Hey NavigationTraders!

We had another great month of trading in March with 12 closed trades and 11 of those winners. Just one small loser. Total profit at $3,423.25.

Now, some of you with larger accounts might be saying, “$3,400 in a month? Big deal. That’s not very much.” Others of you might be saying, “Wow, that’s great.”

Keep in mind, we’re trading a relatively small sized account. We’re only trading 1-5 contracts. Some of our members with larger accounts are trading 5 or 10 times that account.

If you’re trading the contract size 10 times what we’re trading here, then we’re talking about $34,000 a month. So you can really trade these strategies at any level.

I mentioned in last month’s update that right now is the best time to be part of NavigationTrading, because the implied volatility is very high in a lot of different symbols.

This is one of our best months as far as profit goes, and that has to do with the fact that we’re collecting more credit. We’re giving ourselves a better chance to make more profit on these trades, and it’s reflected in the total profit that we made this month.

Breakdown Of March Trade Results

Let’s jump over to the Members’ Area and breakdown each trade as we made them throughout the month. Here’s a snapshot of the members area if you’re a pro member. As you can see, you’ve got the navigation alerts. You’ve got all the different courses for the different strategies that we teach. All of it will be loaded in your Members’ Area when you are, or if you are, a Pro Member.

Click the dropdown for NavigationALERTS and take a look at the closed trades for March. If we start at the beginning of the month, our first closed trade was on 3/6 in BKNG. BKNG used to be Priceline, but they’ve changed their ticker. We did a Post-Earnings Short Put Vertical in BKNG. This is just a textbook Post-Earnings Short Put Vertical, just like we teach in our earnings course. We booked a profit of $212 on that trade.

Next trade was XLE, an energy ETF. We did a Short Strangle there and booked a profit of $168.

In EWZ, the Brazilian ETF, we did a Short Strangle and booked a profit of $144.

Then, in /ZN, which is the ten-year note, we did a Short Strangle. As you can see, we had to do a few rolls, a couple different adjustments, but by staying mechanical, we were able to book a nice profit of $468.75.

Our one loser was in ORCL. We did a Pre-Earnings long straddle. Just never quite got the move that we needed to be profitable here, so we took a small loss of $66.

Next trade was in SPY, the S&P 500 index. We did a traditional Iron Condor with four contracts, booked a profit of $272.

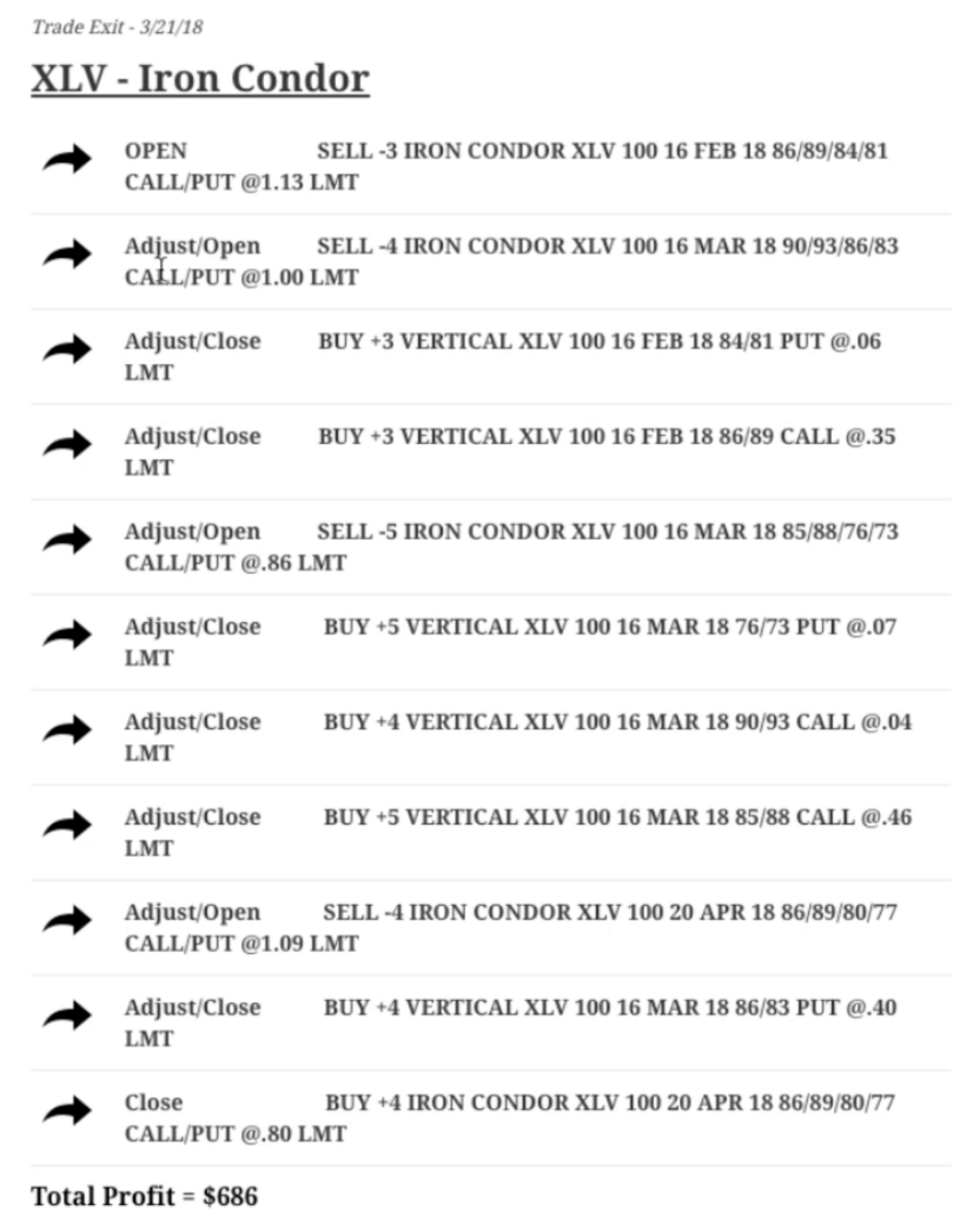

Next trade was another Iron Condor in XLV. You can see we had to make multiple adjustments here over a couple different cycles. In the end, by staying mechanical, booked a nice profit of $686.

EWW did a Short Strangle and booked a profit of $160.

GLD, the gold ETF, we did an Iron Condor and booked a profit of $148.

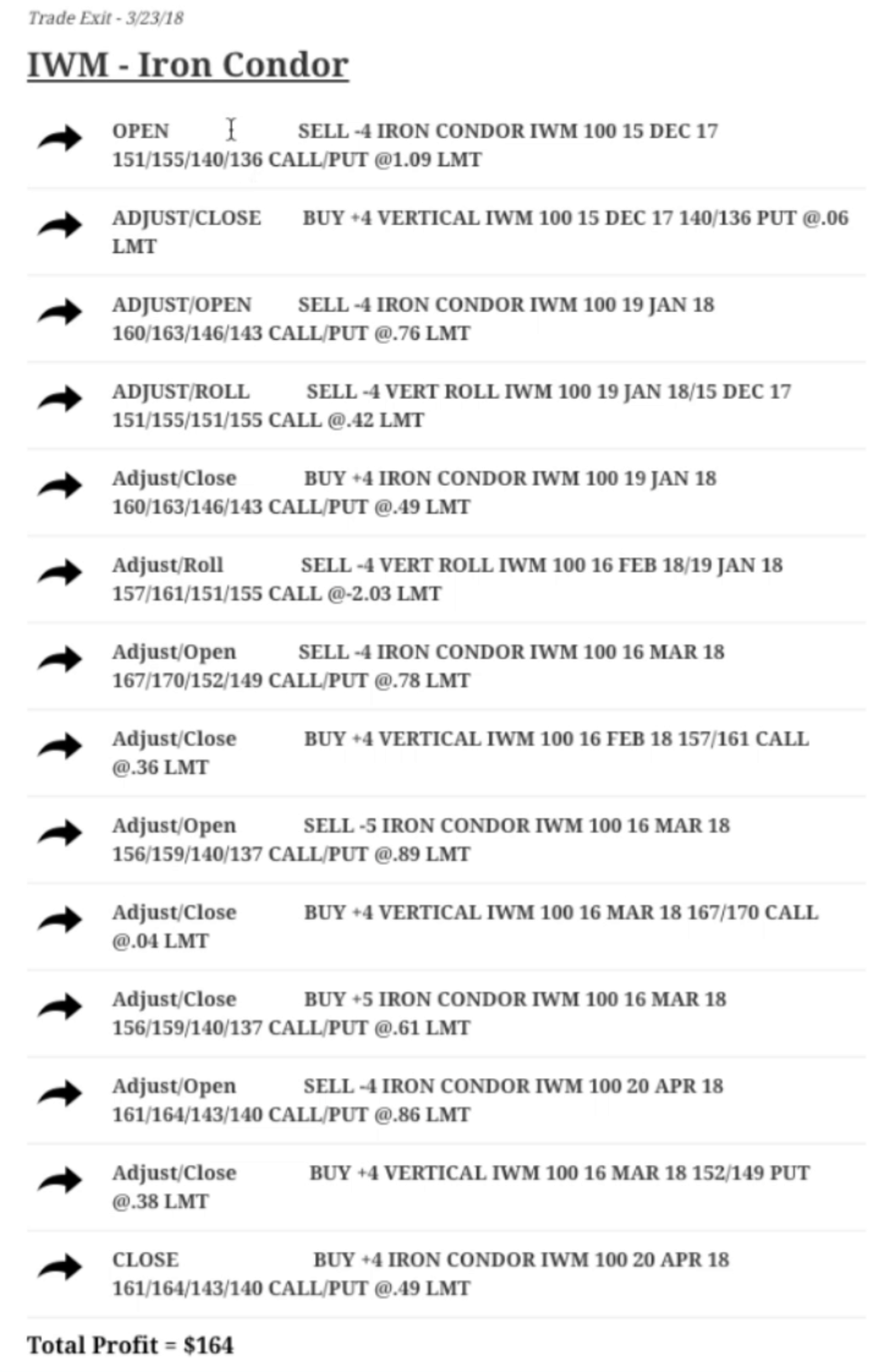

IWM, the Russel small cap index, as you can see, we did multiple adjustments here. Price initially went way against us, but we were able to continue just to stay mechanical, make our adjustments, booked a profit of $164.

It is such a big deal to be able to manage out of a trade that goes completely against you over a couple of different option cycles, turning that losing trade into a profitable trade. I can’t tell you how BIG of a deal in your overall performance that is. Learning the adjustment strategies that we teach and staying mechanical with your trade always pays off in the long run.

We also did a Short Strangle in the euro, /6E. Just had to make one adjustment, but by doing so, we were able to book a nice profit of over $937.

Lastly, in EEM, the emerging market’s ETF, we did a Long Put Vertical. It was kind of a short directional play and we booked a profit of $129.

Overall Performance

Let’s go to one of the pages on our site, navigationtrading.com/performance. This is open to everyone, not just Pro Members. This is where you’ll see all of our updated statistics. Year to date for the first three months in 2018, we’ve had 36 closed trades. Our average profit per trade is $162, with a win rate of over 86%. You can see the breakdown of the trades we just went over and the profit. We have all the previous months posted as well, so February and January.

Our 2017 statistics are posted on this page. In ’17, we had 75 trades. Our Average profit was $140, with an 88% win rate. You can see the breakdown going all the way back to June of last year, when we started posting these trades.

As I mentioned, we’re trading in a relatively small sized account. The most we have done on any one trade was five contracts. If you have a smaller account, you can do as many as we’re doing, or you can do even less. If we’re doing five, you can still do one or two. If you have a larger account, you can be doing 5 or 10 times the amount that we’re trading. You can do this on any level, in any size account.

Remember, our Pro Membership is currently closed to new members. But, if you click on the Pro Membership button on our site, you’ll be directed to a waitlist page, where you can put in your name and email address. On a first come, first serve basis, we will let you know if a spot opens up.

We are so excited for trading these next several months! Volatility is back, which makes trading much more profitable, and much more fun. We can’t wait to share with you as we continue to move forward.

I hope that was helpful!

Happy trading!

Follow