What’s up NavigationTraders?!

I wanted to give you a quick review of our trade results from February. Another month in the books, and another winning month for NavigationTrading Pro Members.

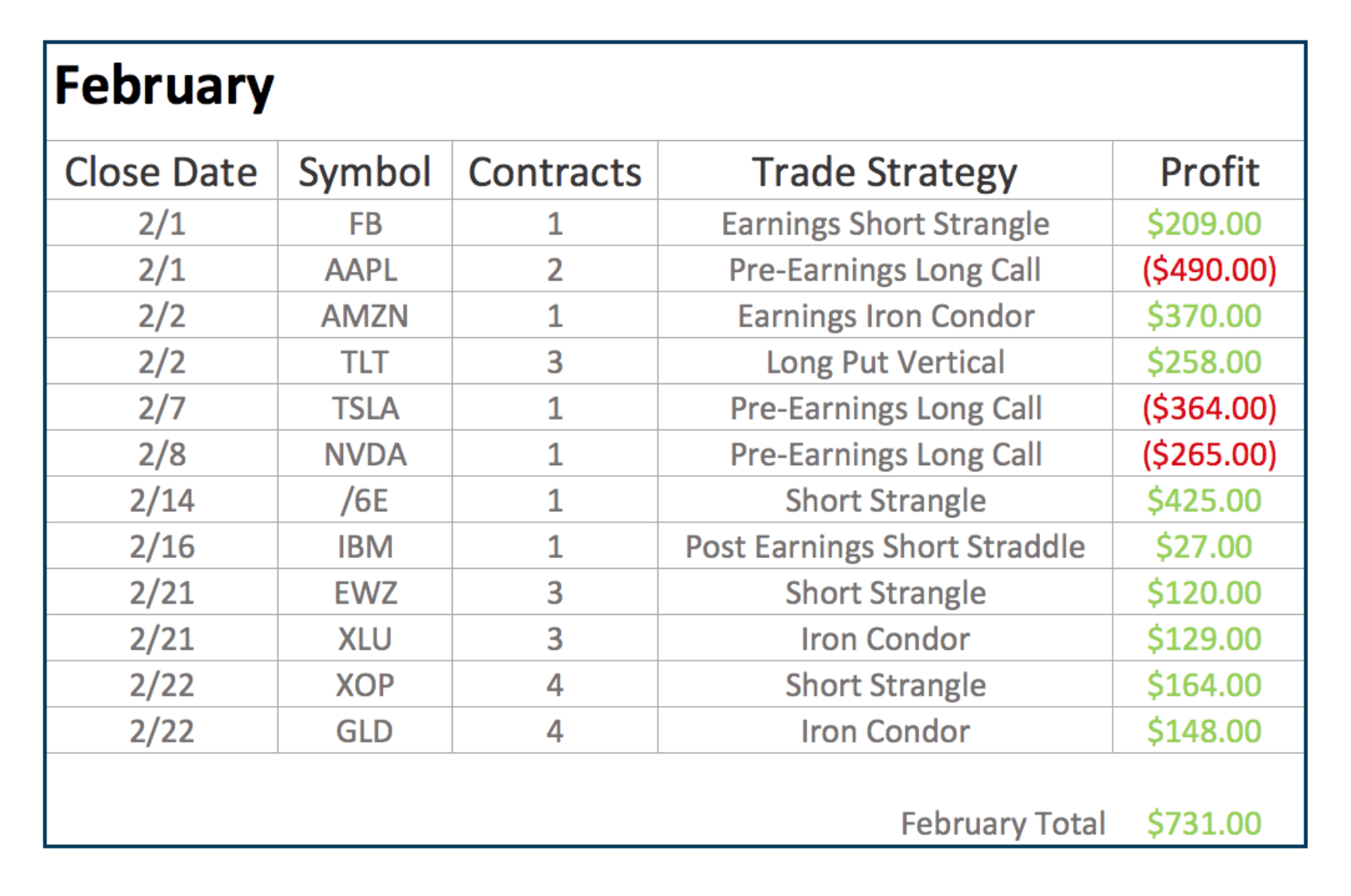

We had 12 closed trades in February, nine of which were winners for a total profit of $731.

We traded multiple strategies like we do every single month.

We traded Earnings Short Strangles, Earnings Iron Condors, Pre-Earnings Long Calls, Post-Earning Short Straddles. With it currently being in the heart of “earnings season”, you’re going to see a lot more of those earnings trades.

Next month, you’ll see quite a few more core income strategies. But we did have some Short Strangles, Iron Condors and Long Put Verticals to round things out.

One of the reasons that we’re successful, is not only the fact that we diversify the underlying symbols that we trade, and the timeframe that we trade them in, but we also diversify between different strategies.

Some of our strategies are long biased, some are short biased, and some are neutral strategies. That’s one of the ways we are able to continue booking consistent profits.

I’m going to break-down each trade, and then towards the end of this blog post, I want to show you why now is the absolute best time to be a Pro Member at NavigationTrading. With the market environment, the expansion in implied volatility, there is no better time than period like right now to be trading the way that we do.

Let’s go to our performance page at https://navigationtrading.com/performance. From here you can see all of our trade statistics from when we first started posting in June 2017.

So, this is the breakdown so far for 2018.

In the first two months, we’ve had 24 closed trades. Our average profit is right at $100. Winning percentage is at 83.3%. If you scroll down, you’ll see each month broken down. But let’s focus on February.

February Performance Breakdown

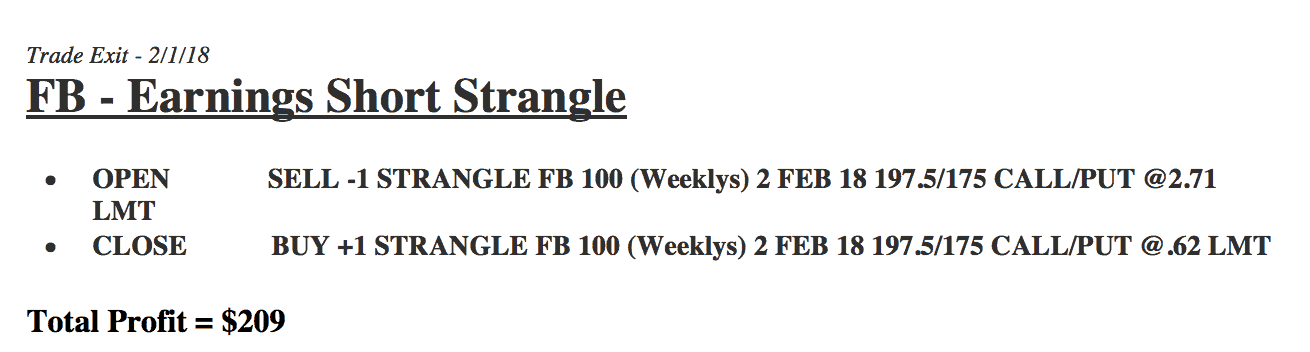

The first trade that we closed in February was an Earnings Short Strangle in Facebook. We booked a profit of $209.

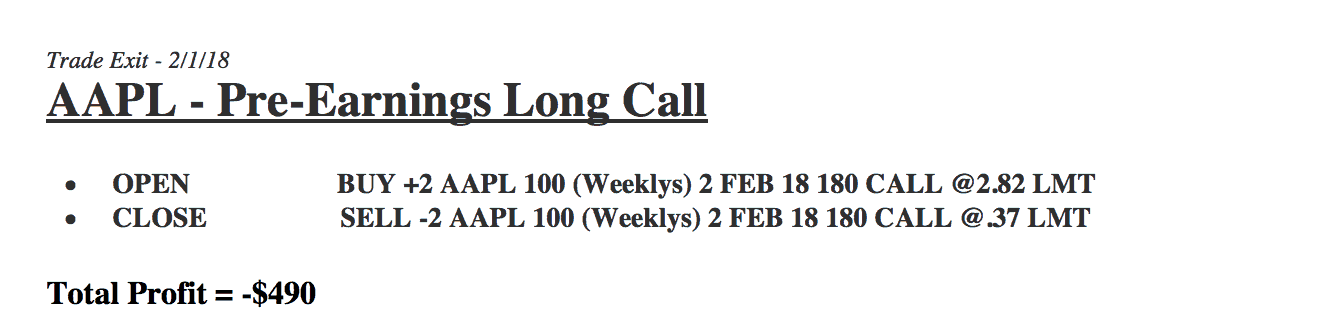

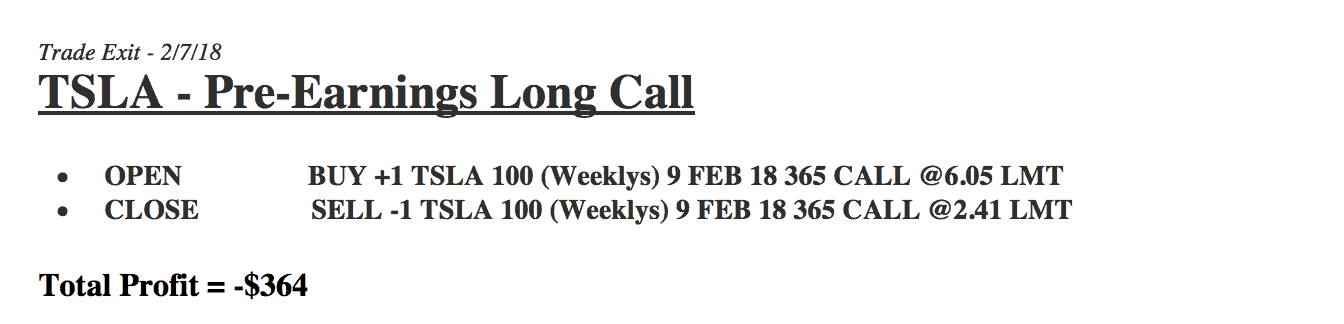

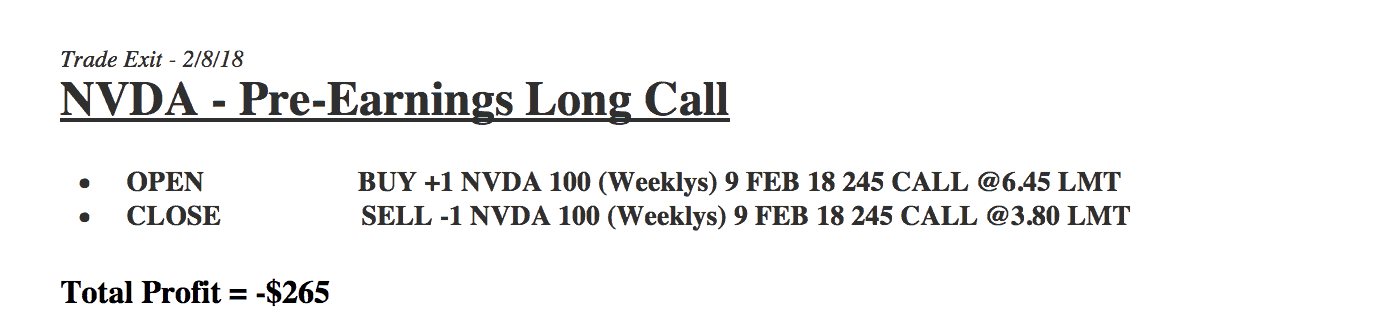

The Pre-Earnings Long Call trades were our three losers this month. And if you think about it, we had those on and then saw a huge down movement in the market in February.

So, we got caught long on those, but at the same time, they were helping keep our portfolio balanced between long and short positions, and these few just happened to get caught.

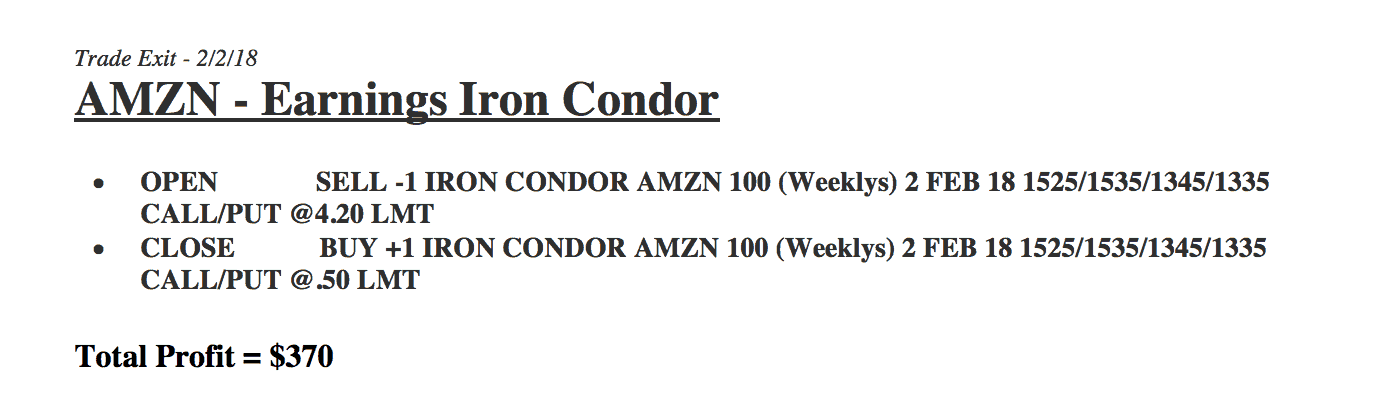

So, those didn’t work out well, but we had an Amazon Earnings Iron Condor which booked a profit of $370.

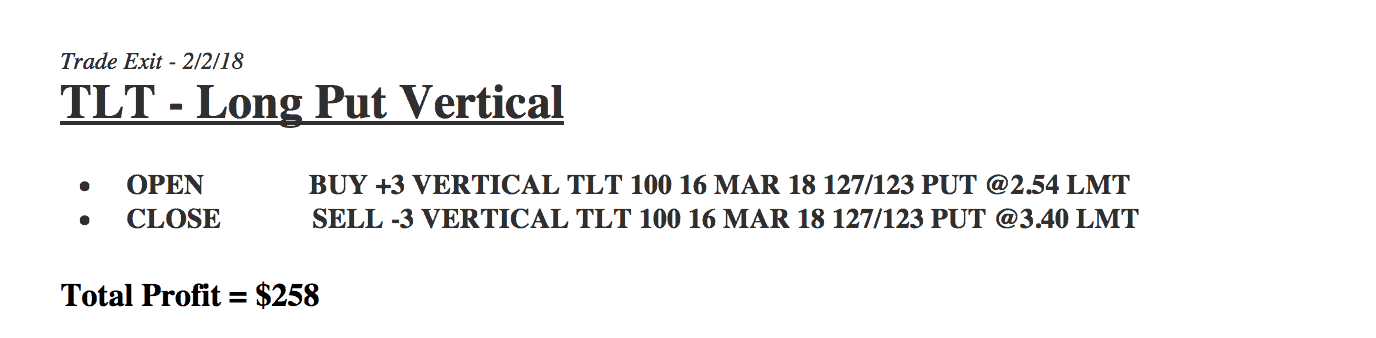

We had a Long Put Vertical in TLT with a profit of $258.

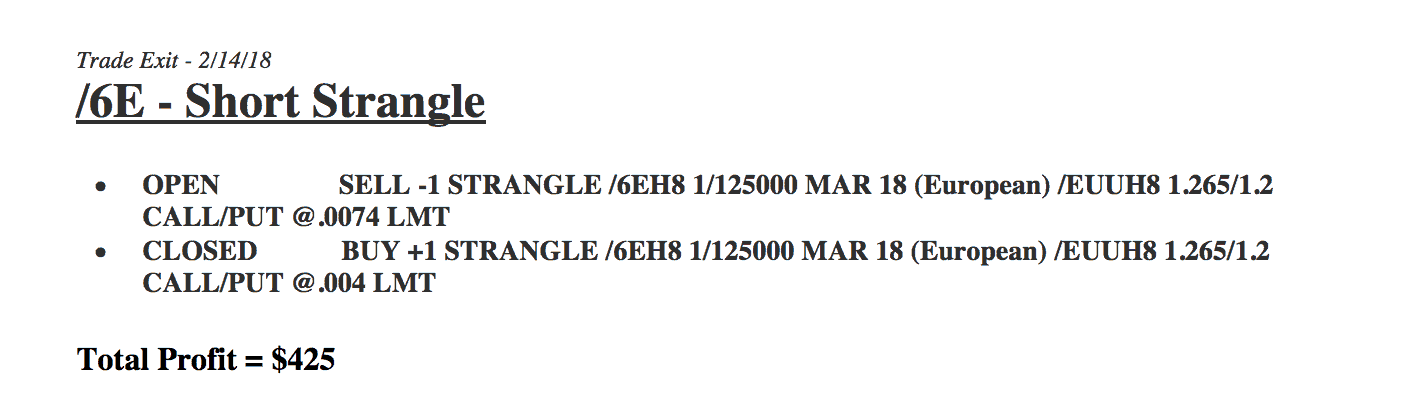

We did a Short Strangle in /6E (the Euro) and booked a profit of $425.

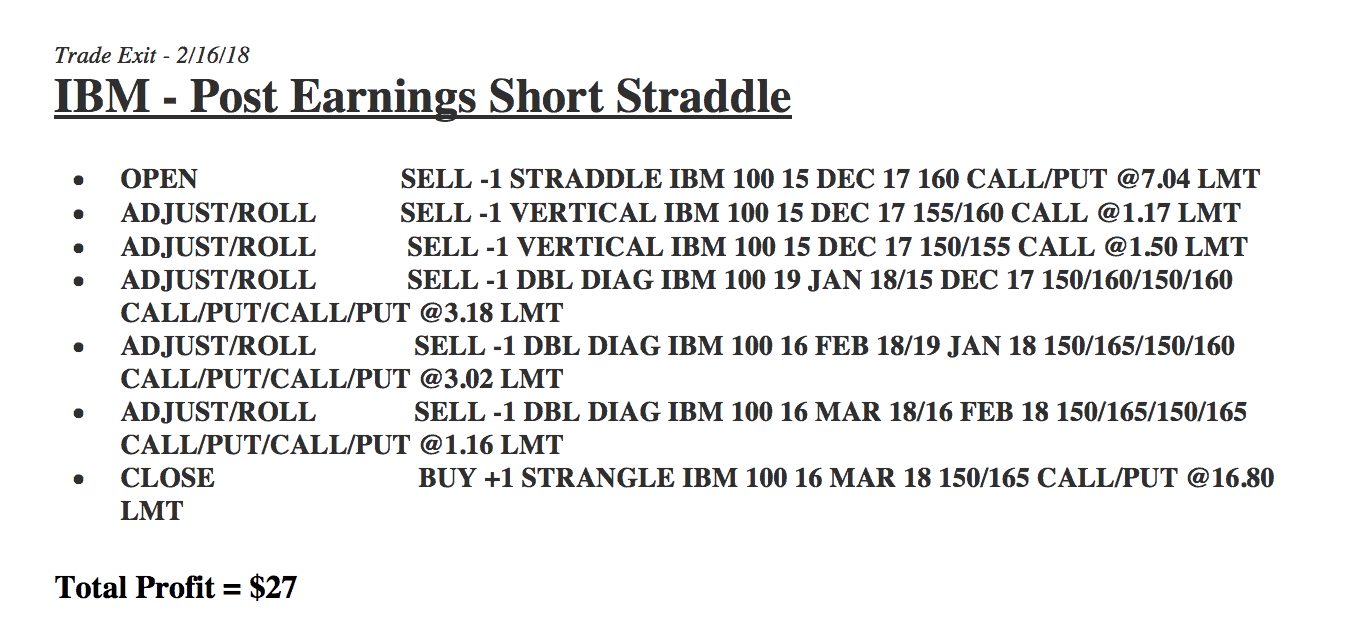

IBM was a Post-Earnings Short Straddle that we put on a couple earning cycles ago. We mechanically managed and adjusted that trade back to a profit. We just booked a tiny profit there.

But we did take a fairly sizeable losing trade, because the market moved against us right out of the gate, and we were able to mechanically manage back to a profit. IBM was a great case study on how to turn a losing trade into a winner.

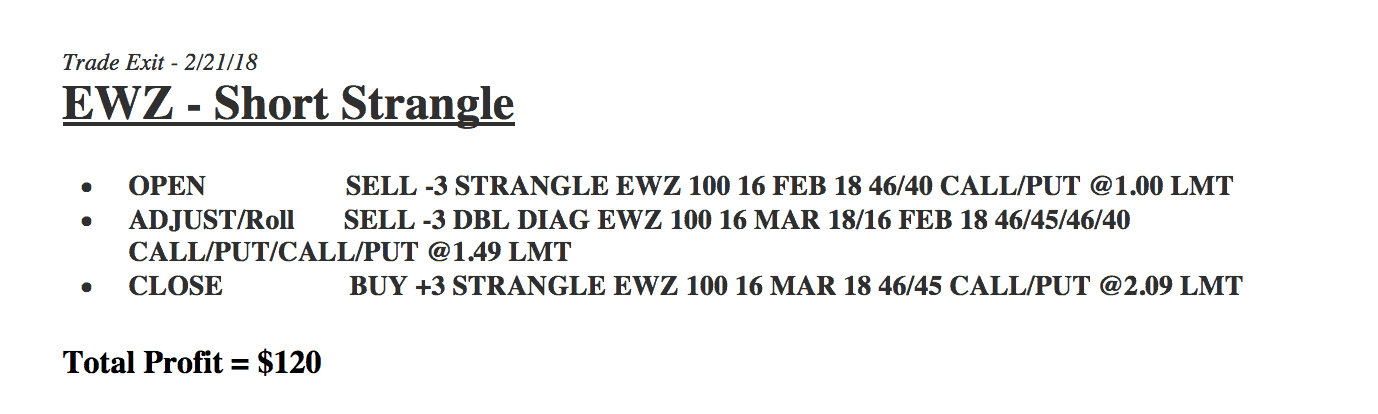

We did a Short Strangle in EWZ with a profit of $120.

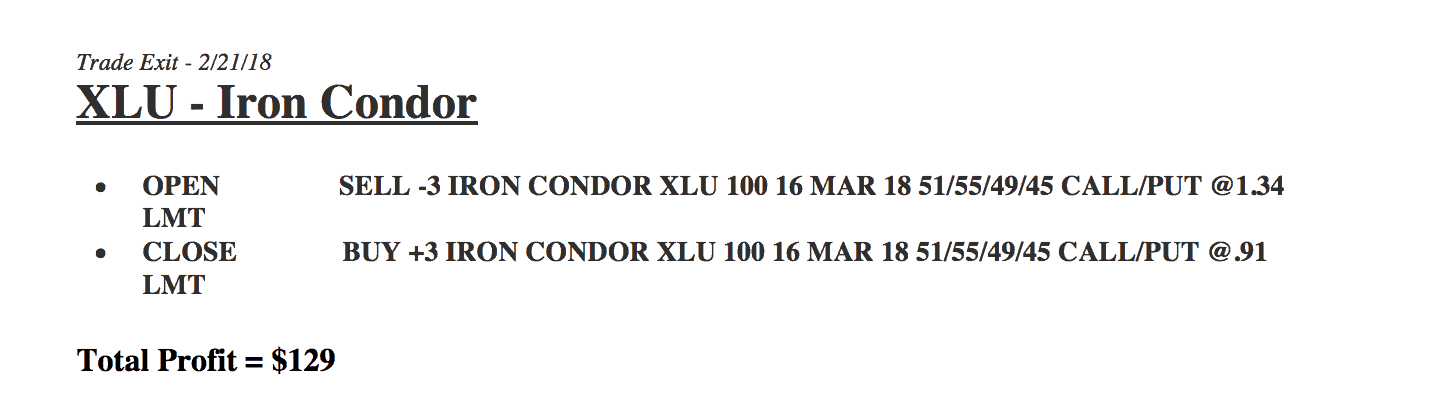

In XLU, the utility ETF, we did an Iron Condor with a profit $129.

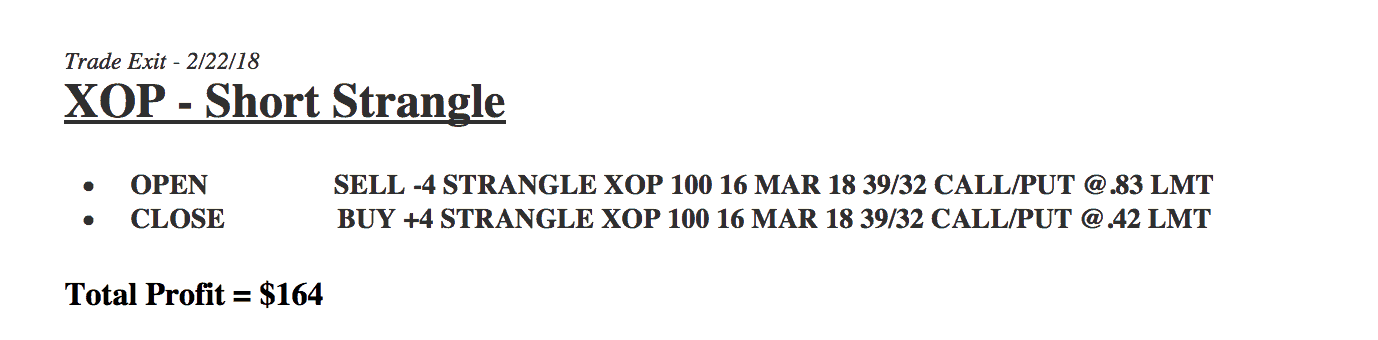

In XOP, we did a Short Strangle and had a profit of $164.

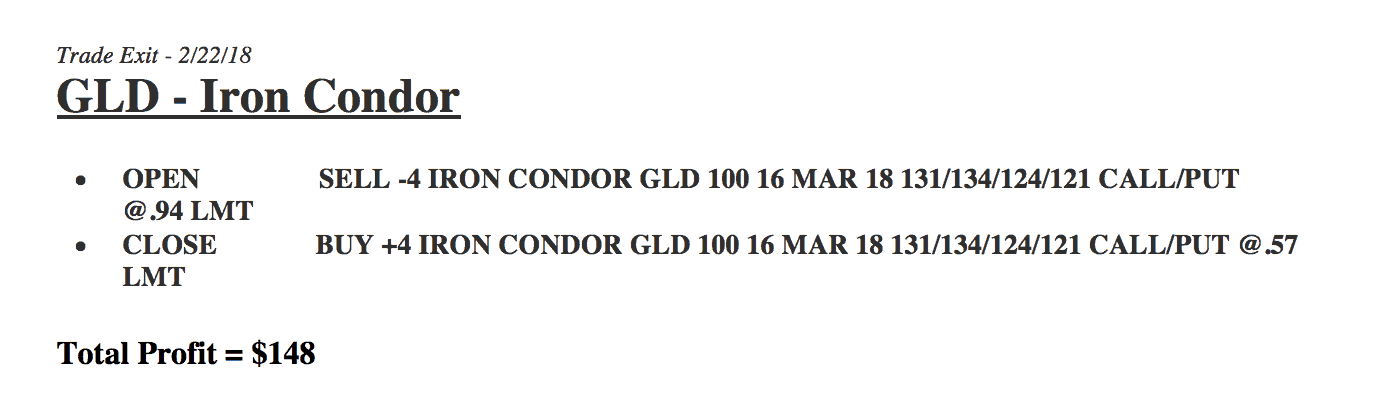

And lastly, in GLD, the gold ETF, we did an Iron Condor and booked a $148 profit.

Our total profit was a little bit lower than what we’ve typically seen in the past. But, with the continued two-sided action, and volatility in the market, our current portfolio is setup to really perform well.

Like I said, there couldn’t be a better time to be selling premium, and trading the way that we do at NavigationTrading!

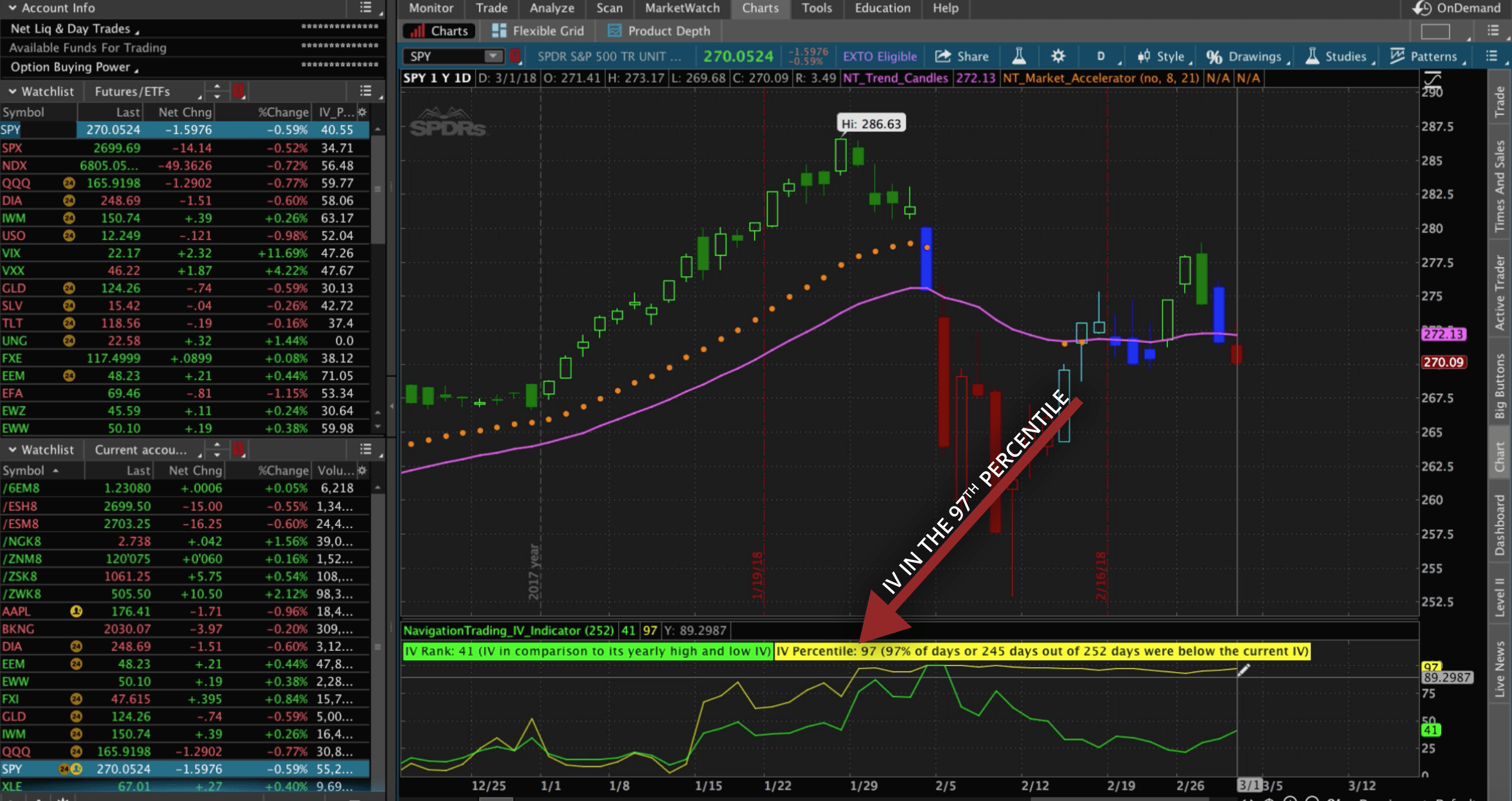

The chart below is the SPY ETF in the S&P 500 index. You can see the IV percentile is still at the 97th percentile, so this is a great time to be selling premium.

Options are expensive right now, and that’s when we want to sell them, when they’re most expensive. We’re waiting for that implied volatility to contract, and that’s when we’ll benefit.

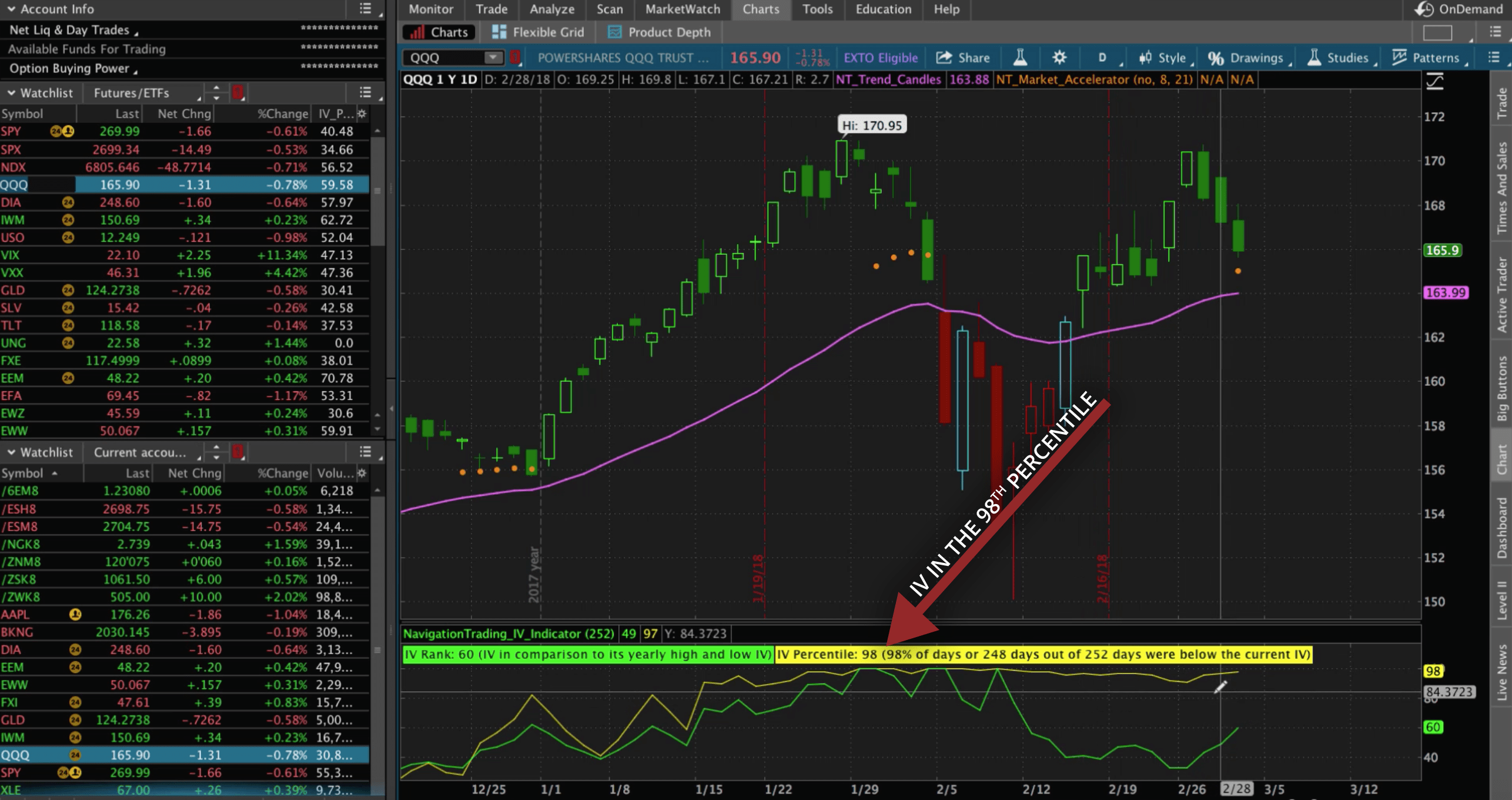

I venture to say that some of the profits that we see in these coming months are going to be higher than what we’ve seen in quite some time, due to this expansion in implied volatility. That’s not just in the S&P 500. If you look at the NASDAQ, we see the same thing. Extremely high implied volatility.

DIA (the DOW), same thing.

IWM (small cap stocks) and USO (oil) is above that 50 level that we like to see.

GLD (gold), starting to get some contraction here, but still relatively high.

TLT and bonds in the 79th percentile.

UNG (natural Gas) is one of the low ones.

And, all of these international symbols: EEM, EFA, EWZ, all have high implied volatility.

EWW (the Mexican ETF), FXI (the Chinese large gap), and XRT (retail) have high implied volatility.

Some of these energy related ETF’s, XBI and Biotech, have super high implied volatility as well.

Just about every single category has high implied volatility, and that’s when you want to be executing this type of trading.

If you are not already a Pro Member, make sure you go to https://navigationtrading.com/pro-trial to check out our $1 Pro Membership trial. The trial lasts 2 weeks and it’s only a dollar!

Hope you enjoyed this quick recap from February.

Happy Trading!

-The NavigationTrading Team

Follow