Hey NavigationTraders!

Here is your update on our trade performance for March 2019.

Another month is in the books and another great month for Pro Members!

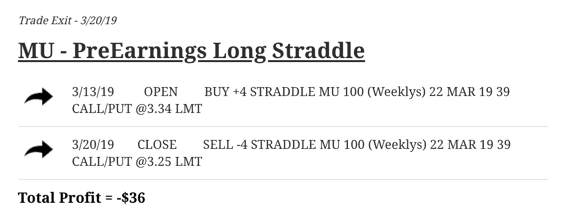

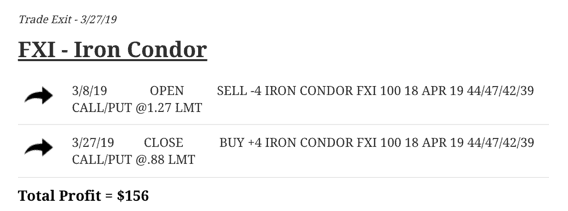

We closed 10 trades, 8 of which were winners, making a total profit of $773.

We traded five different strategies, including:

- Short Strangles

- Iron Condors

- Short Call Verticals

- Long Put Verticals

- Pre-Earnings Long Straddles

- Pre-Earnings Long Calls

Pro Membership

Our Pro Membership is currently closed to new members. If you go to our site and click on any of the Pro Membership buttons, you will be redirected to our waiting list page. So, if you are interested in receiving our NavigationALERTS and getting all of the video training for the strategies that we teach, you will be able to do that, but you’ll have to be on a waiting list until we open our membership back up.

We’re very focused on our current members and making sure that they continue to get the high level of service that they deserve. We’re near capacity for our Pro Membership, so we decided to create a waiting list.

You can still go ahead and check out our Pro Membership, and you will be notified once the membership opens back up. We’re letting in one or two members per week, but we’re just trying to control that influx of new members.

You can learn more about our Pro Membership at navigationtrading.com/pro-member.

Performance Page

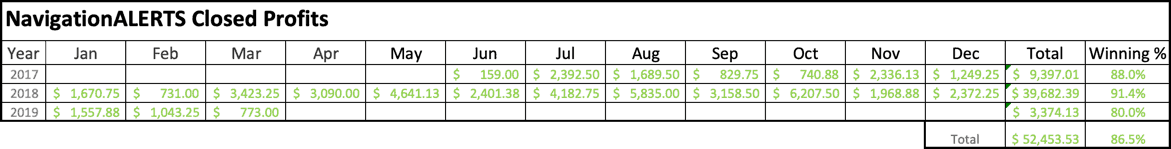

Let’s take a look at our performance page. So far in 2019, we’ve closed 30 trades, average profit per trade is at $112, with a winning percentage of 80%. As you scroll down, you can view our 2018 performance, all the way back to 2017, when we first started posting our alerts. We’re updating this page every month.

You’ll also see that we have a cumulative table at the top of the page. As you can see, since we started in June of 2017, we’ve had a total profit of $52,453.53, with a winning percentage of 86.5%.

Keep in mind, we’re trading pretty minimal contracts. We typically stay under five contracts per trade. So, you can trade with a small account, or you can scale up. We have members trading five to ten times the number of contracts that we trade in our Alerts Portfolio. You can trade our NavigationALERTS with any size account.

Our performance has been great, even though we did have one big loser this month in TLT. We went ahead and cut our losses on that one, but that’s trading and that’s just a part of the game.

In Depth Look at Individual Trades from March

Let’s take a look in the Membership Area, and we’ll go through these trades in more detail.

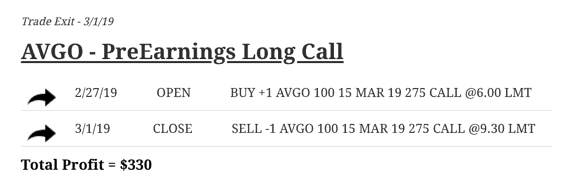

Starting at the beginning of the month on March 1st, we closed a trade in AVGO. We did a Pre-Earnings Long Call, which is a strategy that we teach in our Earnings Course. We booked $330 on that one.

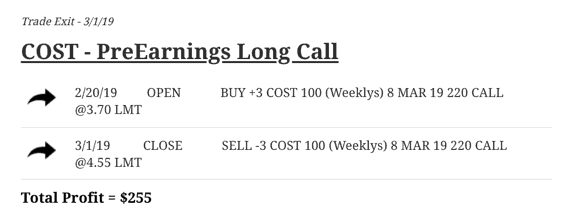

We did another Pre-Earnings Long Call in Costco and booked $255. So, both of those trades worked out nicely for us.

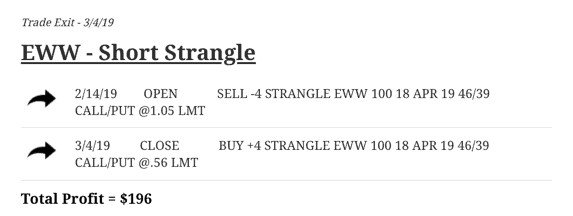

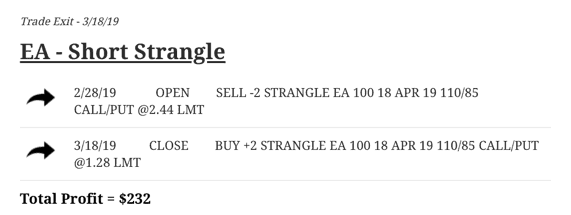

In our EWW Short Strangle, we booked $196.

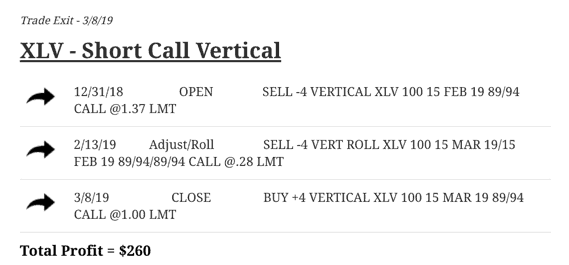

In our XLV Short Call Vertical, we were bearish and booked $260.

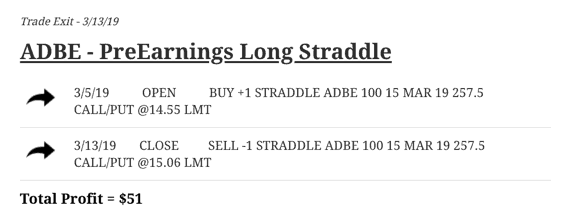

In Adobe, we had a Pre-Earnings Long Straddle. We needed to get out of the trade before earnings, and so we just closed it out. We didn’t get as much as we’d hoped, but booked a positive $51.

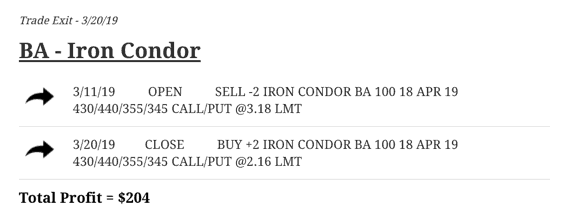

Our next trade was in BA, which is Boeing. Boeing has had a lot of media attention and headlines for their issues with the technology in their airplanes, and a couple of crashes. So, implied volatility spiked, but we did not fear. We took advantage of that, put on an Iron Condor, and booked a profit of $204.

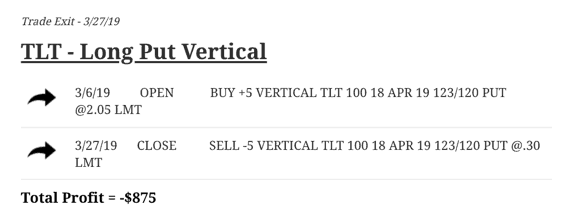

In TLT, we had a Long Put Vertical. We were looking for bonds to go down. The Fed ended up coming out and pausing interest rates, which sent bonds and notes higher. So, we ended up just cutting our losses, and taking a loss of $875.

And that wraps up our closed trades for the month of March!

Member’s Area

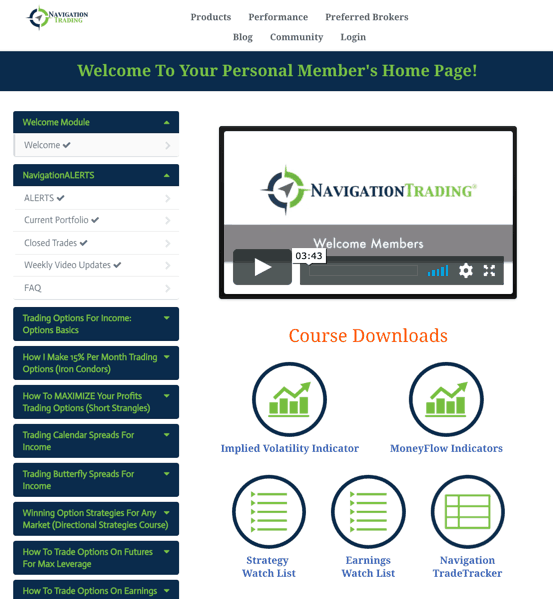

All of our closed trades, are posted in your Member’s Area when you’re a Pro Member. You can find them in the “Closed Trades” tab, nested under the “NavigationALERTS” tab. Also nested under the NavigationALERTS tab, you’ve got the “Current portfolio” tab, the “Alerts” tab, and the “Weekly Video Updates” tab where we give you a weekly video to review trades from the week.

All of our VIP course training is located in your Member’s Area, including courses on these strategies:

- Iron Condors

- Short Strangles

- Calendars

- Butterfly Spreads

- Directional Strategies

- Futures

- Earnings Announcements

- Money Flow

- How to Trade the VIX

- Option Assignment Mini Course

Our Trade Hacker’s Playbook (E-book), as well as some other resources, are all available to you within your Member’s Area if you’re a Pro Member.

The TradeHacker Community

If you’re a Pro Member, you also have access to the V.I.P. Pro Group in The TradeHacker Community at community.navigationtrading.com. You can sign up for the community as a free member as well.

We’ve got hundreds of traders in our community, where people are asking trading related questions and sharing their thoughts. You get to interact with other like-minded traders. There’s trade ideas being posted every single day.

Again, specific to our Pro Members, we’ve got a V.I.P. Pro Group within the community. We post our trade alerts here as well, so Pro Members get the opportunity to ask questions and have discussions on the trades that we post. We also post our Weekly Video Updates in the V.I.P. Pro Group and have a few other Pro Member specific topics within the group.

If you’re interested in getting on our wait list for the Pro Membership, just go to navigationtrading.com/pro-member.

We hope everyone has another great month of trading, and we’ll check back with you next month.

Happy Trading!

-The NavigationTrading Team

Follow