Hi NavigationTraders!

Welcome to our monthly recap where we go over all of the closed trades from the month.

3 Part Iron Duck Option Spread Webclass

Before we jump into the trades, we just wanted to take some time to remind you that our free 3-part Iron Duck Option Spread webclass starts tomorrow, Oct 1st at 4pm central standard time. We haven’t been this excited about a strategy in a long time!

Schedule:

Part 1 – October 1st, 2019 at 4pm CST

Part 2 – October 8th, 2019 at 4pm CST

Part 3 – October 15th, 2019 at 4pm CST

We split the webclass into three different sections because there’s just a lot of information and we wanted to make sure it was broken down and easily digestible. If you haven’t already, make sure you visit: https://navigationtrading.com/ironduckregistration and reserve your spot!

If you’re reading this post after we’ve already had Part 1, no worries! You can still sign up for the webclass and follow along with part 2 and 3 by clicking the link above. Pro Members will be able to view a replay of each part of the webclass in their Member’s Area. If you’re not a Pro Member and would like to view part 1 of our Iron Duck Option Spread Webclass, you can sign up for our $1 14-day by visiting: https://navigationtrading.com/pro-trial.

By signing up for our Pro Membership trial, you’ll get access to the replays and all of our other VIP course training as well.

The Iron Duck Option Spread Webclass will be a step-by-step strategy course. We hold nothing back, and give you everything you need to trade the strategy. Here’s an idea of what we’ll be going over within the Iron Duck Option Spread webclass:

-

- ✓ How we structure trades to make money over 90% of the time

-

- These are really high probability trades.

-

- ✓ How to profit when the market goes up, down or sideways

-

- ✓ The one special tweak that we use to eliminate risk to one side of the trade

-

- ✓ Our favorite setup to maximize profits each week

-

- These are shorter term trades, and so we’re getting in-and-out.

-

- ✓ The most profitable symbols to trade and which ones to avoid

-

- ✓ How to make consistent profits without any trade adjustments

-

- So, no rolling or adjusting. You’re just going to get in and get out based on the specific criteria that we teach you.

-

- ✓ How to keep a short bias in the market, but eliminate risk to the upside

-

- ✓ The best way to trade this strategy in a small account.

-

- We’ve got members who have multimillion seven-figure accounts, and we have members who have just several thousand dollars in their account. And with this strategy, you can scale it down to as little as risking a couple hundred dollars per trade, or scale all the way up to as much as you want. So, the scalability of the strategy is really a good fit for anyone, no matter their account size.

-

- ✓Lastly, we’re going to give you a step-by-step “cheat sheet” so that you always enter the trade correctly

-

- You can print this off and put it by your computer so you know exactly when to enter and how to manage the trade just like we teach in the strategy course.

You definitely don’t want to miss out on this strategy!

Performance

Now let’s jump into the closed trades for the month of September!

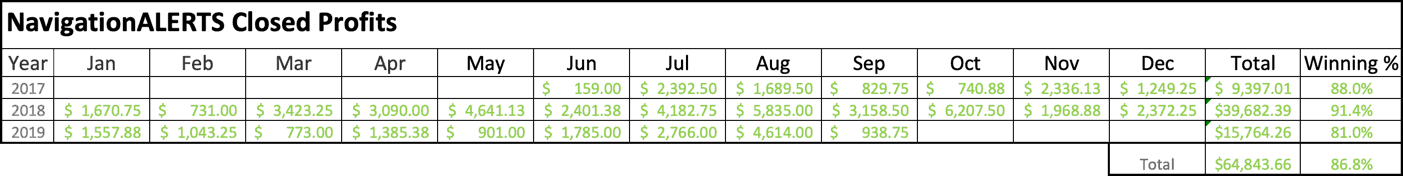

Our total profit came to a little over $938. Our average profit per trade was a little over $67. The average profit per trade and our winning percentage was actually much lower than it typically is. Typically, we’re at between 80-100%-win rate for the month. That just didn’t happen this month. We ended up with about a 64% winning percentage.

We traded six different strategies including:

- Short Strangles

- A Short Call Vertical

- A Long Put Vertical

- A Long Put

- Weekly Iron Condors

- Weekly Double Calendars

If you go to our Performance page, you can see up at the top of the page, we post a table of our cumulative profits and winning percentage going back to when we first started posting our alerts in June of 2017. We update this table every month.

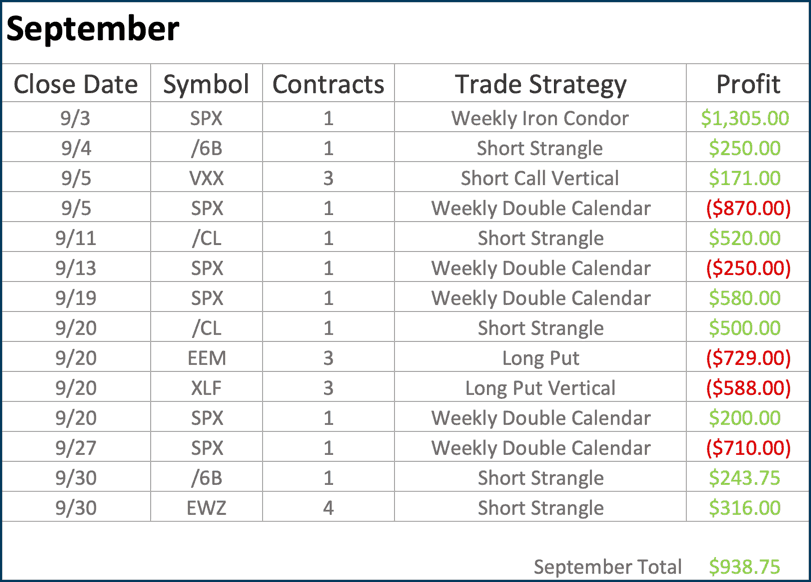

And if you scroll down, you can see different tables for each month that show the ticker symbol, the date, the number of contracts, the strategy, and the profit for each closed trade that month.

You can see we had five different losing trades this month, which is not typical. We might have one or two every now and then, but that’s just part of trading. You’ve got to play the probabilities. They don’t always work out in the short term, but over the long term, over many trade occurrences, it’s just a game of math.

Notice the number of contracts we traded in September. They’re between one and four contracts. We’re doing this so members can trade these specific trades in small accounts or large accounts. We have some members who trade 10 times the number of contracts that we do. In that case, you’d just have to multiply the profit and loss by the number of contracts you trade. You can really trade our NavigationALERTS in any size account.

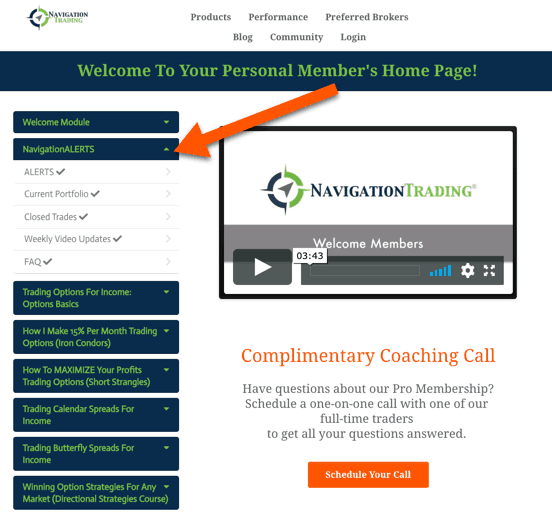

Pro Members Area

Let’s navigate to our Pro Membership area. We are in the process of doing a complete revamp of our membership area, so be on the lookout for that in the coming months.

Your Pro Member’s Area is where you get access to all of our VIP course training, including the new Iron Duck Option Spread course we talked about earlier.

If you click on the “NavigationALERTS” tab in your Member’s Area and then click on the “Alerts” tab nested underneath, you’ll see all of our live NavigationALERTS are posted here. You can also get a snapshot of our current portfolio by clicking on the “Current Portfolio” tab, again nested under “NavigationALERTS”. All of our closed trades are posted under the “Closed Trades” tab.

Let’s go there now!

In-Depth September Performance

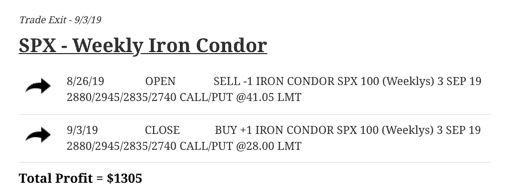

Scroll down so that we can start at the beginning of September. Our first closed trade was in SPX. We put on a Weekly Iron Condor and booked a nice profit right out of the gate of $1,305.

Then in /6B, which is the British pound, we did a Short Strangle and booked a profit of $250.

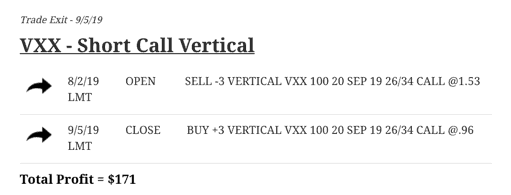

In VXX, we did a Short Call Vertical. We were in this trade a little over a month, but booked a profit of $171.

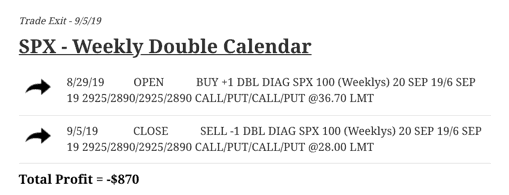

We had a loser on one of our Weekly Double Calendars in SPX. We lost $870 on the trade. Price just sort of ran away from us. We hit our stop loss point, and so we closed for a loss.

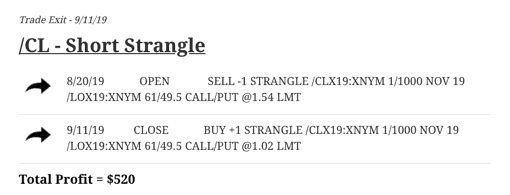

In /CL, which is Oil, we did a Short Strangle and booked a profit of $520.

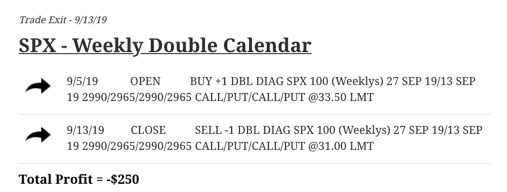

We did another Weekly Double Calendar in SPX. We ended up getting close to the expiration point and it was just outside of our range, so we took a small loss of $250 on the trade.

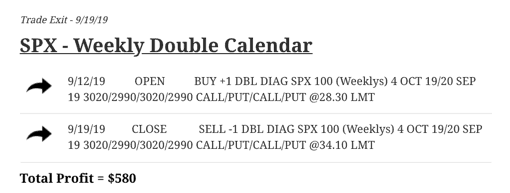

We did yet another SPX Weekly Double Calendar, and booked a nice profit of $580 on that one.

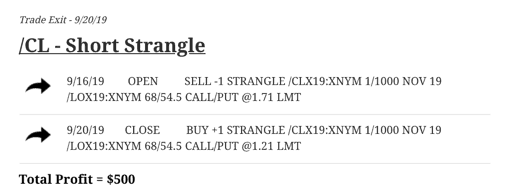

Then, we went back to the well of Oil with another Short Strangle, and booked $500 in profit.

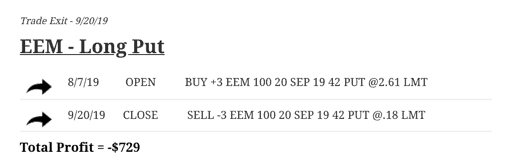

In EEM, we did a Long Put. We were trying to get directionally bearish, in EEM. Price surged on us and ran away, so we took a loss of $729 on the trade.

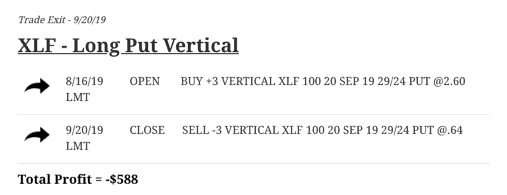

In XLF, we did a Long Put Vertical and it was kind of the same story. We were getting bearish and ended up taking a loss of $588.

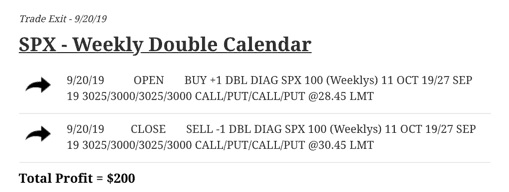

In SPX, we did another Weekly Double Calendar, and were able to book a profit of $200.

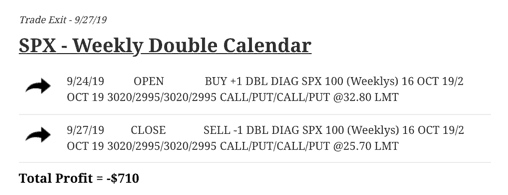

In our next Weekly Double Calendar in SPX, we took a loss of $710.

In /6B, we went back and did a Short Strangle, booking a profit of $243.75.

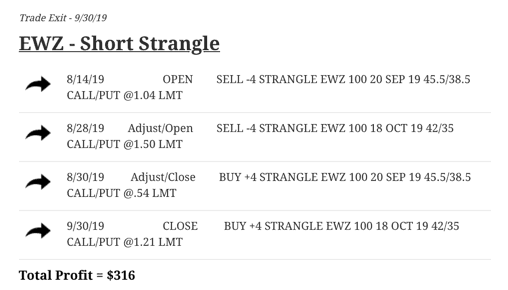

And lastly, in EWZ, we had to do a couple of adjustments in the trade, but ended up booking a nice profit of $316.

And those are all of our closed trades for the month of September!

If you’re interested in getting our live NavigationALERTS delivered directly to your inbox and via text message, just click the orange button below this post to try out our Pro Membership by signing up for our 14 day trial for just $1

Don’t forget to register for our Iron Duck Option Spread webclass, by visiting: navigationtrading.com/ironduckregistration. We hope to see you there!

Happy Trading!

-The NavigationTrading Team

Follow