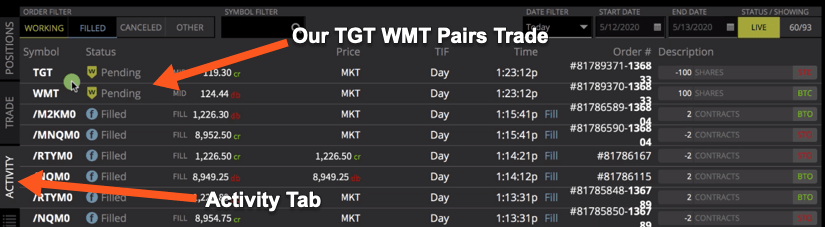

Lastly, how do you manage existing orders? If you go to your Activity tab, you can see the Target and Walmart order that we put in. We entered the limit order below where the market was trading, so you can see it’s a working pending order.

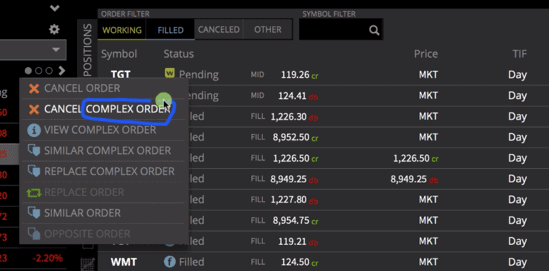

If you wanted to cancel this order or if you wanted to change the price, you don’t have to do that on each individual leg. You can actually do it as a pairs trade. All you have to do is right click and you can see there’s a new list of orders available on this dropdown and they are referenced as “complex orders”.

If we wanted to cancel the complex order, we could click “CANCEL COMPLEX ORDER”. If we wanted to replace the complex order, we could click that option and the dialogue box would pop back up. Then we could choose a different price. We can adjust that price to try to get it filled. In this case, we don’t really want to get filled on this. We’re going to right click on the pending order and just cancel complex order.

So that is how you trade pairs on the tastyworks platform. If you have any questions, feel free to drop us a line in the TradeHacker Community!

Happy Trading!

-The NavigationTrading Team

Follow