Hey NavigationTraders!

I want to take a few minutes to go over our NavigationALERTS from August.

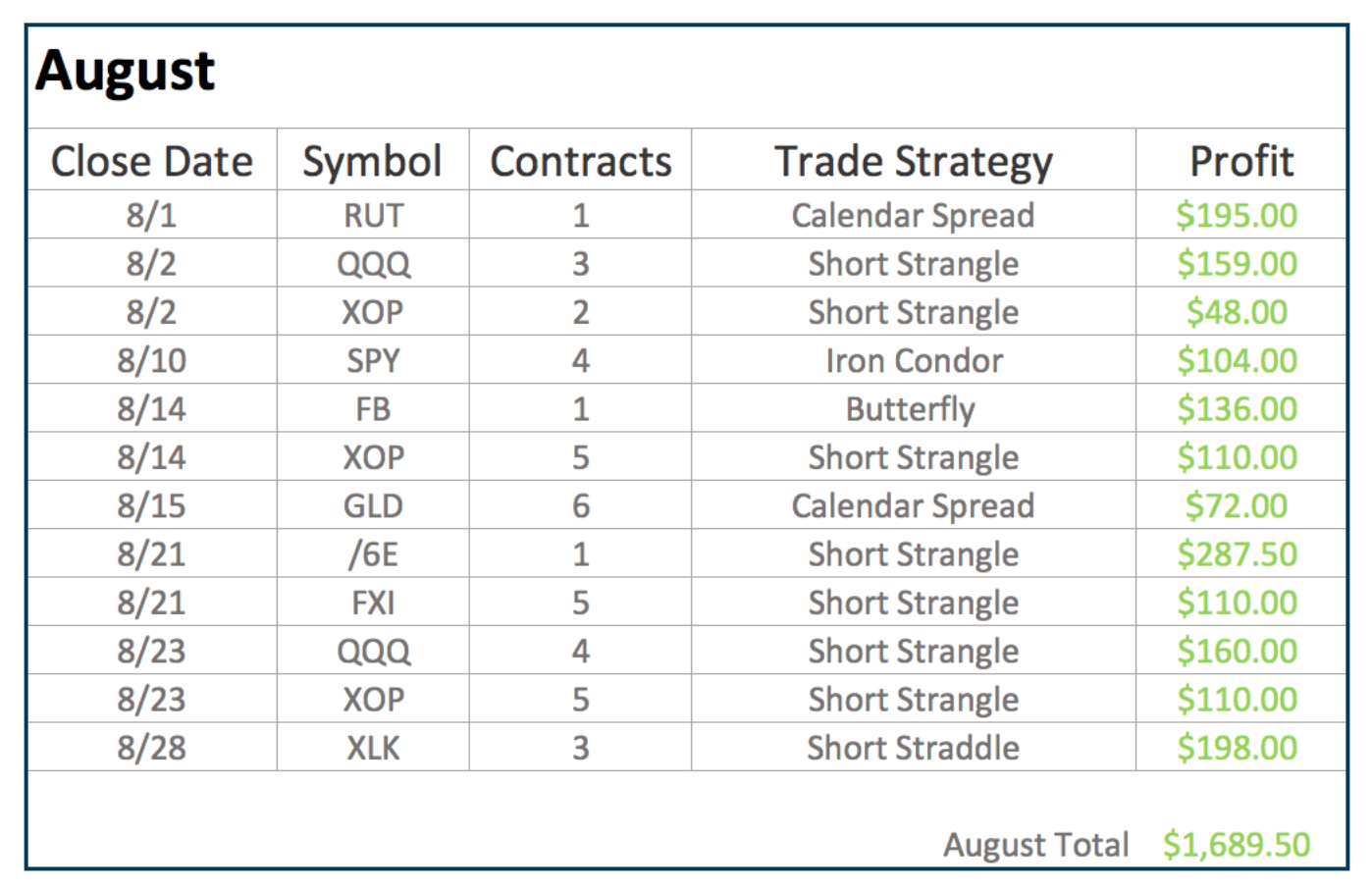

We had 12 closed trades, all of which were winners!

In July we were 10 for 10, so we’ve had a 100%-win rate the last couple months on closed trades.

Our total profit this month was $1,689.50.

We’re not just trading one strategy. Look at the diversification in strategies that we used.

We traded Iron Condors, Strangles, Calendar Spreads, a Straddle, and a Butterfly Spread.

We’re utilizing the different strategies that we have available. We’re not only diversifying the symbols that we trade, but also the strategies that we trade, and that’s such a big part of being consistently profitable over time.

You might be thinking, “Okay, $1600. Big deal.” But keep in mind, the amount of capital that we’re using to generate that is pretty small. So if you wanted to trade 10 times the number of contracts, if you had a larger account, then you’re looking at almost $17,000 a month.

You can do these strategies at any level. You can do it with a small account, and you can do it with a large account. The reason we trade a smaller number of contracts is because we really want to show you that even with a small account, you can generate consistent returns.

In-Depth Look into Our Trades from August

Let’s take a look at our trades from August!

Once you’re logged into your Member’s Area (if you’re a Pro Member), click on the NavigationALERTS tab and select the “Closed Trades” option. You can access past months’ results at the bottom of this page. Once you’ve clicked on August, go ahead and scroll to the bottom of the page to start at the beginning.

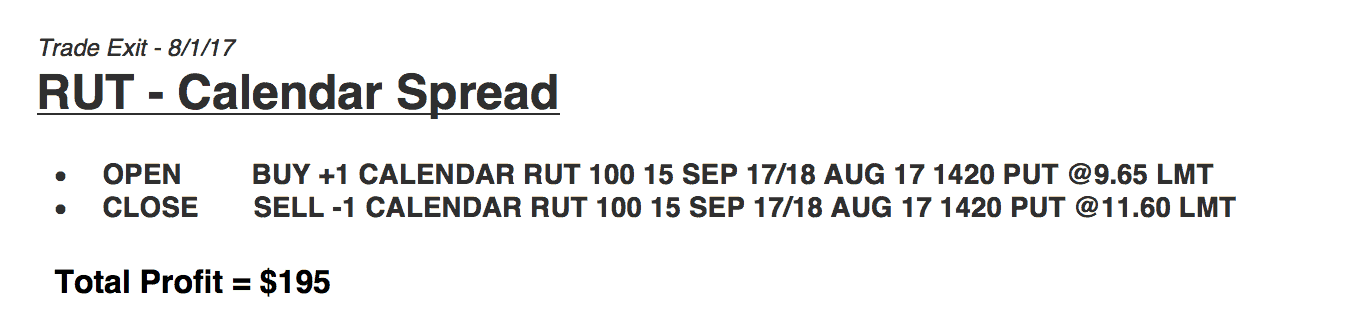

The first trade we closed in August was a Calendar Spread in RUT. We risked about $500 on this trade, and ended up booking a profit of $195.

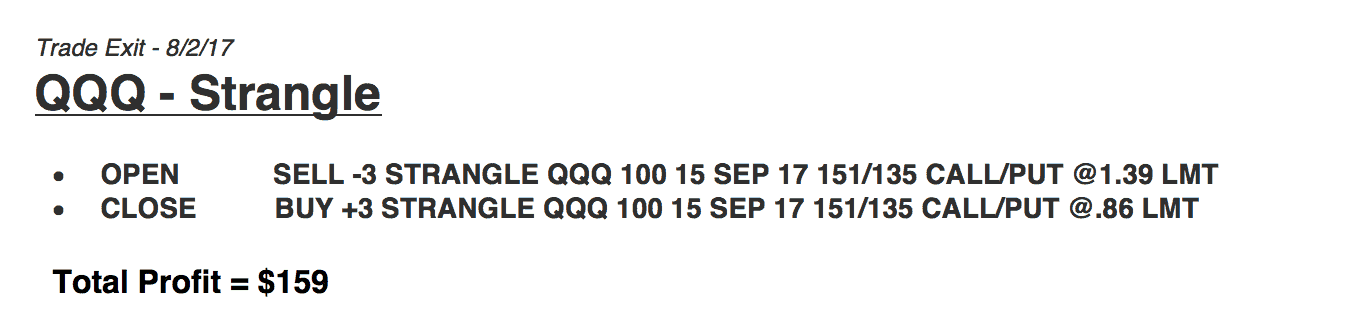

In QQQ, we did a Strangle for three contracts. Depending on if you have a standard margin or a portfolio margin account, you’d probably put up somewhere in the neighborhood of $1000-$1500 in capital. We booked a profit of $159.

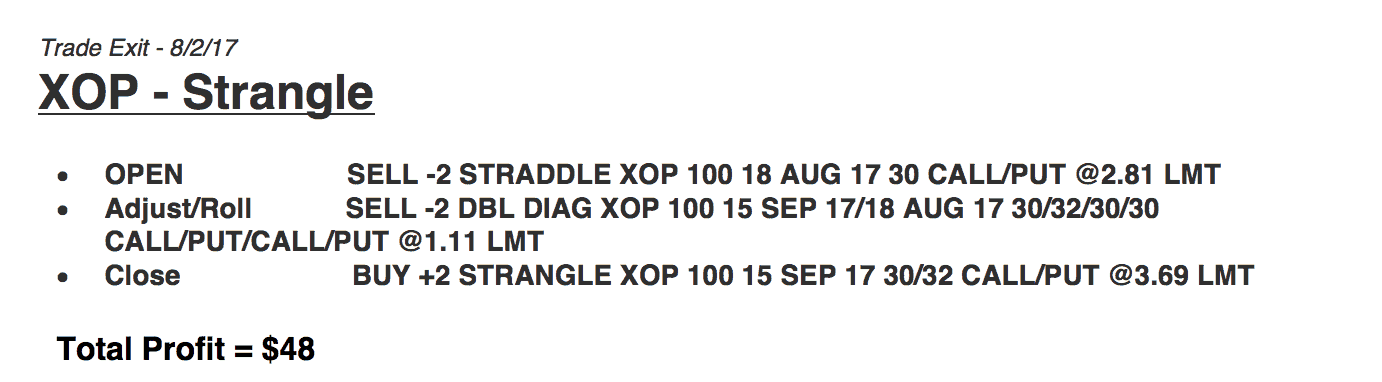

In XOP, we did another Strangle, putting up $800-$1000. We booked a profit of $48.

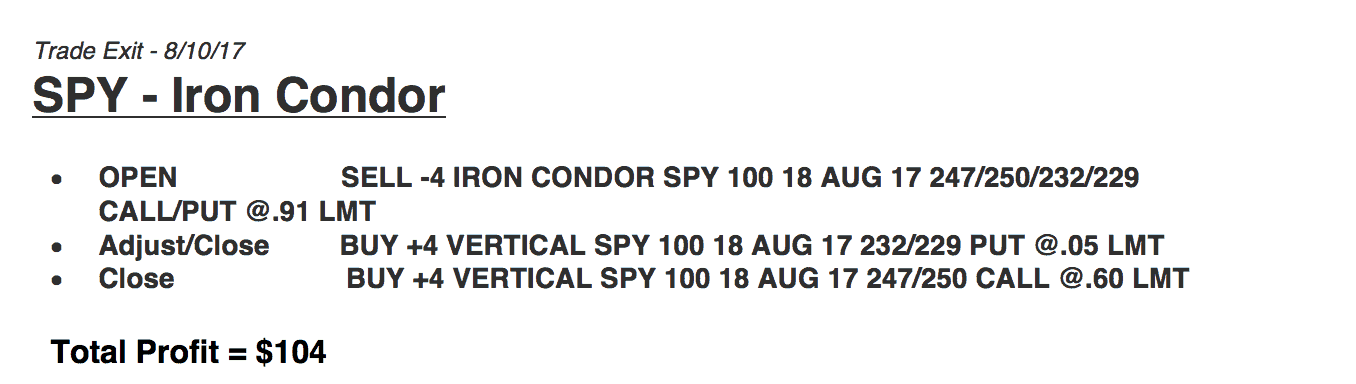

In SPY, we did an Iron Condor, booking a profit of $104.

On a lot of these trades, we’re just doing one contract. Even on the trades that we did five, if you have a smaller account, you could do just one. If you have a large account, you could do 50 or 500 contracts. It doesn’t matter. Whatever level of account size you have, is what you can do with these alerts.

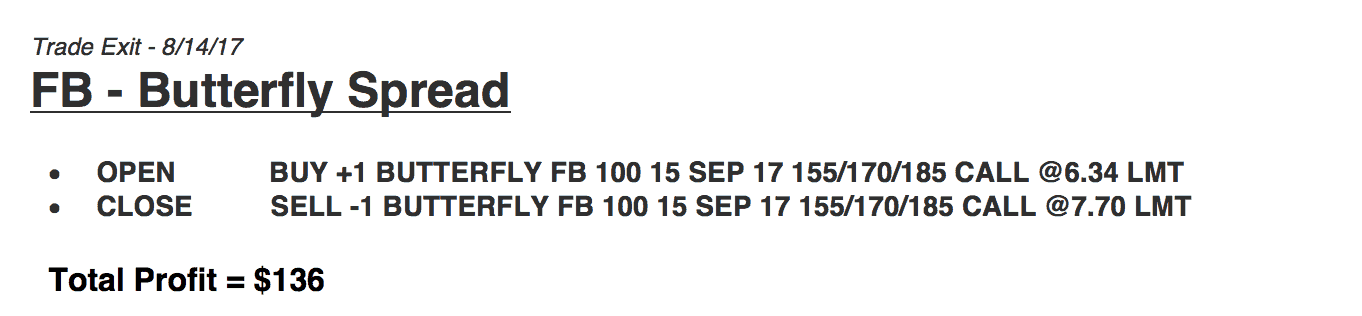

In Facebook, we did a Butterfly Spread for a profit of $136.

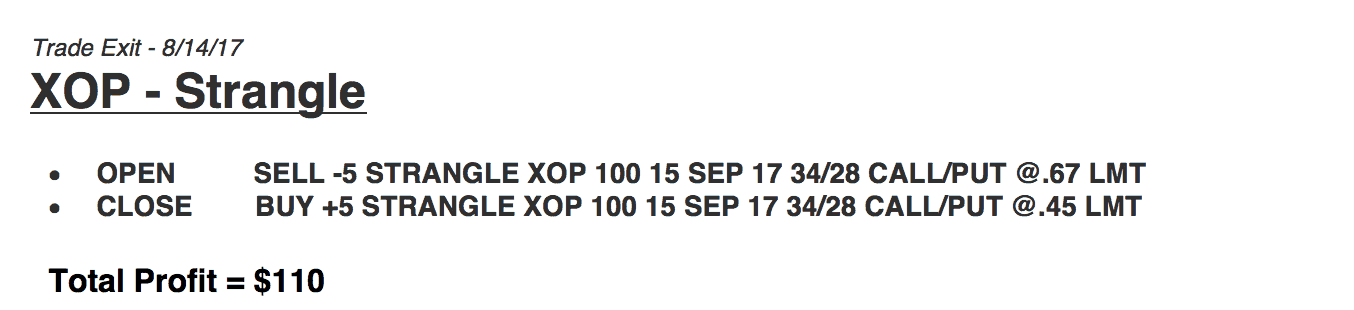

In XOP, we did another Strangle and booked a profit of $110.

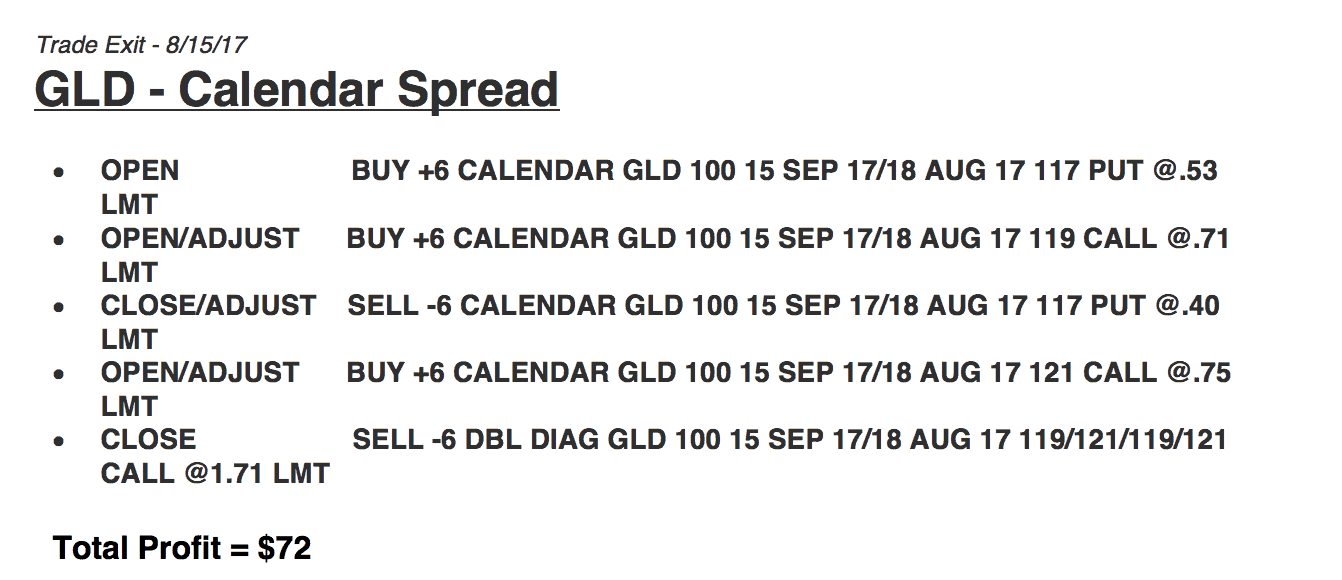

In Gold, we did a Calendar Spread and booked a profit of $72. These are not all easy trades. In other words, we didn’t just put them on and take them off for a profit. In GLD, we had to adjust three different times before we were able to book a profit.

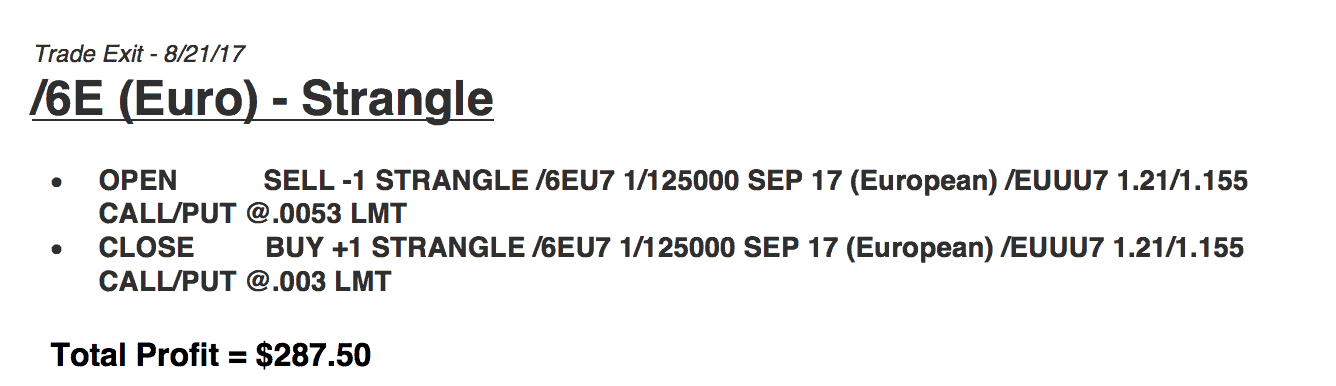

We did a Strangle in the Euro Futures Contract. So, not only are we using individual stocks, we’re using ETFs and we’re using Futures. I’m showing you how you can use these strategies on all different types of symbols.

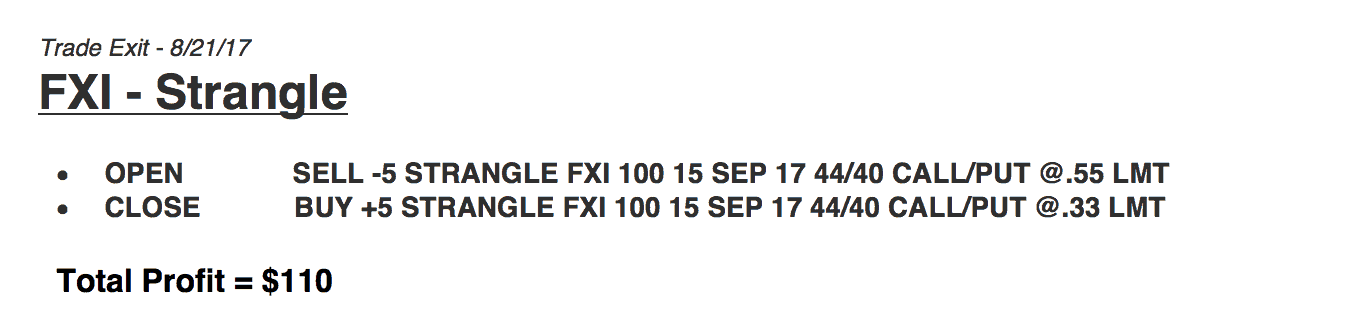

In FXI, we did a Strangle, booking a profit of $110.

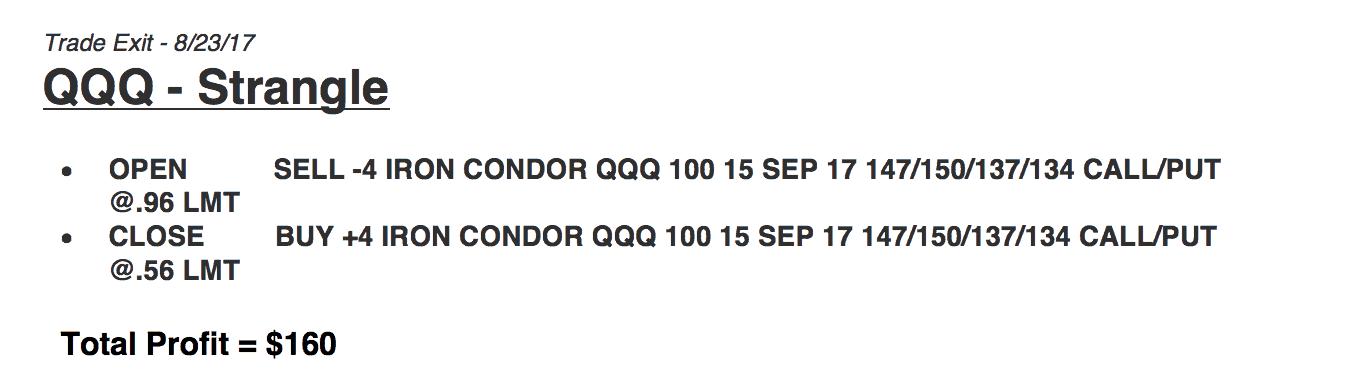

In QQQ, we did another Strangle, booking a profit of $160.

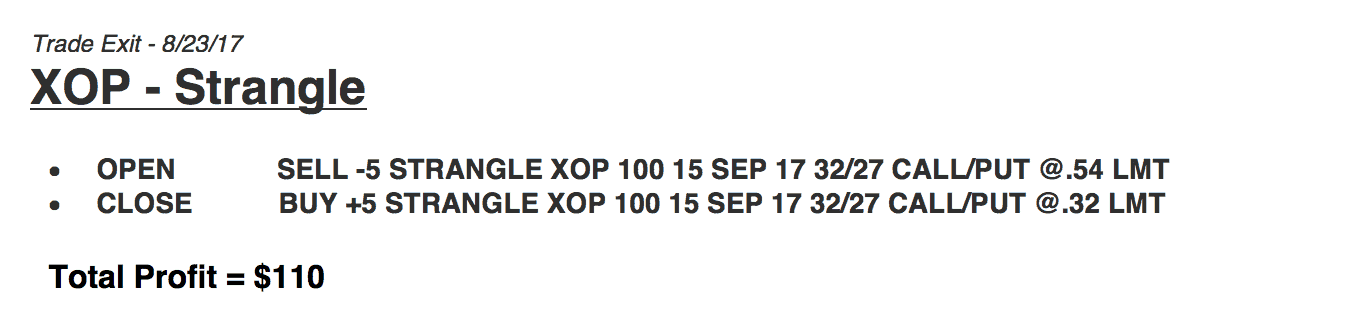

Back in XOP, we made another $110.

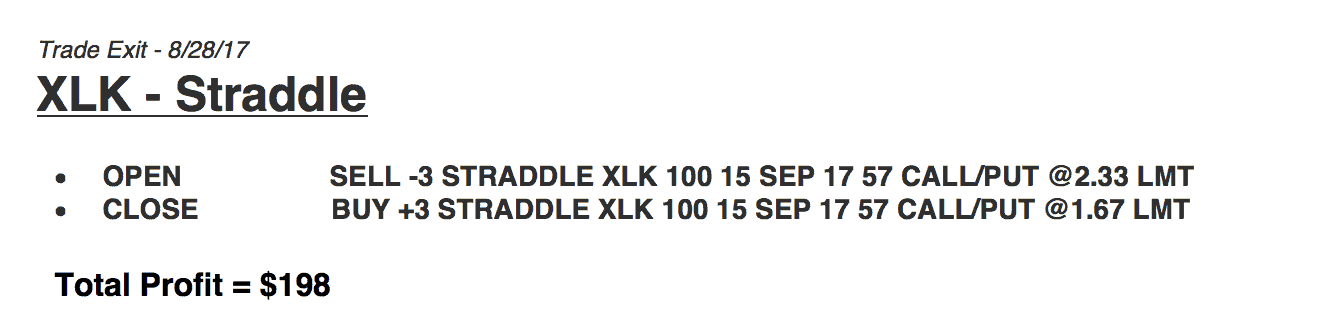

And in XLK, we did a Short Straddle, booking a profit of $198.

So that just shows you the power of these strategies and the consistency that you can achieve with these types of trading strategies.

If you have any interest in receiving our NavigationALERTS, just go to https://navigationtrading.com/pro-trial to sign up for our $1 two-week trial.

If you have any questions, always feel free to email us at info@navigationtrading.com.

Happy trading!

-The NavigationTrading Team

Follow