Hey NavigationTraders!

We just wanted to recap of all of our closed trades for the month of June. We can’t believe that the year is already halfway over, and that we’re already reviewing performance results from June.

FREE Webclass Trading Options for Weekly Income

Before we do though, I want to mention one thing that we’ve got coming up tomorrow, on Tuesday, July 2nd at 4:00 p.m. central time. We are broadcasting live our newest strategy course, Trading Options for Weekly Income, which is in a little bit of a different format. Typically, we prerecord all of the modules for our members to create the course.

In this case, we are broadcasting the course live. We want to get it out to all of our members. We’re super excited about this strategy and sharing it with our members! Everyone is welcome to join us. There’s no cost to join the live broadcast.

The recording from the webclass will only be available in the Members Area for Pro Members. But again, you can join at no cost by registering for the live broadcast.

Most of our strategies are related to monthly income. We’re in the trade for, a lot of times, 20-30 days or even longer if we have to make rolls.

With weekly options and weekly income and the strategies that we’re going to teach, you are in and out of these trades within six to seven days. There’s no adjustments, no rolls.

Here’s some of the things that we’re going to cover:

- how we routinely make over 40% return on investment in less than seven days

- our top two strategies that we use to produce weekly income

- the three most profitable symbols that we trade for weekly income

- exact entry and exit criteria to maximize profits and minimize risk

- the best way to trade a small account for weekly income

We’ve got members that have seven figure to million dollar accounts. And we’ve got members who have smaller accounts. We want to show you the best way to trade for both account sizes.

- Lastly, we’ll show you how to reduce taxes on your trading profits by more than 50%

The other thing to keep in mind, is that these strategies that we’re teaching are IRA eligible. So you can trade these whether you have a margin account, a cash account or an IRA or some type of retirement account.

To register, just go to navigationtrading.com/weeklyincome. It’s going to be a full house, so make sure you save your spot! Again, the webclass will be tomorrow, July 2nd, at 4 p.m. central time. Make sure you’ve got your time zones right. We look forward to seeing you there!

In-Depth Look at June 2019 Performance

Let’s jump back into recapping the closed trades for the month of June. We’ll have to navigate to the Pro Member’s Members Area. If you’re not a Pro Member, this is what the Members Area looks like for Pro Members.

We’re looking at the “Closed Trades” tab, which is nested under the “NavigationALERTS” tab. Keep in mind, this is also where you have access to all of our strategy courses. The weekly income course that we’re presenting tomorrow will be added to this list of strategy courses as well.

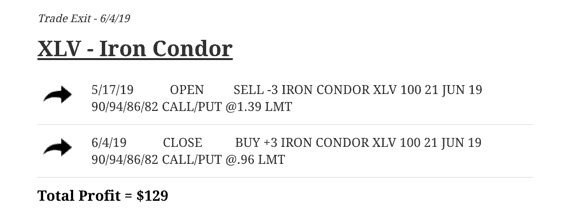

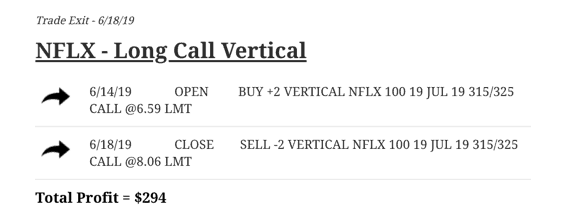

Let’s go to the beginning of June to review our closed trades in order. The first trade we closed was on 6/4, which was an Iron Condor in XLV. We just put this trade on, took it off, and booked a profit of $129.

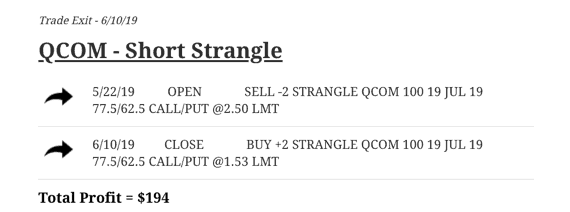

Our next trade was a Short Strangle in QCOM. Again, put that on and took it off, with no adjustments needed, booking a profit of $194.

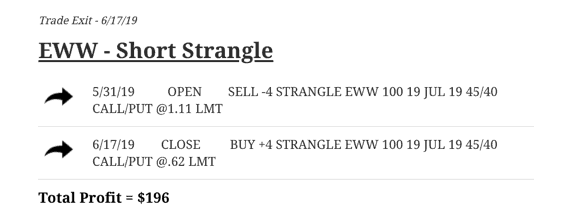

In EWW, we did another Short Strangle. We put it on, and after a little over two and half weeks, we booked a profit of $196.

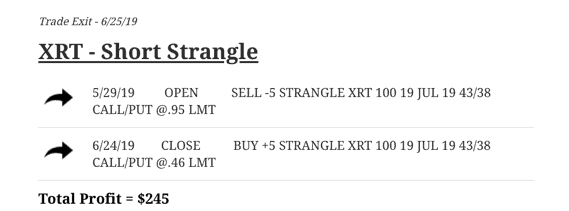

In XRT, the retail ETF, we did another Short Strangle. No adjustments were needed on this trade either. We booked a profit of $245.

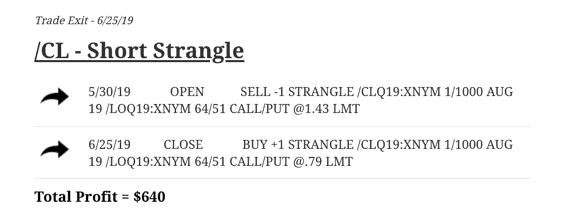

In CL, which is the oil futures contract, we did a Short Strangle. We booked a nice profit of $640.

The only closed trade that we had to do an adjustment on was KRE, which is the brokerage ETF. We had one adjustment, one roll, but by staying mechanical we ended up making a small profit of $87. We were down on the trade, but managed our way back to a profit. So the adjustment was pretty successful.

Those are all of our closed trades from the month of June!

Going back to our webclass tomorrow, after we do our live broadcast of our weekly income course, we will begin sending out alerts as part of the Pro Membership for these weekly income strategies. So if you’re a Pro Member, you’ll be getting the alerts so you can follow along exactly with what we’re doing after we teach you how to do it yourself in our weekly income course.

Again, to register for our FREE webclass tomorrow, just go to navigationtrading.com/weeklyincome.

We look forward to seeing you on the inside. Have a great month.

Happy Trading!

-The NavigationTrading Team

Follow