Hello NavigationTraders!

Welcome to this month’s update.

I want to take some time to review all of our closed trades for the month of November.

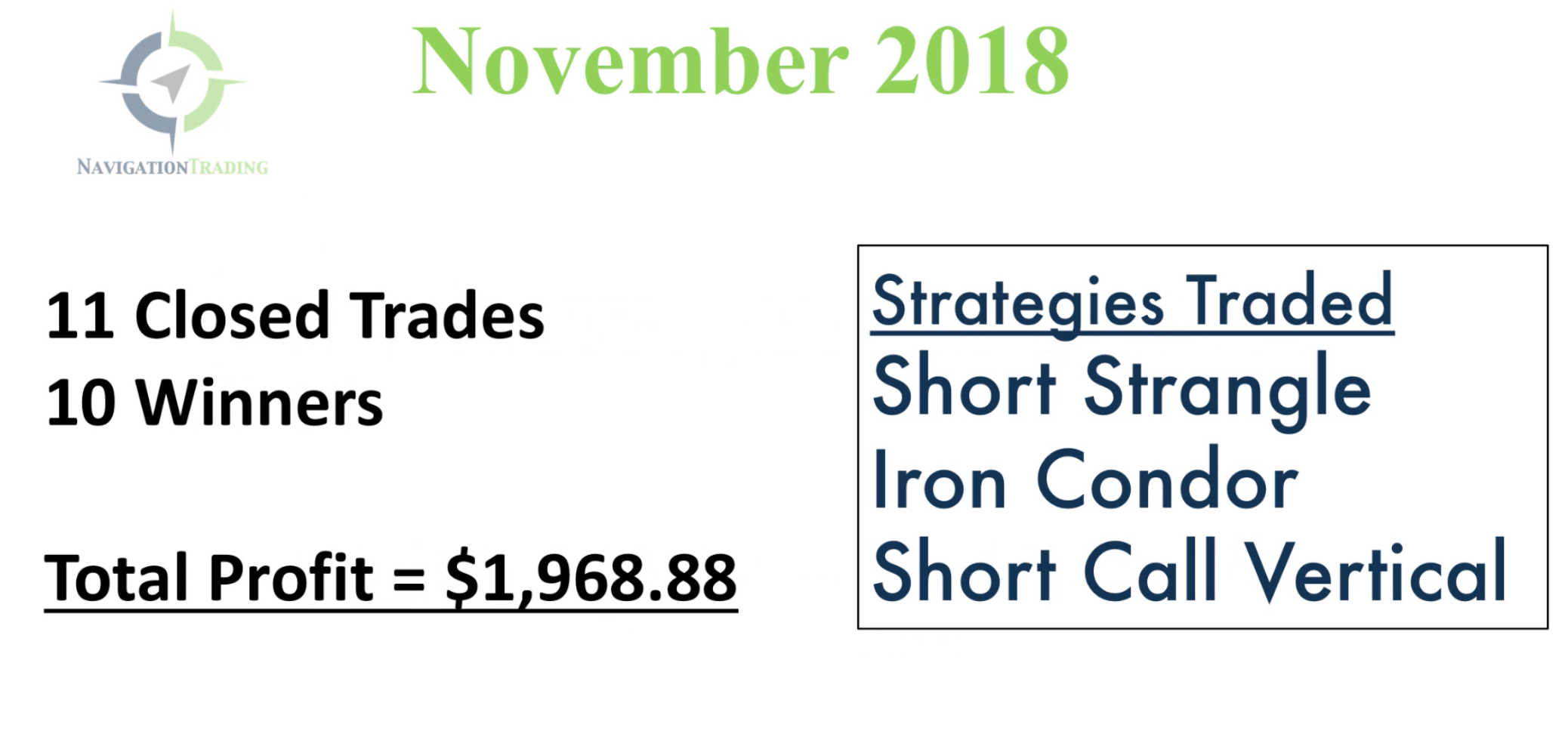

This month we had 11 closed trades, 10 of which were winners, for a total profit of $1,968.88.

We traded three different strategies, which is actually fewer than we normally trade. You can see the strategies we traded were Short Strangles, Iron Condors, and Short Call Verticals. A lot of that has to do with the environment that we’re currently in. Implied volatility is higher in many different symbols; so selling premium in Short Strangles, Short Iron Condors and Short Call Verticals, is where the opportunity is.

This continues to be one of the best opportunities to be trading the strategies that we teach. If you’re interested in receiving our NavigationALERTS, which we send out immediately via email and text message, just go to navigationtrading.com/pro-trial and check out our $1 14-day Pro Membership trial.

The TradeHacker Community

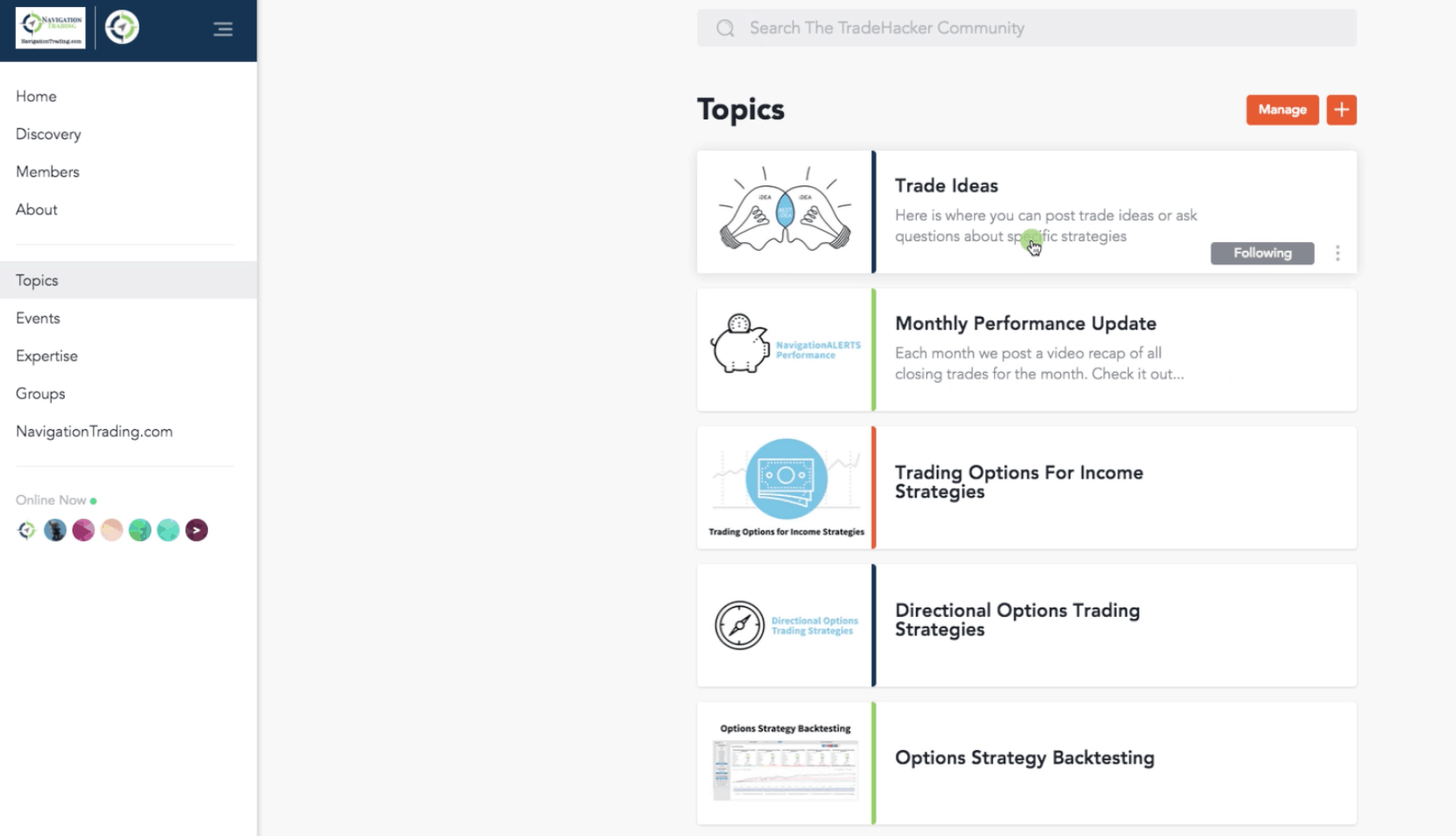

Before we jump in and go through each trade from this month, I want to remind you guys that we just rolled out our TradeHacker Community. If you go to community.navigationtrading.com, you can join for free! We put this community together specifically for NavigationTraders.

It’s a community of traders helping other traders. It’s really exciting for us to see the engagement, and traders answering other traders’ questions. The NavigationTrading Team is constantly in the community as well, interacting and answering questions from our members.

If you click on “Topics”, you’ll see there are a list of topics that you can check out. You can share Trade Ideas, check out our Monthly Performance Updates, look over Trading Options for Income Strategies and Directional Options Strategies, learn about Options Strategy Backtesting and the tastyworks platform, review Options Know How, and add input in Trading Strategy Discussions.

For our Pro Members, we put together a private group, exclusively for them. It’s in this group, that we’re posting our NavigationALERTS. We’re going to be jumping in the VIP Pro Group with videos during the week, and all kinds of new content to help our members become better traders. So, if you haven’t checked it out yet, just go to community.navigationtrading.com.

Our Performance Page

Let’s head over to our Performance page, at navigationtrading.com/performance. At the end of each month, we post an update letting our members and other visitors know our trade results. So far, year to date in 2018, we’ve closed 141 trades, we have an average profit per trade of $265, with a winning percentage of 91.5%. If you scroll down the page, you’ll see each months’ results and the different trades that we closed.

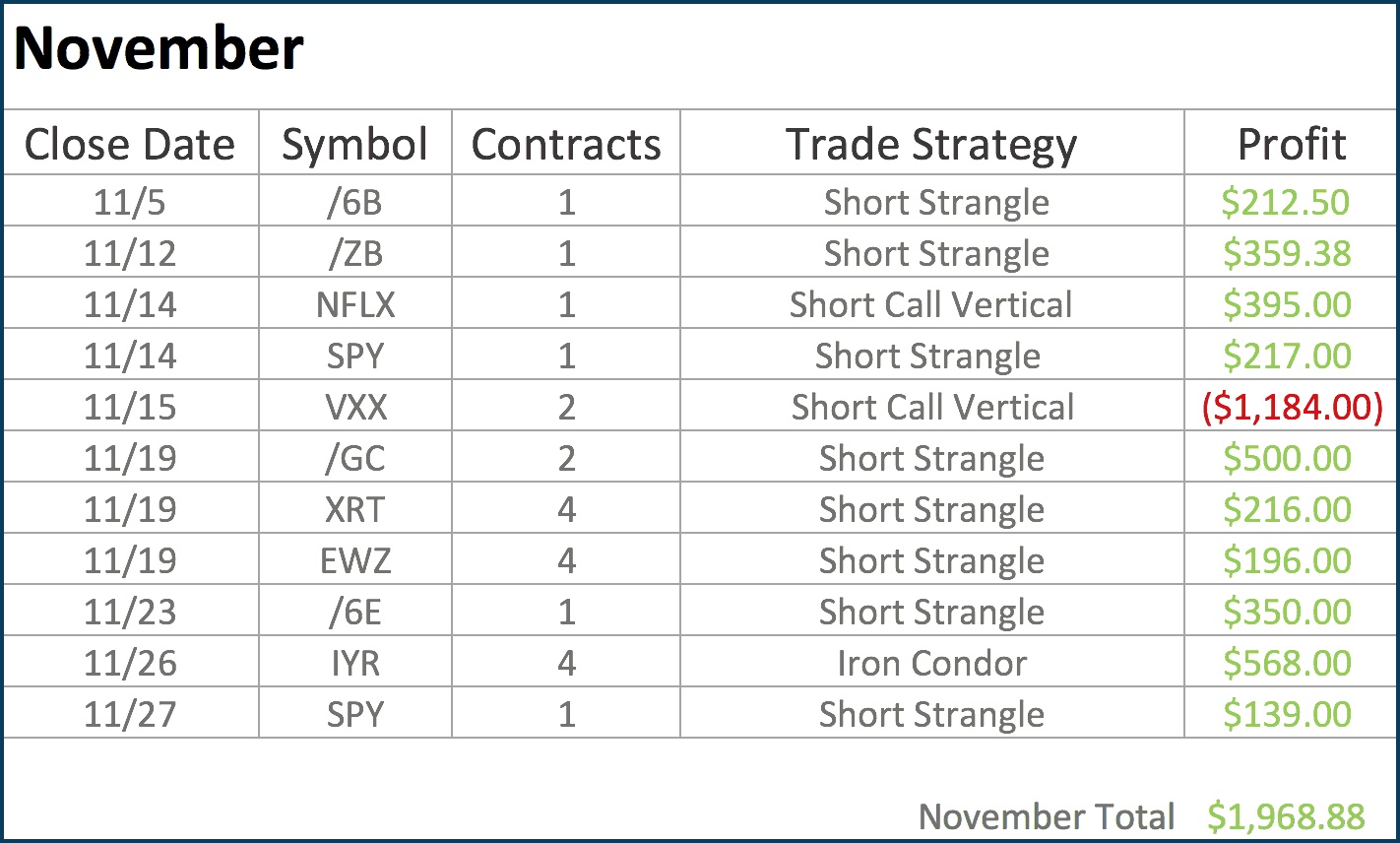

In November, as I mentioned earlier, we closed 11 trades. We had one loser in VXX, which brought our total profit to $1,968.88.

You’ll also notice that we’re typically only trading a couple of contracts with these trades. On some of the lower priced symbols, we traded four contracts. So, most of these trades can be done with a smaller account. We do have members with larger accounts and more experience, who are trading 5-10 times the number of contracts that we are. Each trade that we enter typically takes around $1,000 to a few thousand dollars of buying power, depending on the strategy, and depending on the opportunity.

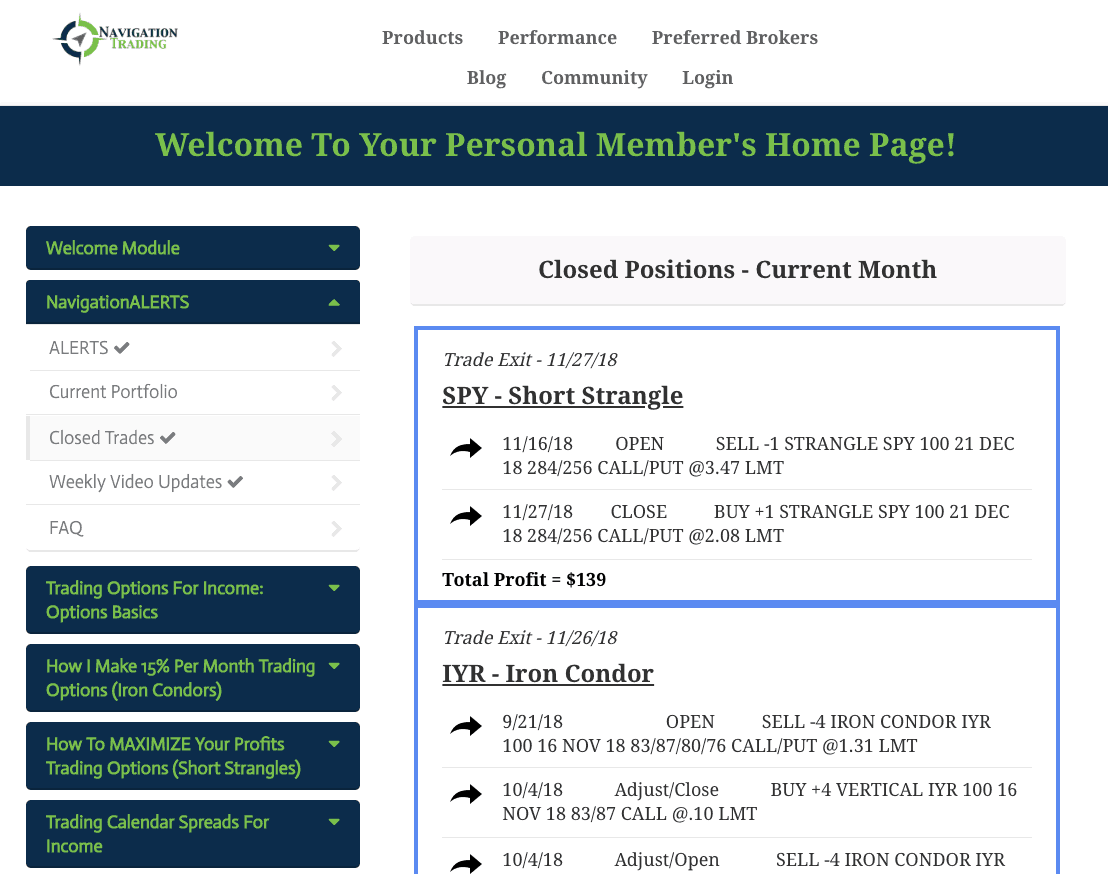

The Members Area

Let’s jump inside the Members area and take a look. For you non-Pro Members, here’s what the Members Area looks like:

This is where we post our NavigationALERTS, Current Portfolio, Closed Trades, our Weekly Video Updates that we record every Friday, and Frequently Asked Questions. All of our course training is located in the Members Area. Each course tab drops down and gives you video modules and training on each of the strategies we teach.

We’ll be in the “Closed Trades” tab, where we can review our closed trades from November.

In-Depth Look at Our Trades from November

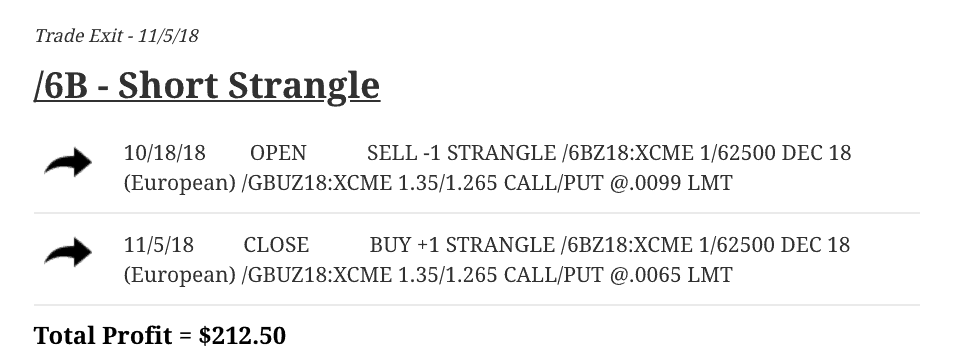

Starting at the beginning, on November 5th, we closed our first trade. This was a Short Strangle in /6B, which is the British pound. We sold the Short Strangle on the 18th and closed it out on the 5th. We were in this trade for just a few weeks and booked a profit of $212.50.

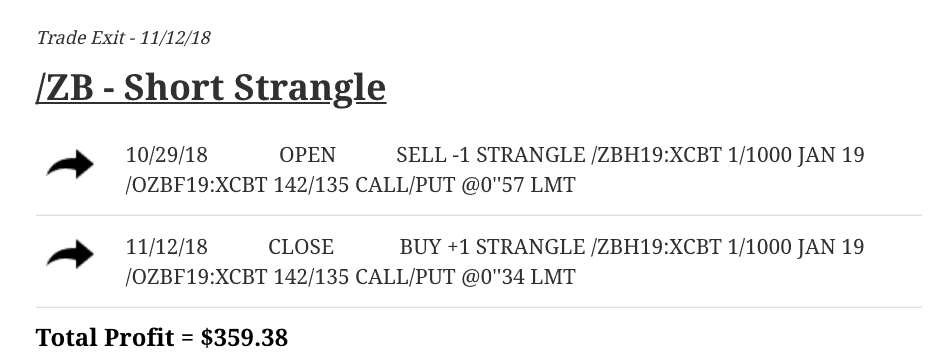

We entered another Short Strangle in /ZB, which is bonds. We were in this trade for just a couple of weeks, and booked a profit of $359.38.

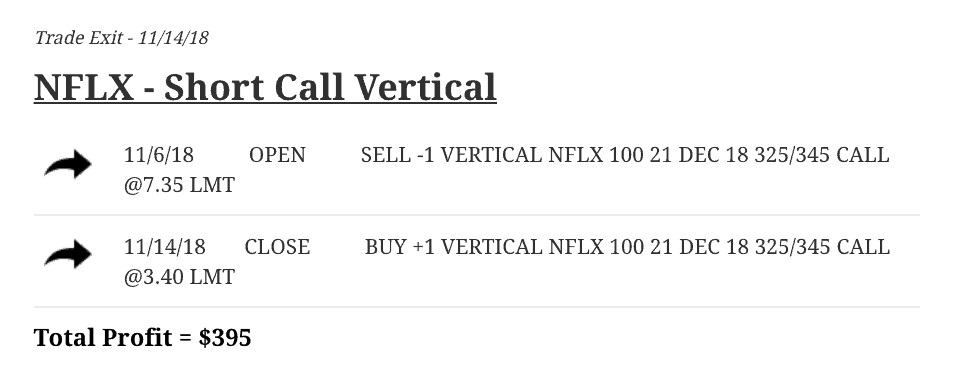

We did a Short Call Vertical in Netflix. We were in this trade for just over a week, and booked a profit of $395.

We did a Short Strangle in SPY, which is the S&P 500, and booked a profit of $217.

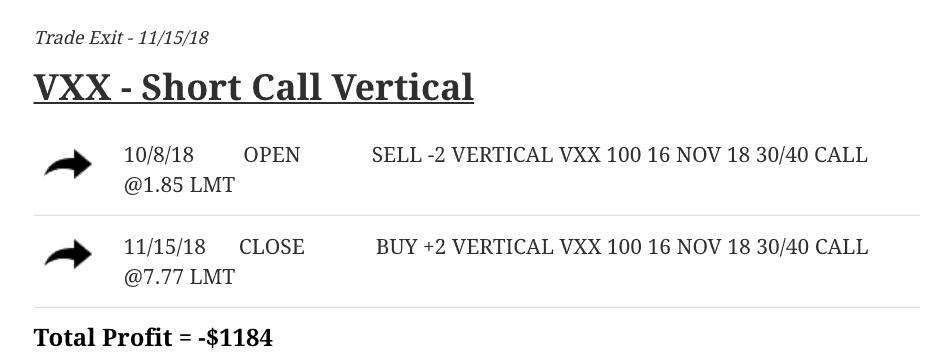

Our one loser for the month was in VXX. This is a volatility-related ETF, and so we were looking for a contraction in implied volatility. The market went down, which pushed implied volatility higher, so we ended up taking a loss on this one. When implied volatility did contract, we were trying to get filled at about breakeven or a small loss. Unfortunately, we didn’t get filled and then price ran away from us, and so we did take a loss on VXX.

We don’t like to play the “hindsight game”, and we show all of our winners and losers. So that’s what’s recorded, a pretty sizable loss in VXX. It’s a bigger loss than we typically like to take on any given trade. But those do happen.

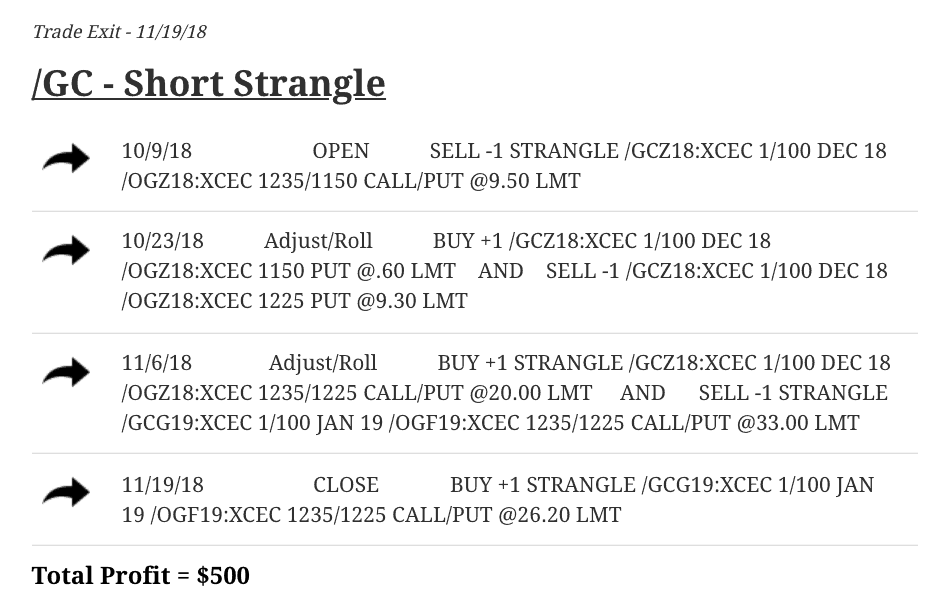

The next trade was a Short Strangle in /GC, which is gold. You can see we had to make a couple of adjustments and rolls. But, by staying mechanical, we ended up booking a nice profit of $500.

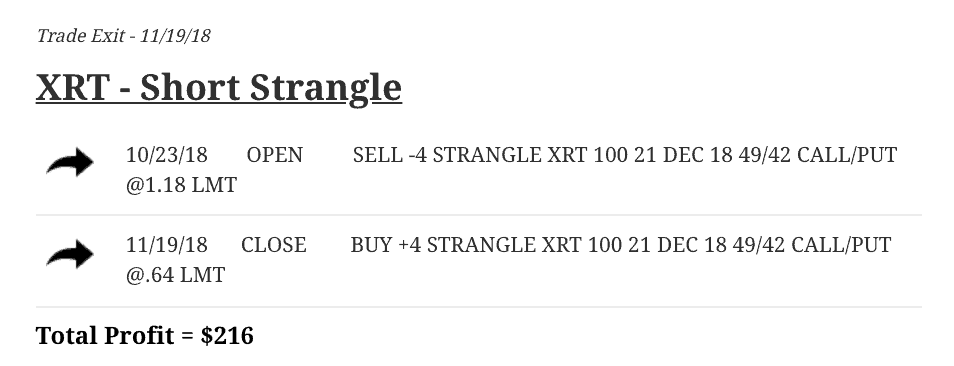

In XRT, which is the retail ETF, we booked a profit of $216.

In EWZ, which is the Brazilian Index, we did a Short Strangle and booked a profit of $196.

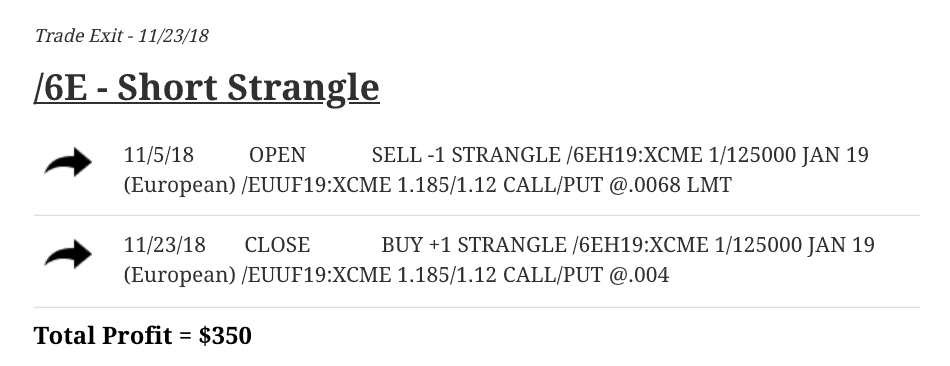

In /6E, which is the Euro, we did a Short Strangle and booked a profit of $350.

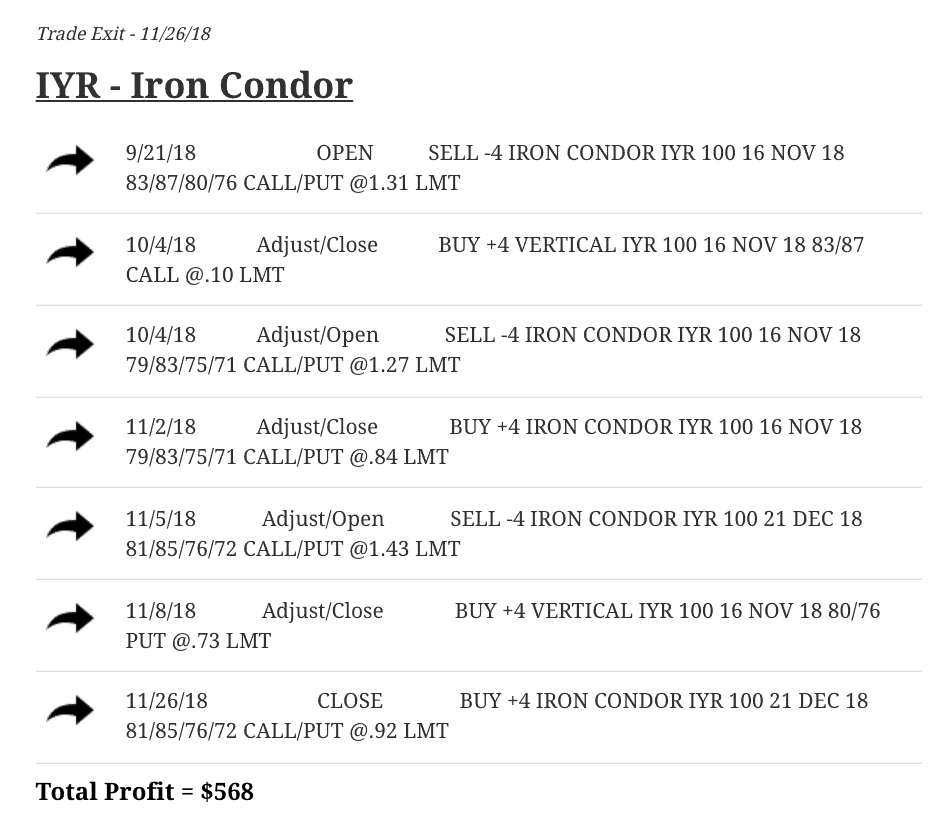

In IYR, which is the real estate ETF, we did an Iron Condor. You can see we had to make several adjustments, but again, by staying mechanical and using the methodology that we teach, we were able to book a nice profit of $568.

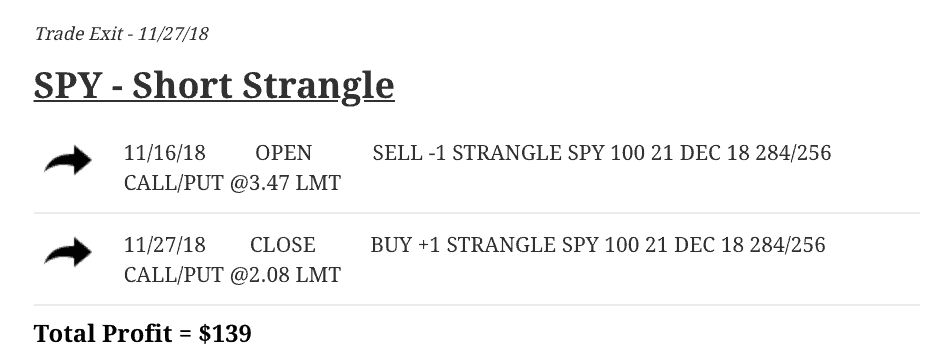

Lastly, we did another Short Strangle in SPY, where we booked a profit of $139. And that concludes our closed trades for the month of November.

As we head into the last month of the year, we hope to finish strong. We hope this implied volatility stays high.

If you’re not already a member, and you’re interested in trying out NavigationTrading, just go to navigationtrading.com/pro-trial. We’re offering our 14-day trial for only $1 right now! You can check it out and see if it’s for you.

With implied volatility as high as it is, this is one of the best times to be trading the methodology and the strategies that we teach.

We hope to see you on the inside!

Happy trading!

-The NavigationTrading Team

Follow