Hey NavigationTraders!

Welcome to our month end video update. July is in the books, so we just wanted to take some time to review our closed trades for the month of July.

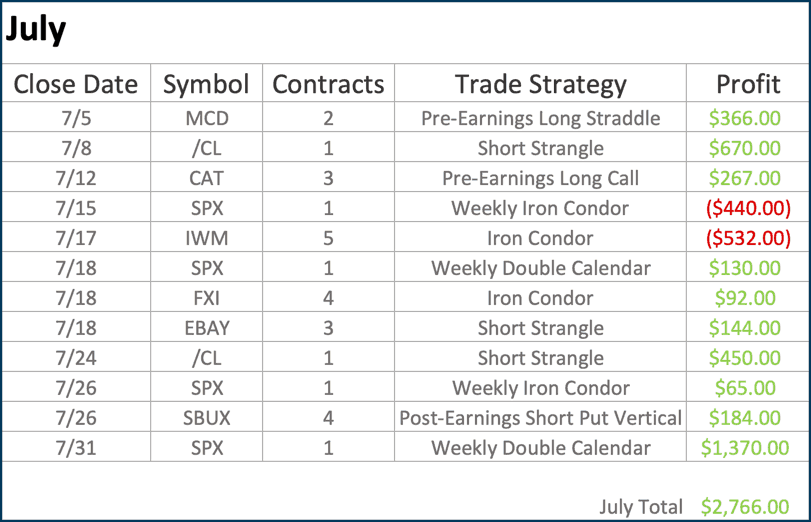

July Performance

Our total profit for the month of July came to $2,766. Our average profit per trade was $255. We had 12 closed trades, 10 of which were winners, giving us a winning percentage of 83.3%.

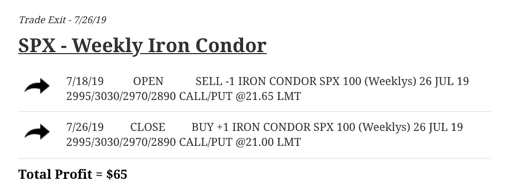

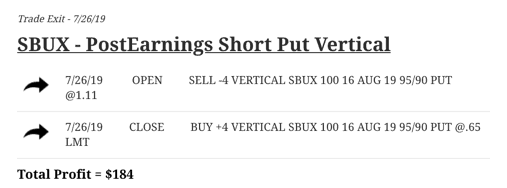

We traded quite a few different strategies this month, including:

- Short Strangles

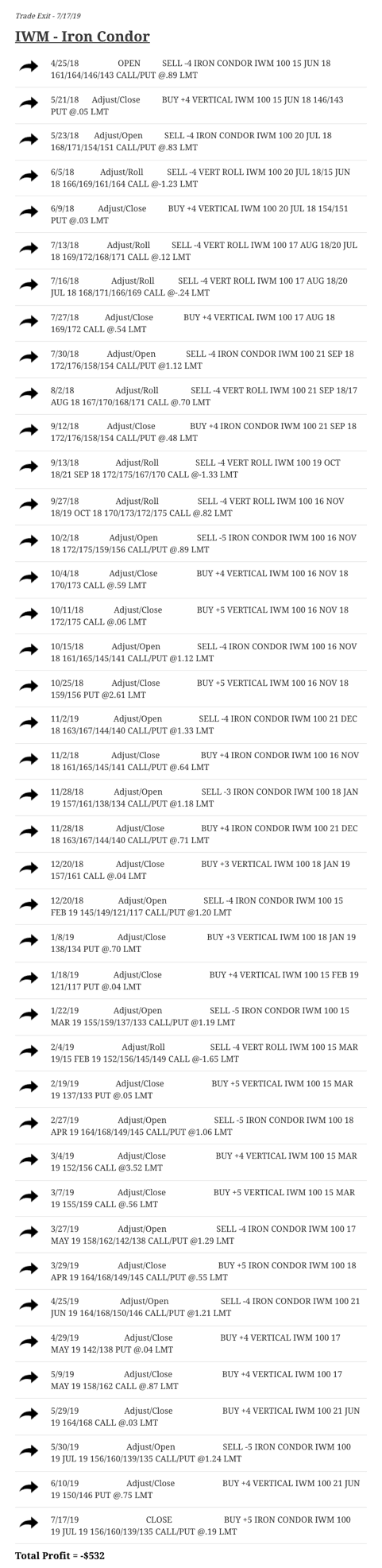

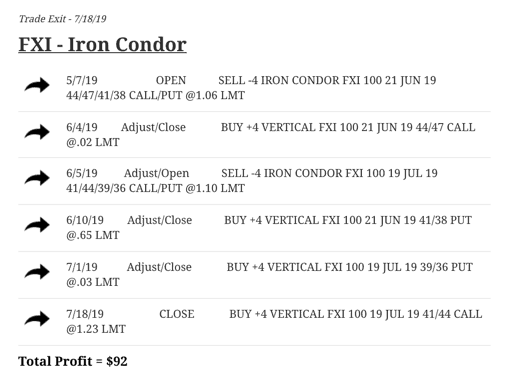

- Iron Condors

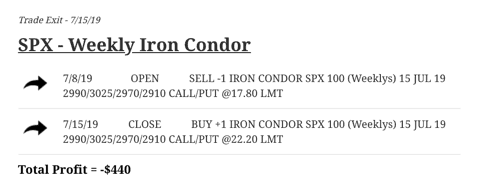

- Weekly Iron Condors

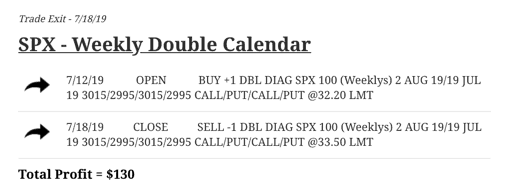

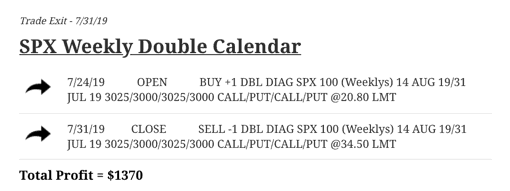

- Weekly Double Calendars

- A Pre-Earnings Long Straddle

- A Pre-Earnings Long Call

- A Post-Earnings Short Put Vertical

We just recently released our newest strategy course called Trading Options for Weekly Income, so that’s why you’ll see us incorporating those weekly options strategies more each month. We teach those strategies step-by-step in our weekly options course, which you can find in your Pro Member Member’s Area.

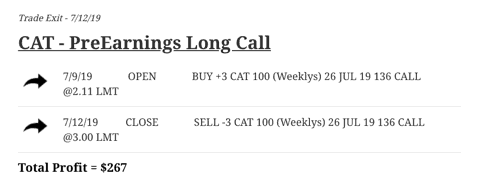

We also have an earnings course available in your Member’s Area called How to Trade Options on Earnings for Quick Profits, which will walk you through how to trade our earnings related strategies.

If you’re not a Pro Member yet, and you’re interested in following along with our live trade alerts via text and email, you can try out our Pro Membership by signing up for our $1 14-day trial at https://navigationtrading.com/pro-trial!

This Year’s Performance

Let’s jump over to our Performance Page and take a look at where we’re at year to date.

In 2019 we’ve closed 76 trades. Our average profit per trade is at $134, with a winning percentage of 82.9%. Up at the top of our Performance Page, we’ve got a table with our cumulative profits since we first started sending out alerts in June of 2017. So if you’re interested in seeing our overall performance, you’ll definitely want to check that out.

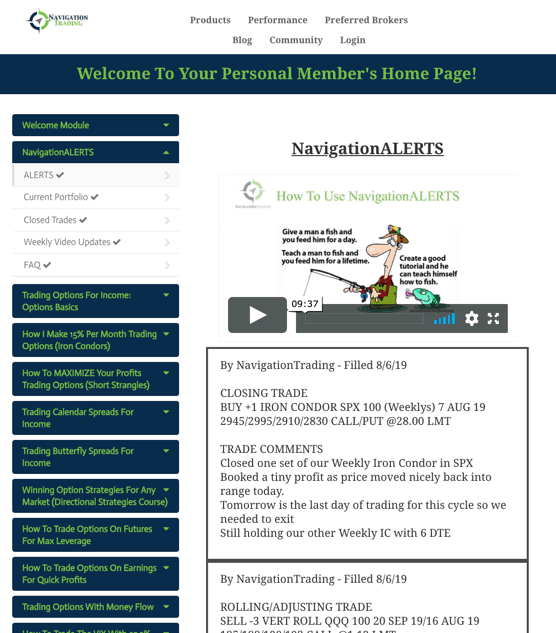

Pro Member Member’s Area

Let’s navigate to the Pro Member Member’s Area. If you are a Pro Member, this is what it’ll look like.

In addition to the alerts posted here, you’ll also see the different strategy training courses in the left sidebar, from Iron Condors to Short Strangles, Calendar Spreads and Butterflies, directional strategies, futures, earnings, money flow, the VIX, option assignment, and the weekly income course that I mentioned above.

You also have access to our e-book, The Trade Hacker’s Ultimate Playbook, as well as indicators and watch lists. All of these resources are available is in your Member’s Area as a Pro Member.

Individual Trades In-Depth

To view our closed trades for the month of July, click on the “Closed Trades” tab nested under the “NavigationALERTS” tab. We’ll dive a little bit deeper into each of the trades we closed this month.

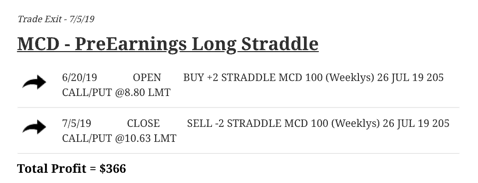

Starting with McDonald’s, we did a Pre-Earnings Long Straddle and booked a profit of $366.

In /CL, which is the oil futures, we did a Short Strangle and booked a nice profit of $670.

Our other loser was an Iron Condor in IWM, and you can see all of the adjustments that we had. We had been in this trade for quite a while, making adjustments. Price moved really far against us right out of the gate, so we were just managing and trying to get back some of the initial losses that we took here. We weren’t able to get back to profits.

We ended up just closing this out because implied volatility got super low. We were down quite a bit more than this, so we cut back on a lot of those losses, which is the key to these adjustments. We turned what was a pretty significant loss, into a, I don’t want to say small, but a loser of $532, as opposed to quite a bit more.

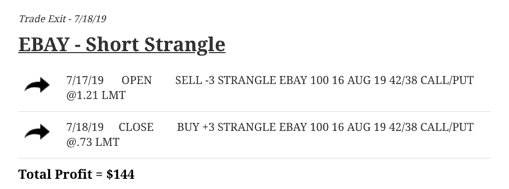

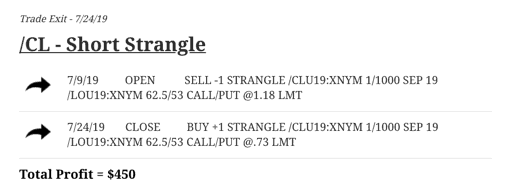

Then we went back to oil (/CL), and did a Short Strangle there. No adjustments were needed, and we took this off after just a couple of weeks, booking another profit of $450.

Those are all the trades we closed in the month of July. Again, if you’re interested in getting our NavigationALERTS, you can sign up for our $1 14-day trial at https://navigationtrading.com/pro-trial!

We look forward to another great month of trading in August, and we hope to see you on the inside.

Happy Trading!

-The NavigationTrading Team

Follow