Hey NavigationTraders!

In this lesson, we want to address a question that we get quite a bit, “I’m a new trader, what should I focus on first?”. We’ll give you somewhat of a cheat sheet to walk you through what we think you should be focusing on when you first get started with NavigationTrading.

Paper Trading

Paper trading is one of the most critical things you should do when you’re beginning your trading journey. A lot of the major brokers have a paper trade capability. This means they’ll give you an account with virtual money and full functionality of the platform, so that you can place trades, watch them, learn, and understand the concept of trading before you actually have to risk any real money.

Thinkorswim from TD Ameritrade has a paper trading capability. Tastyworks, our other preferred broker, is working on their paper trade platform, but it’s not available just yet. You can still set up theoretical trades in their platform, and watch them as price moves around. This can give you a better idea of what the effect of different situations are going to be on that trade.

We highly recommend paper trading before you start trading with real money.

Understand the Process

We’ve seen way too many new traders join NavigationTrading, often times people with larger accounts, who think that just because they have a lot of money and they’ve been successful in other areas of business or life, that they can be successful trading without learning the ropes and actually understanding the process. They’ll start trading our NavigationALERTS without having any idea how the trade actually works, and it always blows up in their face.

We really encourage you to take the time to LEARN FIRST. If you come out of the gate not understanding the process and start making trades, especially if they’re larger trades, you’re going to get slapped. The market is going to slap you.

Here’s what that does to your psyche. Now you start thinking, “This doesn’t work” and, “This is not going to work for me, I lost money”. From an emotional and psychological standpoint, these losses set you back. It puts you behind the eight ball from becoming a successful trader.

Then, if you decide to quit before you actually see success and really understand the concepts and why they work, you’ll never get to the point of being consistently profitable. That’s a real shame, because trading options is one of the most powerful things that you can ever learn from a standpoint of generating consistent income, being profitable and building wealth.

So please, please, please start paper trading, understand the concepts and understand the strategies before you risk any real capital.

Strategy Courses

If you’re a Pro Member at NavigationTrading, then you’ll have access to all of our different strategy course training. This is what the Pro Members Membership Area looks like:

Options Basics

The first course we have listed in the Pro Members Membership area is our Options Basics course. This teaches you how to set up your platform, and shows you some very basic concepts of getting started.

Iron Condors

Once you’ve gone through our Options Basics course, then the first strategy that we would recommend looking into is the Iron Condor course. This allows you to place trades that are delta neutral, meaning you are not trying to choose a direction. All you care about is the price of that stock, or the price of that ETF staying within a specific range.

Iron condors are great vehicles to start with, as they are defined risk trades. This means you define your risk at order entry and you know exactly what you’re risking on that trade before you even press the go button. It’s a very powerful strategy, and a great place to start for new traders.

Short Strangles

The second strategy course we recommend is our Short Strangles course. There are different opinions on this. Some people think, “Oh no, these are naked options. You should not even think about using these as a new trader”. But the bottom line is, if you use Short Strangles on low priced symbols, you can take a smaller amount of risk.

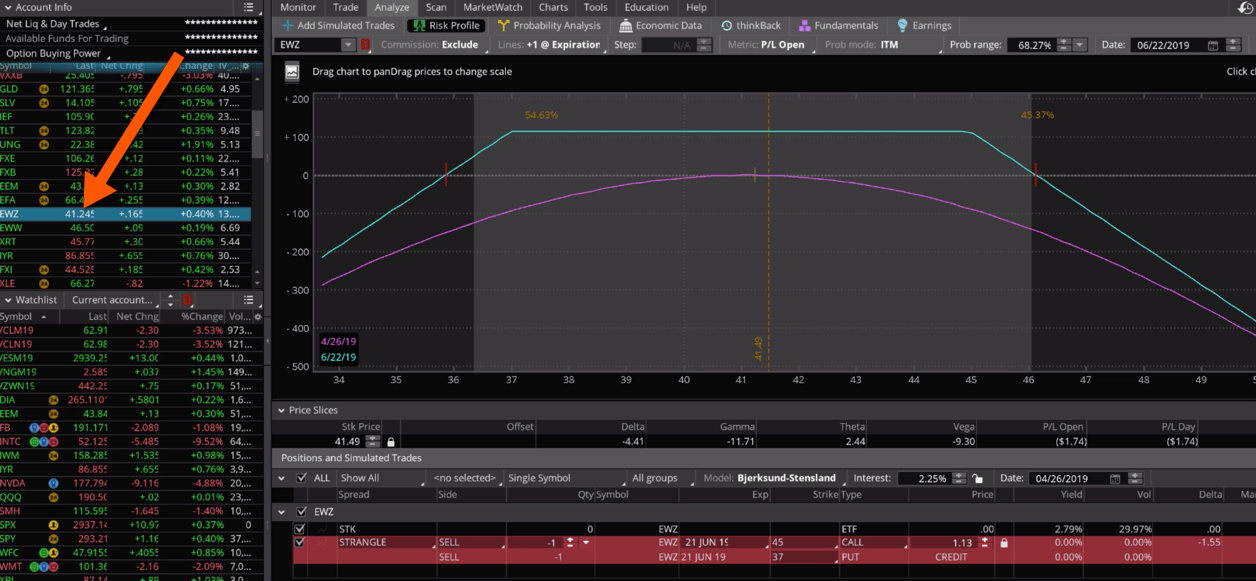

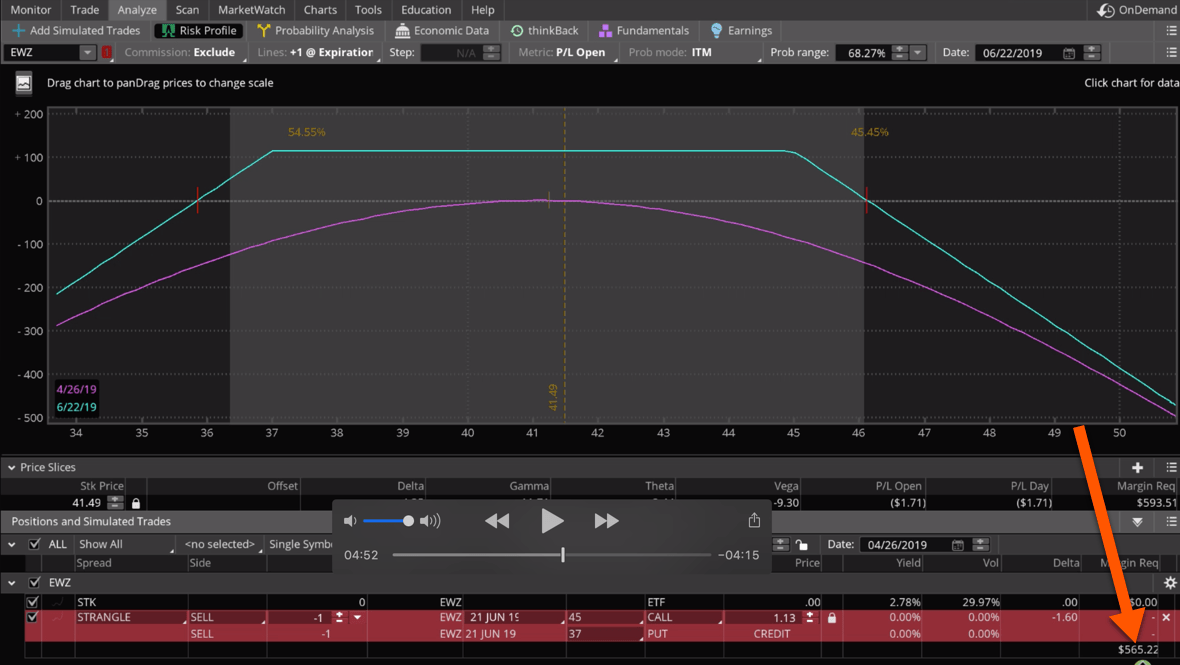

Here’s an example. If we go to the platform, we’ve pulled up EWZ, which is the Brazilian ETF. It’s kind of like the DOW of Brazil. If you look at the graphic below, you can see it’s a $41 symbol.

If we enter a Short Strangle, which is what we’re looking at below, this is the risk profile, the visual representation of a Short Strangle. And, if you look down in the bottom right corner, the margin required to put this on is $565.

You can kind of think of that as theoretical risk. Now of course, if there’s some major black swan event, you could lose more than $500. That’s true. But it’s not very likely, and these are very high probability trades.

If you want to start learning Short Strangles, which is an excellent strategy that you’re going to want to learn eventually, you can do that even with smaller accounts and even as a beginner. You’ll just want to stay extremely small with one contract on lower priced symbols like EWZ, EWW, or XRT. These are all great symbols to start with.

Both Iron Condors and Short Strangles are delta neutral type strategies, so we don’t care if price goes up and we don’t care if it goes down. We just want it to stay in a specific range.

Directional Strategies

From there, the next course we would suggest for a new trader, is our Directional Strategies course, which is called, “Winning Option Strategies for Any Market” within the Pro Members Membership Area.

Throughout the course, we go into several different directional strategies. If you have an assumption that a stock or ETF is going to move a certain way, we want to use vertical spreads. That allows you to define your risk and have a directional assumption, but still put the probabilities on your side, which is very important no matter what you’re trading.

Earnings Trades

As a new trader, we want to get you some wins, we want to get you engaged, and to where you understand these strategies. That’s what’s going to make you consistently profitable long term. We don’t want to provide too many different things for you to do as a new trader, because we think that could get pretty overwhelming. But, we do want to mention one last thing, and that’s for you to look at Earnings trades.

If you are a part of the NavigationTrading TradeHacker Community, we have a lot of traders in there who are posting trade ideas. A lot of the ideas that we’re looking at every single day are Earnings trades.

The reason that we like Earnings trades for new traders, is because you can put these on with defined risk. The strategies that we utilize can allow you to risk very little capital. If you start with one contract, we’re talking about just a few hundred dollars at risk on any one trade.

For new traders, Earnings trades help you learn our strategies very quickly. This is because when we put on these overnight Earnings trades, we’re putting them on before the market closes each day for that specific Earnings announcement on that specific stock. Then, we’re typically closing it the very next day. This is an expedited way to learn some of our strategies, whether it’s Iron Condors, or Strangles, or Butterflies, or Iron Butterflies, or some of the other strategies that we use on these Earnings trades.

With Earnings trades, you can look at how the strategy works and how implied volatility affects the pricing of these options, and it happens overnight. So we’re in one day, and we’re out the next, and it gives you that expedited learning curve. As opposed to some of our main core income strategies that we hold for several weeks, to sometimes a couple months if we have to adjust or roll.

Recap

And that wraps up our new trader checklist. Here’s a quick recap!

- Paper trade

- Learn how to trade Iron Condors and Strangles

- Learn how to trade directional strategies using verticals

- Look to use overnight Earnings trades to expedite the learning process

- Stay small

The key to this business is staying small, relative to your account size. And, when you’re first starting out, you need to stay even smaller, because we want you to understand the concepts, learn how to trade, get some wins, get consistently profitable from the get-go, and that’s going to help you long term.

We hope this lesson was helpful! If you are ready to get started just click the button below. We look forward to seeing you on the inside!

Happy Trading!

-The NavigationTrading Team

Follow