What’s up NavigationTraders?!

It’s another month in the books!

I can’t believe it’s already the fourth quarter of 2017. September is over, and I want to give you a quick update on the performance of our NavigationALERTS.

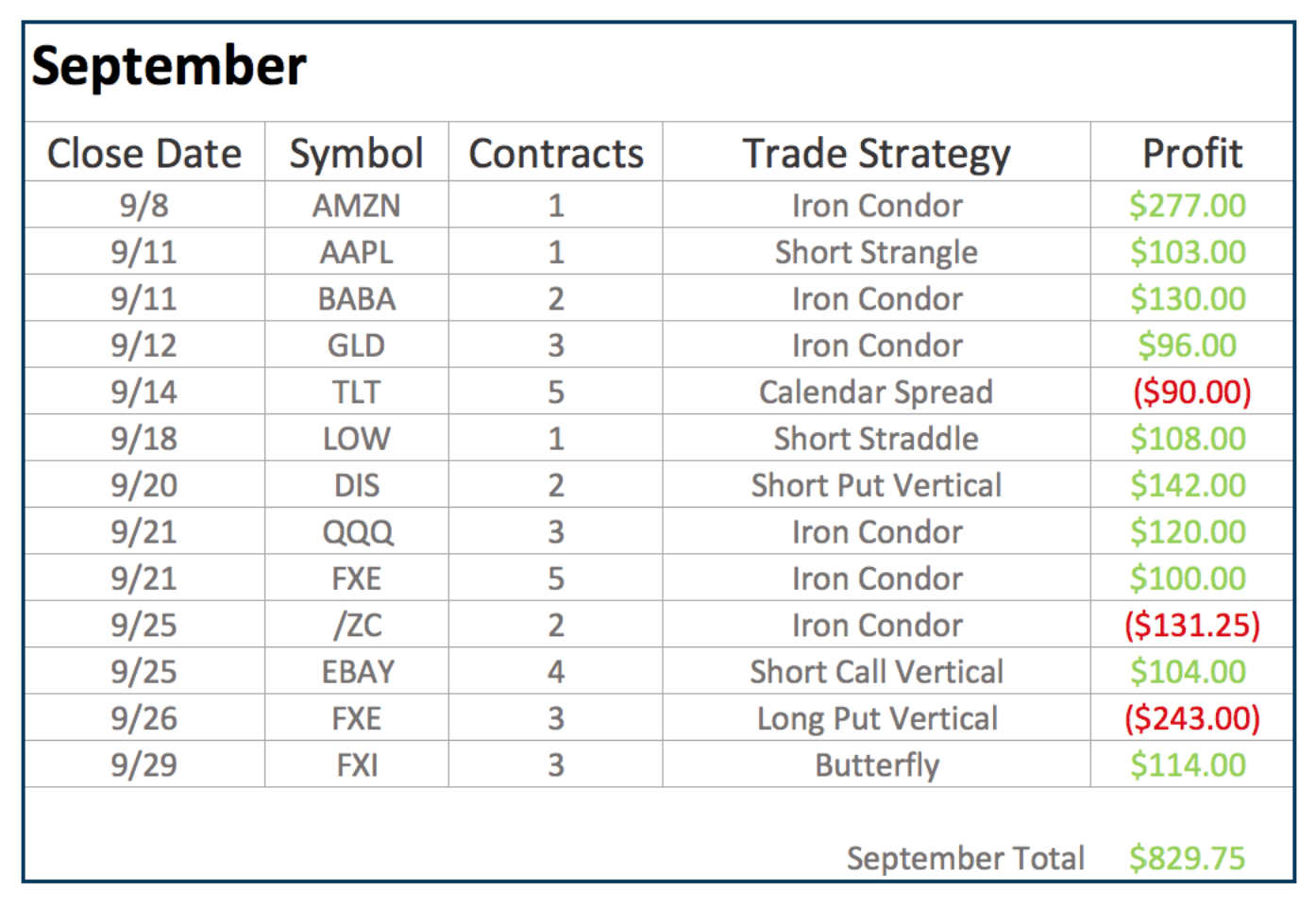

If you look at the chart below, you can see we had 13 closed trades, 10 of which were winners. Our total profit came to a little over $829.

The last couple of months have been awesome with 100% winners!

This past month we had a few close out that were losers, but it was still a profitable month.

You might be thinking, “Big deal, $829”, but we’re doing minimal contract sizes here. We’re risking anywhere from 500 to a couple thousand dollars per trade. Total capital at risk at any one time is maybe $10,000.

If you have a larger account and you’re doing 10 times the number of contracts we’re trading, instead of $829, you’re looking at over $8,000 a month.

You can scale this on any level. I trade these alerts super small because I want those that have smaller accounts to understand that they can trade these strategies and have consistent profits.

Let’s go over the strategies that we traded this month. We had a really well-rounded diversified strategy portfolio. We traded Iron Condors, a Short Strangle, a Calendar Spread, a Short Straddle, a Butterfly Spread, a Short Put Vertical, a Short Call Vertical, and a Long Put Vertical.

We took some directional trades this month with vertical spreads. The majority of our trades were Delta Neutral, income generating strategies, that we use and teach every day at NavigationTrading.

That’s the power of our methodology. We’re not just trading Iron Condors, or just trading Strangles, or just Put Spreads or Call Spreads. It’s so important to have a variety of strategies, and not only diversify the underlying symbols that you trade, but to diversify the different strategies you trade. That’s the key to consistent profits!

In-Depth Look into Our Trades from September

Let’s go to the “Closed Trades” option under the NavigationALERTS tab and dive into the different strategies that we traded this month.

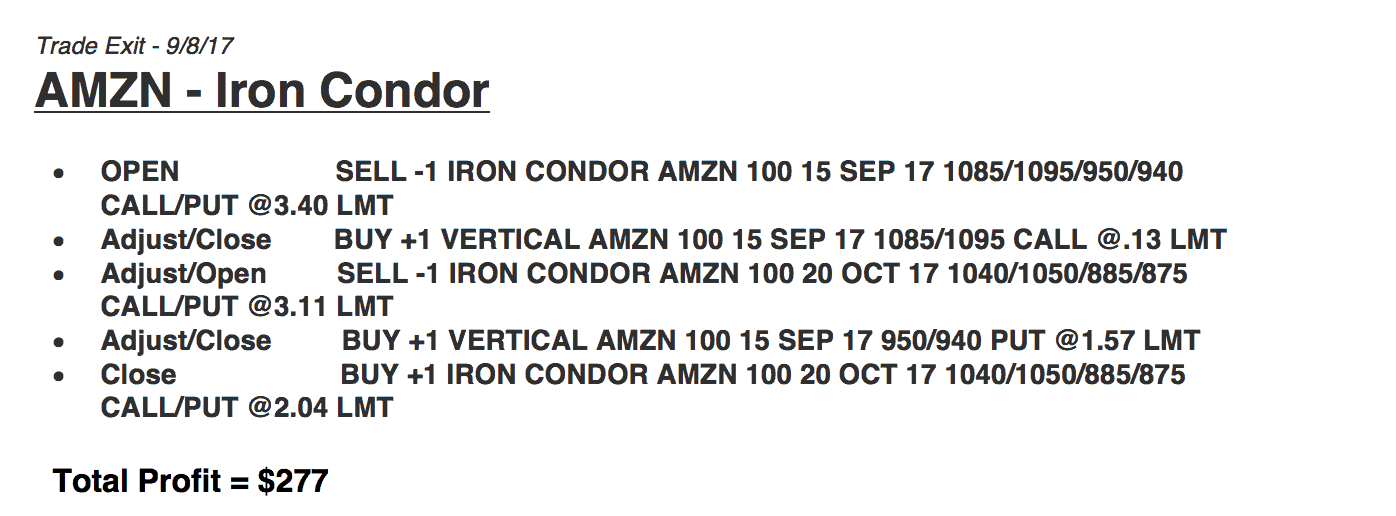

Amazon was the first closing trade we had. We did an Iron Condor, and as you can see, we had to make several adjustments before closing this trade. We closed it out for a total profit of $277.

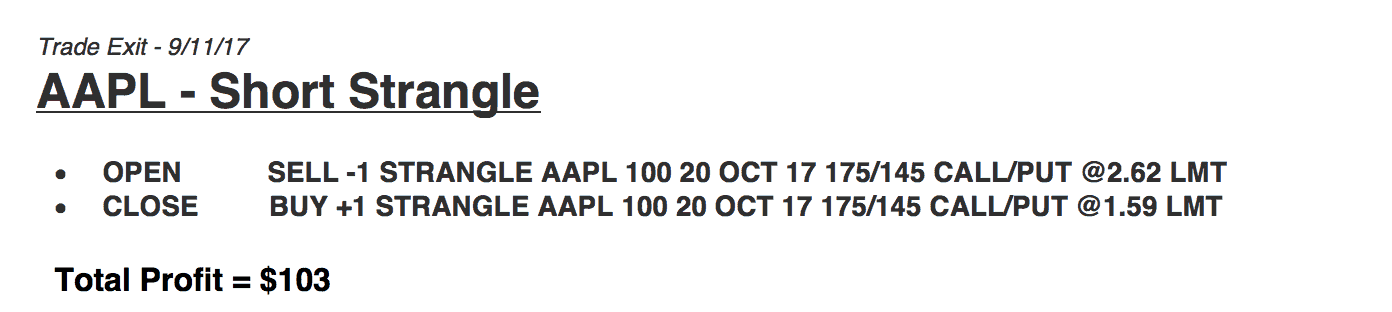

Next, we had a Short Strangle in Apple. This was one of those nice trades where we just put it on, and took it, off booking a profit of $103.

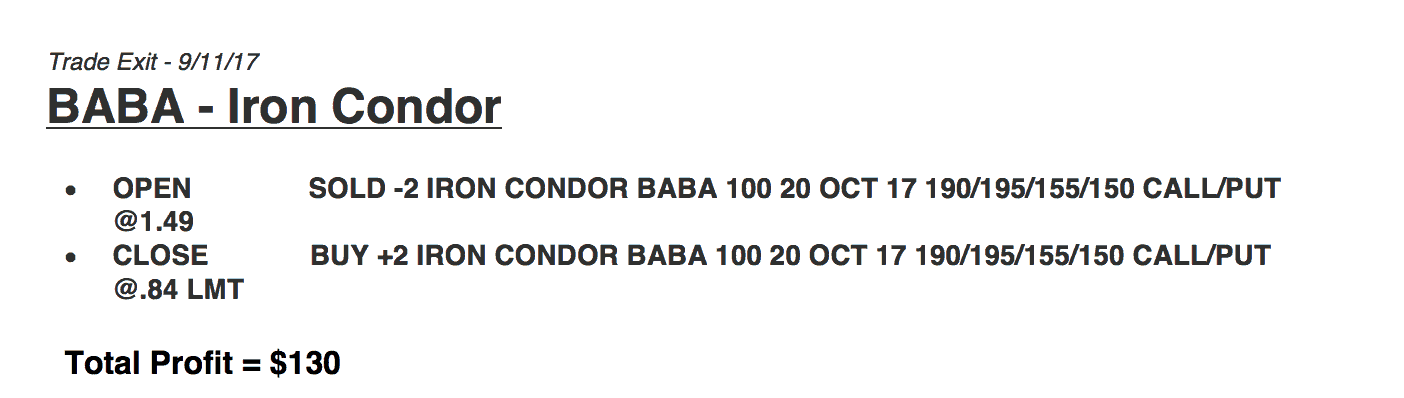

Same thing in Alibaba. We did an Iron Condor, no adjustments necessary, put it on and took it off.

We did an Iron Condor in gold and made a nice quick profit of $96.

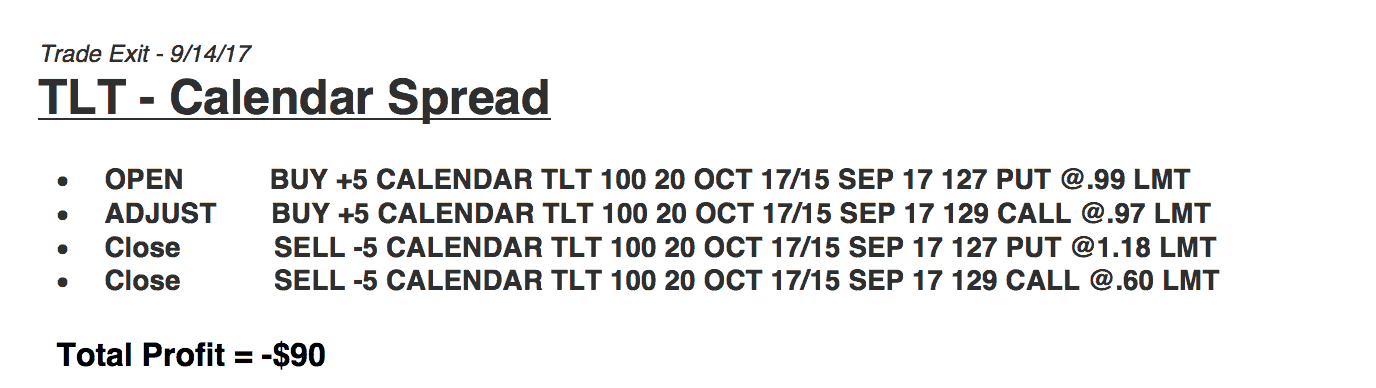

In TLT, we did a Calendar Spread. We had to adjust this a couple times, and ended up taking a small loss.

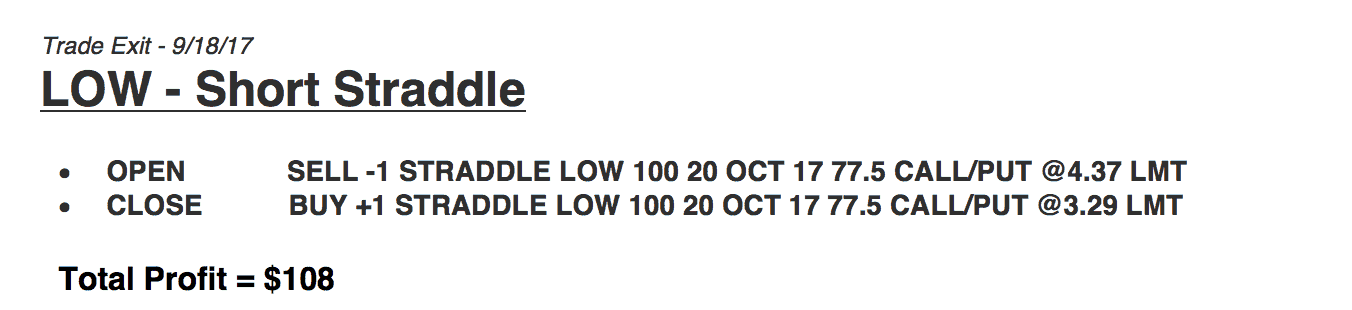

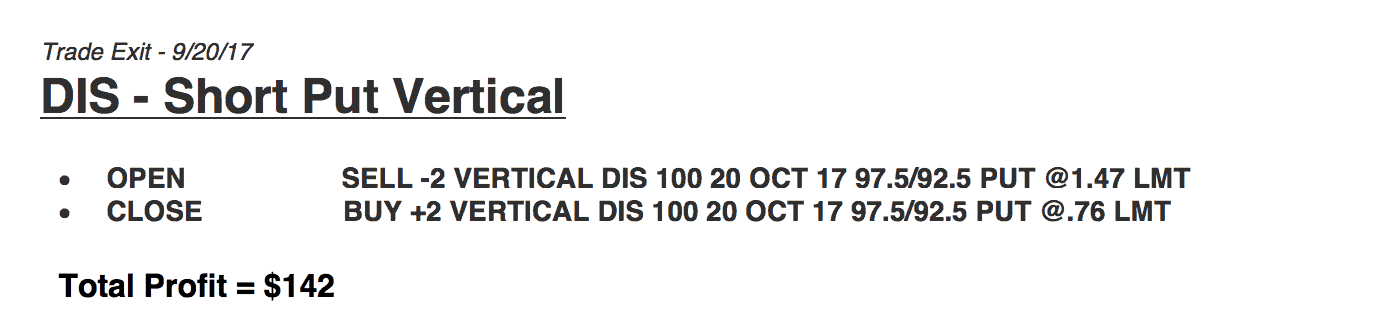

Both Lowe’s and Disney were trades based around the disastrous hurricanes that happened last month, which was a really bad situation for a lot of people. But, we were able to take advantage of some of the implied volatility and the overreaction in price with both Lowe’s and Disney. We got out of both of those with a profit.

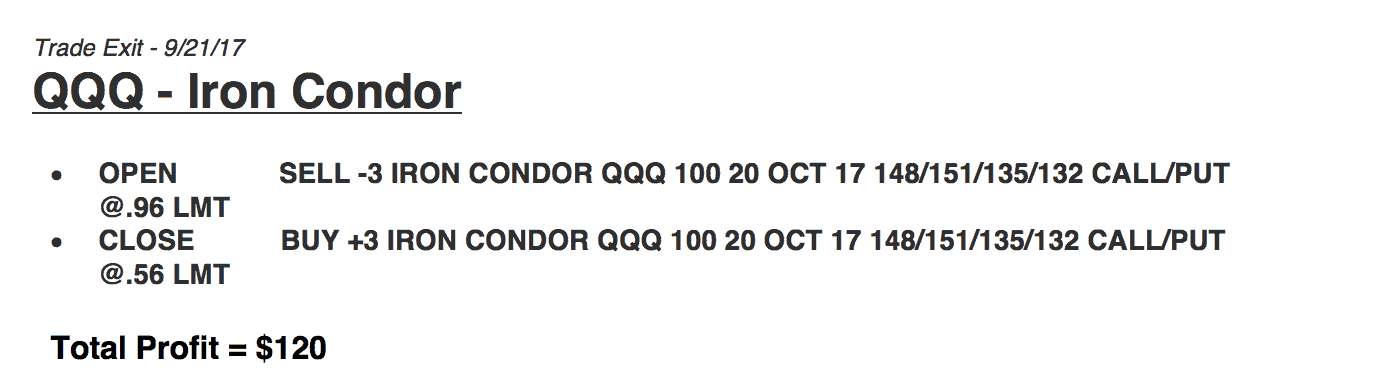

In QQQ, we did an Iron Condor and booked a profit of $120.

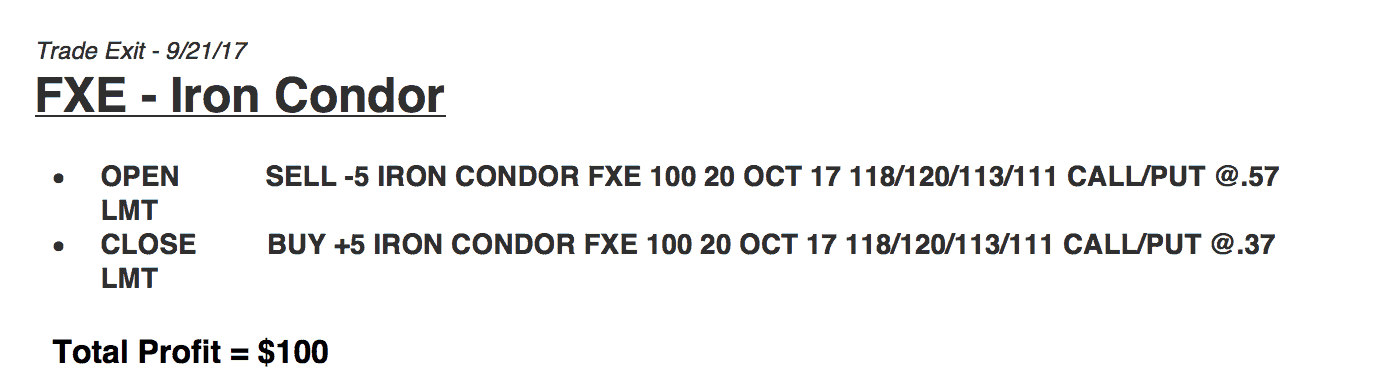

In FXE, we did another Iron Condor, booking a $100 profit.

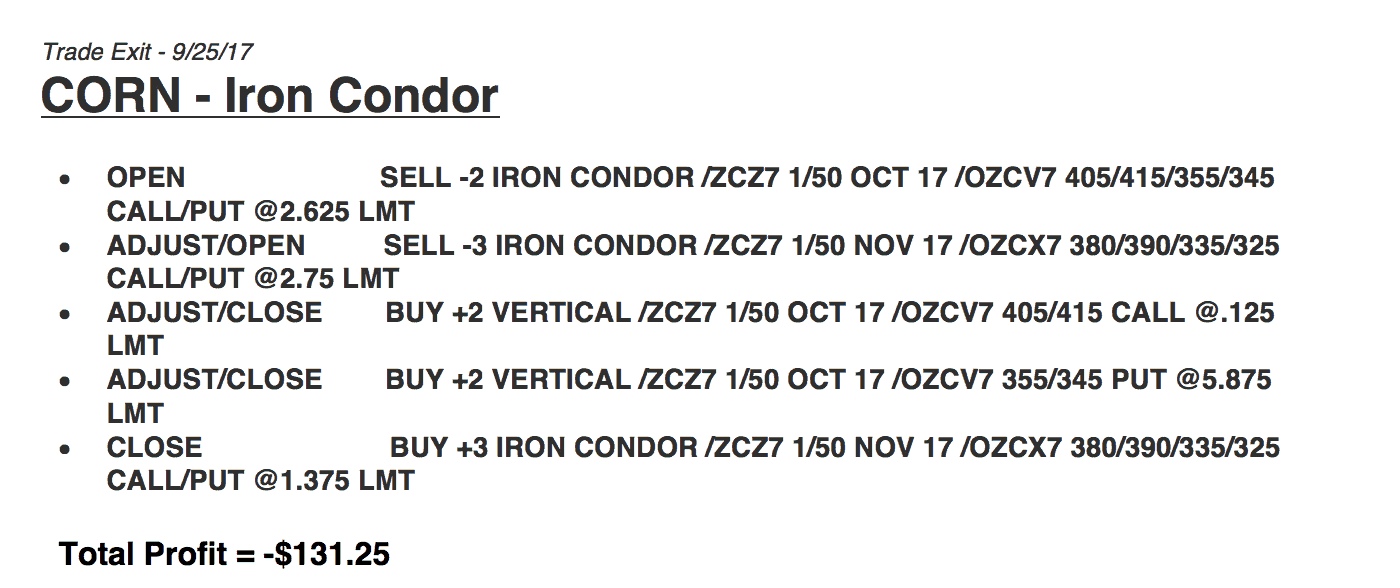

One of our other losers was in Corn. We did an Iron Condor in the Corn futures, and had to make a few adjustments, got back some of the loss, but ended up losing just over $131.

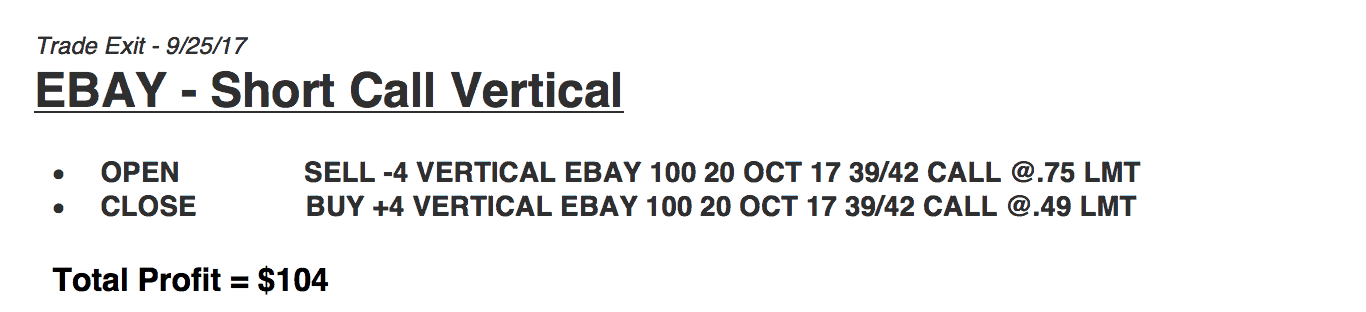

We did a Short Call Vertical, kind of a directional play in eBay, and booked a profit there.

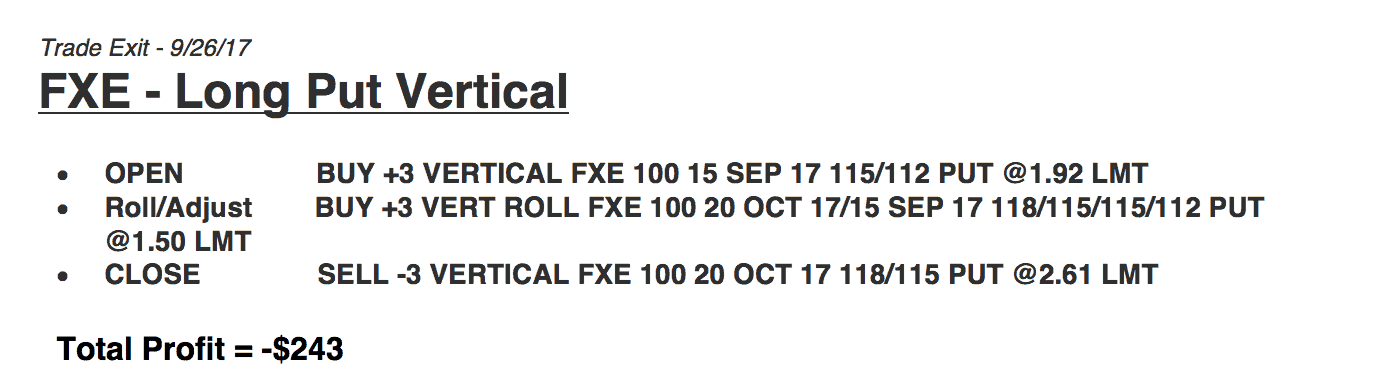

FXE was also another directional play in the Euro, looking for some downside momentum, and just didn’t get enough. If we would have held this a couple days longer, we probably would have got back to break-even, but you can’t trade in hindsight.

We show all of our trades, winners and losers. The numbers, the profits tell the actual story. But, we did take a loss on this one.

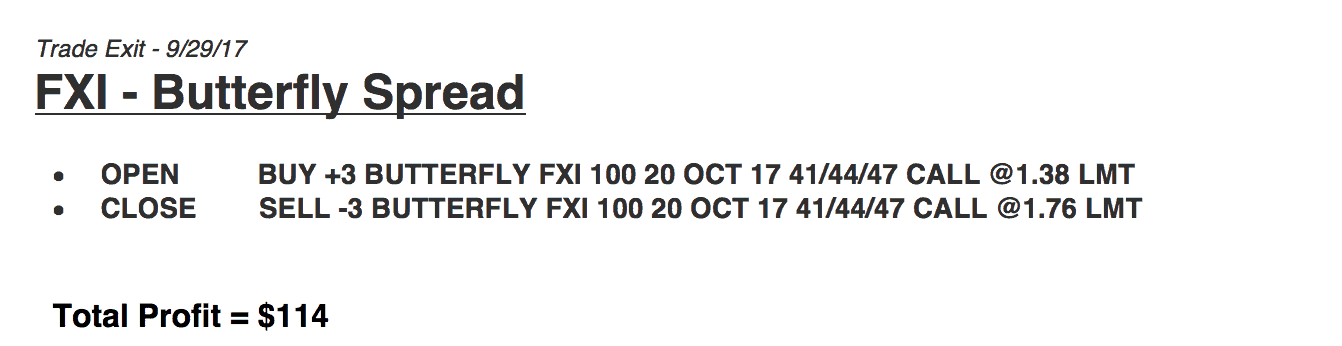

Lastly in FXI, which is the Chinese Large Cap ETF, we did a Butterfly Spread and closed that out for a winner.

If you’re not a Pro Member and you want to learn more about how we book consistent profits, trading these strategies, just go to https://navigationtrading.com/pro-trial. Sign up for our two-week Pro Trial for only $1! See if NavigationTrading is right for you.

Once you sign up, you’ll have instant access to our NavigationALERTS, our VIP course training, our indicator package, watch list, and The Trade Hacker’s Ultimate Playbook!

We look forward to seeing you on the inside!

Happy Trading!

-The NavigationTrading Team

Follow