Hey NavigationTraders!

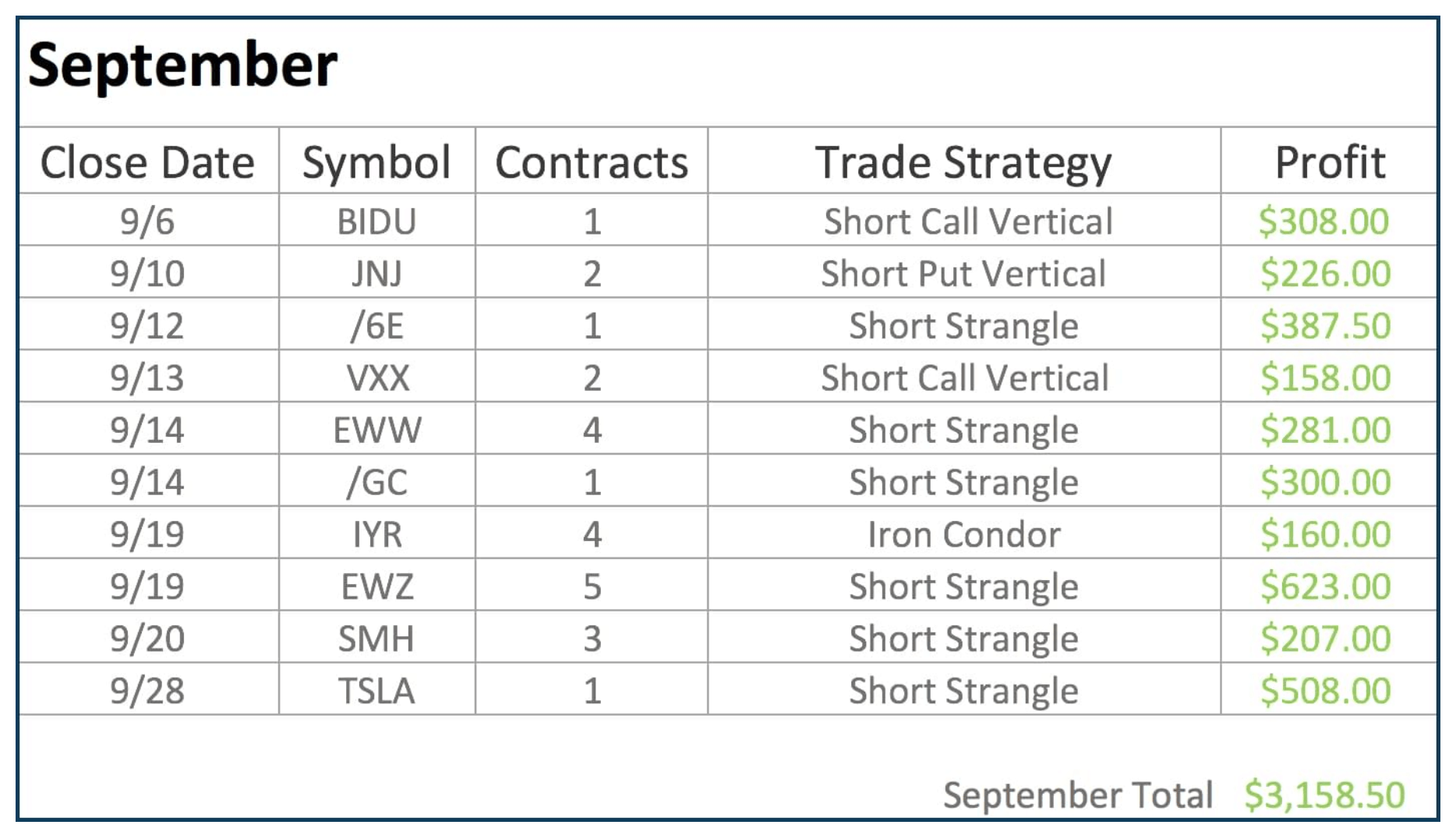

I wanted to take some time to give you update on our trades for September. It’s been another great month of trading. We had 10 closed trades, all of which were winners, making a total profit of $3,158.50.

We traded four different strategies this month. We had several Short Strangles, a Short Put Vertical, a couple Short Call Verticals and an Iron Condor. We didn’t trade quite as many strategies this month, in part, because the majority of Earnings season was already over. So, we didn’t have any Earnings related trades for September.

Again, we had Short Strangles and an Iron Condor, which are delta neutral strategies. We had Short Call Verticals, which are a bearish strategy, and we had a Short Put Vertical, which is a bullish strategy. We’re constantly managing our position, some long, some short, and creating that diversification of strategies that really allows us to be consistent over and over again.

If you’re interested in learning how we create this consistency, our Pro Membership is currently open. Just go to navigationtrading.com/pro-member.

Overall Performance

Let’s jump over to our Performance Page and take a look at where NavigationTrading performance is at year to date, and then we’ll jump into the individual trades for the month and break those down.

You can visit navigationtrading.com/performance any time. Our Performance Page is updated every month, and what you’ll see, year to date in 2018, is that we’ve now closed 118 trades. Our average profit per trade is now up to $247, with a winning percentage over 91%.

We continue to see phenomenal success and consistency with the strategies that we’re trading each month. Below is a snapshot for the month of September. As you can see we had 10 closed trades, all 10 of which were winners. Total profit came to $3,158.50. We’ll go over each trade in just a moment.

We did have more closed trades in August, but like I mentioned earlier, a lot of these were Earnings related trades because we were in the heart of Earnings season.

But, we still had a great month in September. If you review our Performance Page, you will see that each month has been profitable, with very few losers. We show all of our winners, all of our losers, everything is completely transparent.

We started posting these trades in June of 2017. So if you scroll down to 2017, you’ll see we had 75 closed trades, an average profit $125 and an 88% winning percentage.

Right now continues to be a phenomenal time to trade the strategies that we teach, and here’s why:

- Implied volatility is elevated in a good number of underlying symbols.

- Historically September and October tend to be the most volatile months.

Again, if you’re interested in checking out our Pro Membership, just follow this link navigationtrading.com/pro-member. We do have a 14-day trial for just $1. You can see on every page of our site, there’s a big orange button in the upper right hand corner that says “Pro Membership Trial”.

Member’s Area

Let’s jump into the member’s area and break down the trades for this month. If you are a Pro Member, this is what your membership looks like.

If you’re not, this will give you a glimpse of what you gain access to once you’re a Pro Member! Under the NavigationALERTS tab, you’ve got access to our alerts, our current portfolio and our closed trades. We give you a weekly video update every Friday to recap all the trades for the week.

Below the NavigationALERTS tab, we have specific course strategies. We teach you step-by-step how to enter, exit, and adjust every strategy we teach:

- Iron Condors

- Short Strangles

- Calendar Spreads

- Butterfly Spreads

- Directional Strategies

- Options on Futures

- How to Trade Stocks Around Earnings Announcements

- Trading Options with Money Flow

- How to Trade the VXX With 92.3% Accuracy

We’ve got a mini course on option assignment because there’s always some confusion around that. You also get access to our eBook, The Trade Hacker’s Ultimate Playbook.

At NavigationTrading, we’re really trying to take all the road blocks out of your way. We provide the training, step-by-step video courses on each trading strategy, and trade alerts sent to you via text and email immediately after we make the trade.

In-Depth Trade Results for September

On “Closed Trades” nested under the NavigationALERTS tab, we’re going to scroll down and start with the first trade of September.

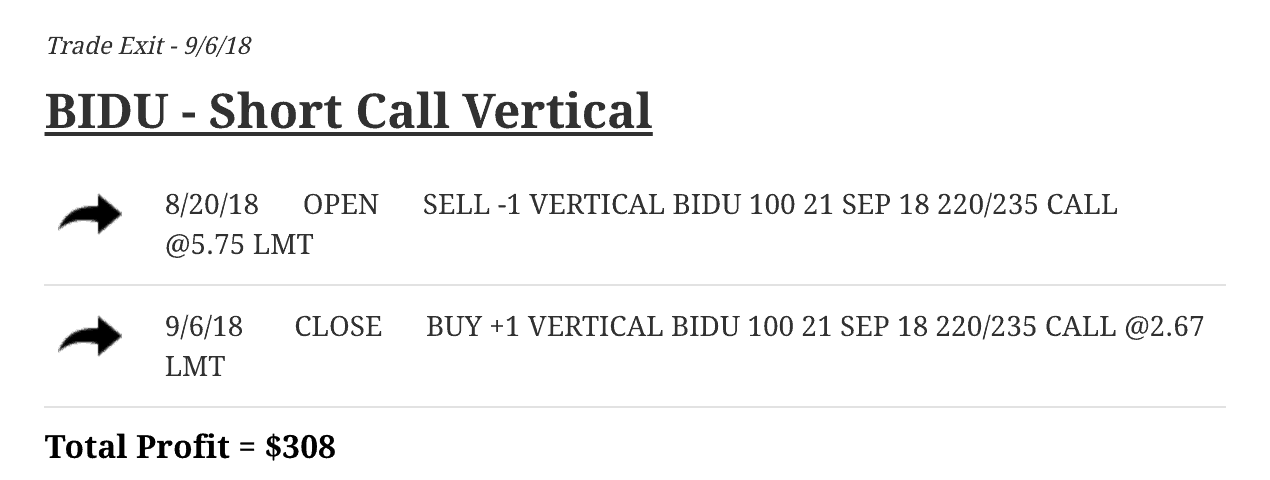

The first trade that we closed was in BIDU. We did a Short Call Vertical. If you’re not familiar with a Short Call Vertical, essentially we are taking a bearish position on BIDU. We wanted it to go down to benefit this trade. We put this trade on 8/20 and closed it out on 9/6. So, we were in the trade for a little over two and a half weeks and we booked a nice profit of $308.00.

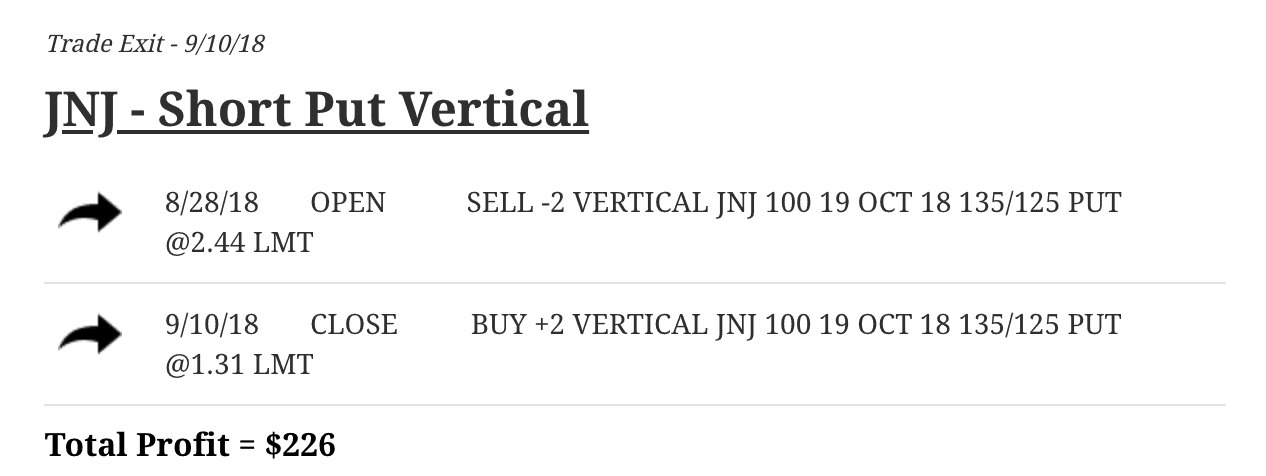

The next trade we did was a Short Put Vertical in Johnson & Johnson (JNJ). With this trade, it was the exact opposite approach from what we did in BIDU. We were taking a bullish stance. We wanted JNJ to move higher to benefit us and it did just that. We were in this trade for about 12 days, and booked a nice profit of $226.

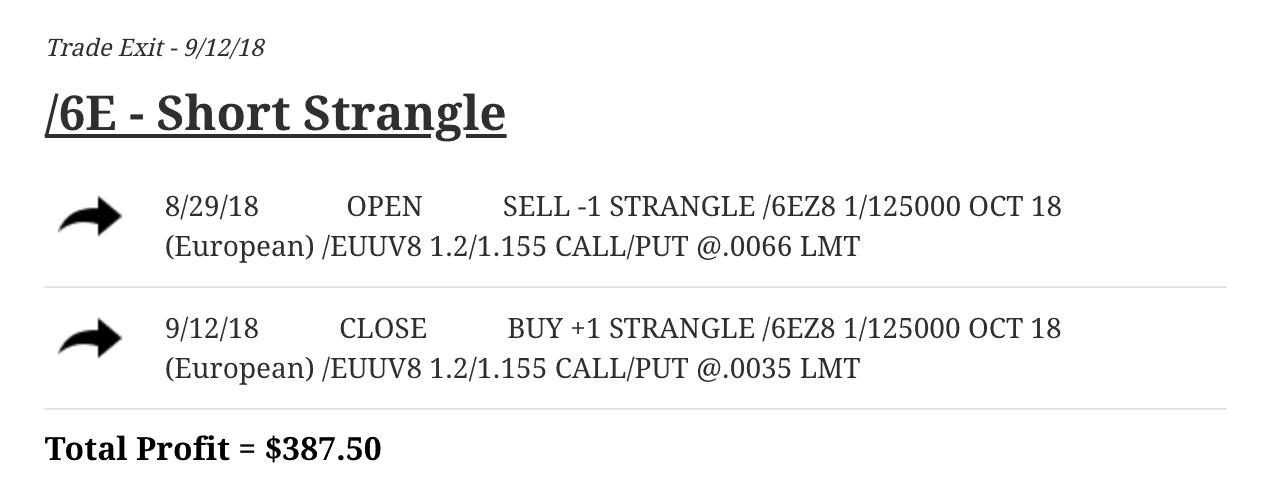

In /6E, we entered a Short Strangle, which is more of what we call a delta neutral strategy, where we don’t care if it goes up or down, we just want it to stay in a specific range. We were in this trade for a couple of weeks, and ended up booking a nice profit of $387.50.

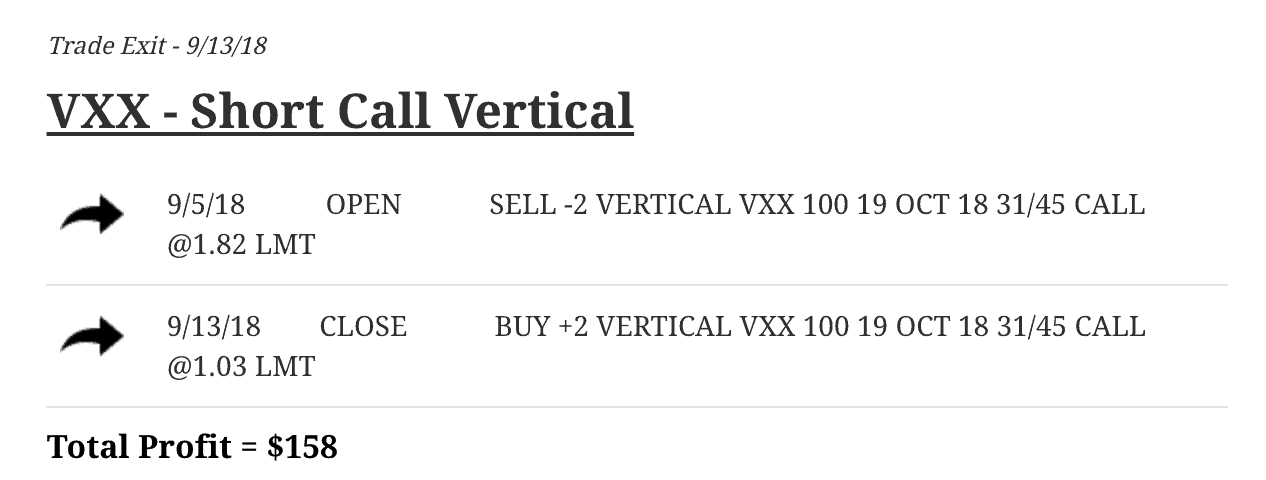

Our next trade was straight out of one of the strategies from our newest course, “How to Trade the VXX with 92.3% Accuracy”. In this case we did Short Call Vertical in VXX. We were in this trade for just a little over a week and booked a profit of $158.00.

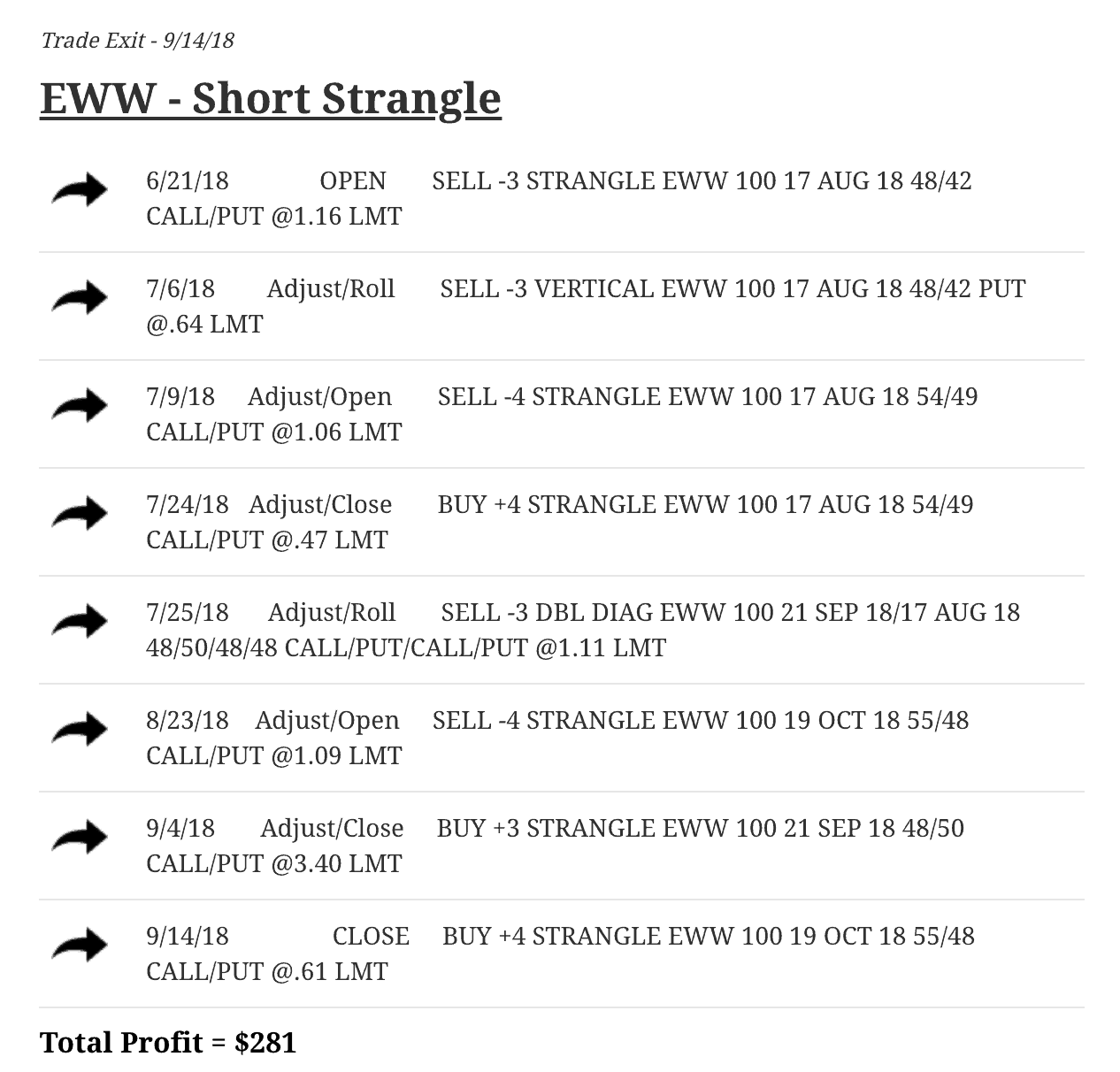

In EWW, we did a Short Strangle. As you can see, we actually started this trade back at the end of June and we had to do several adjustments and rolls, but by staying mechanical and doing exactly what we teach in the course, we were able to book a profit of $281.

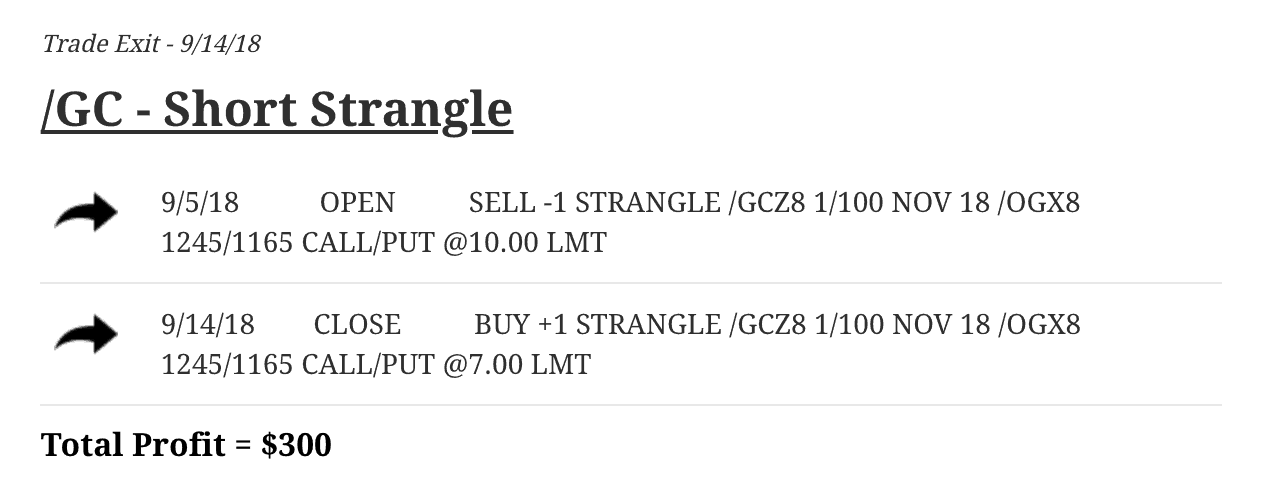

Our next trade was in Gold (/GC). We did a Short Strangle and were in this trade for about nine days. WE booked a profit of $300

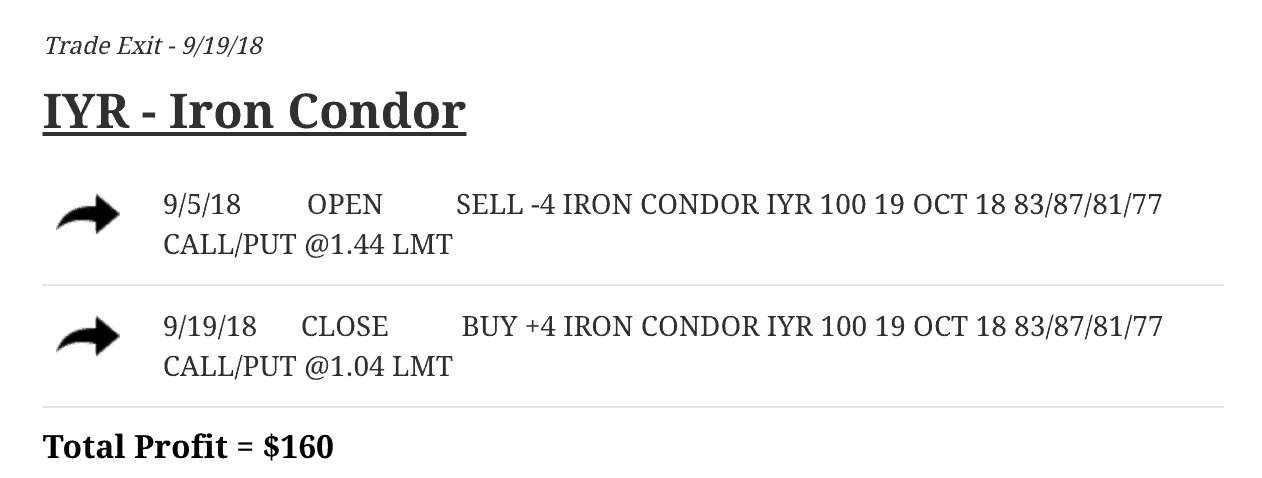

We did an Iron Condor in IYR, which is the real estate ETF. We were in this trade from 9/5 through 9/19. We booked a profit of $160 on that trade.

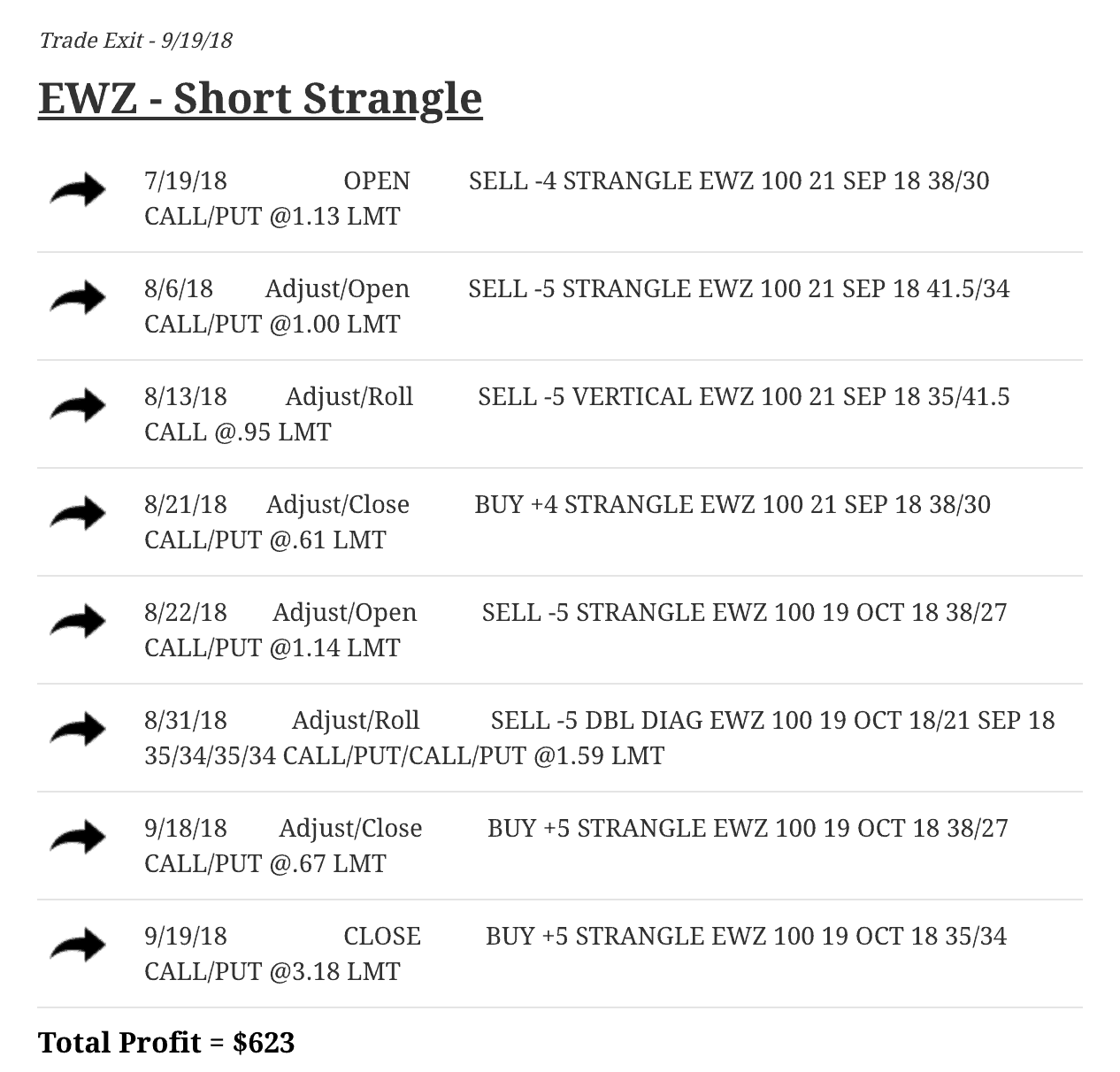

EWZ (the Brazilian ETF), has been a phenomenal trading vehicle because implied volatility has been extremely high, which gives us more premium to sell. Again, we had to make several adjustments here, but by staying mechanical, we booked a nice profit of $623 with a Short Strangle.

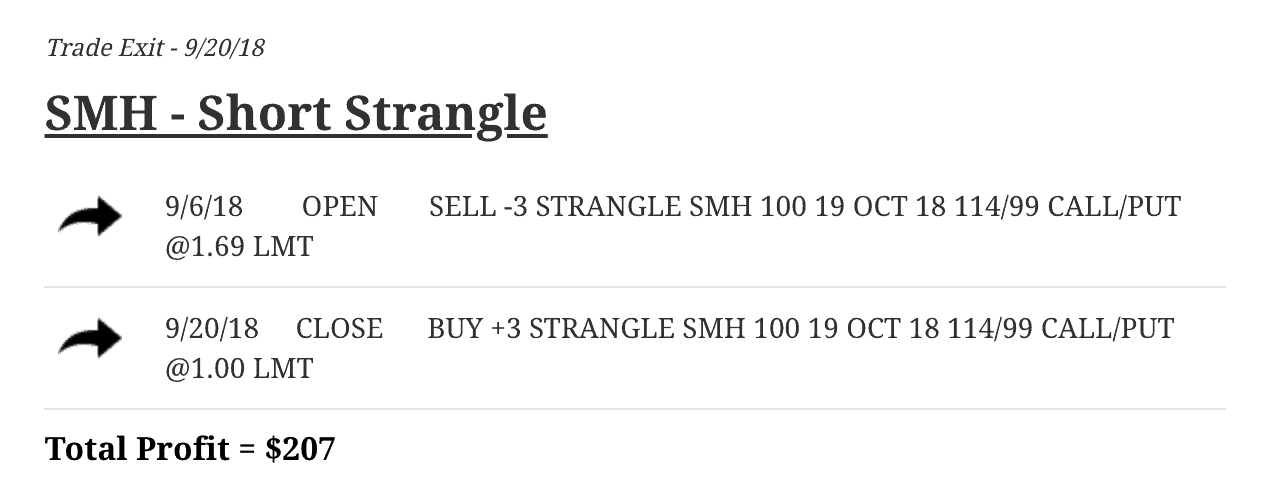

We did another Short Strangle in SMH, which is the semiconductor ETF. This is a symbol that we actually took off of our watch list for a while because the options starting to get not quite as liquid as they used to be. But there’s been a lot of volume, a lot of open interest back in SMH, so we’ve started to trade it again. The implied volatility warranted doing so, and we booked a nice profit on that Short Strangle for $207.

Lastly, in Tesla, we did a Short Strangle and booked a nice profit of $508. There’s been a lot of headlines with Elon Musk and Tesla in the news, which has elevated the implied volatility, making it for a great trading vehicle as well.

Those were all of our closed trades for the month of September. Again, it’s just a phenomenal time to be trading these strategies. If you’re not already a Pro Member, I’m not sure what you’re waiting for. But come check us out at Navigationtrading.com.

Whether you’re a newer trader or a more experienced trader, we will help you get to that consistent profitability.

We hope to see you on the inside!

Happy trading!

-The NavigationTrading Team

Follow