Welcome!

In this lesson, I want to discuss trading Long Stock.

Did you know that buying stock is no better than a 50/50 bet?

Let’s take a look…

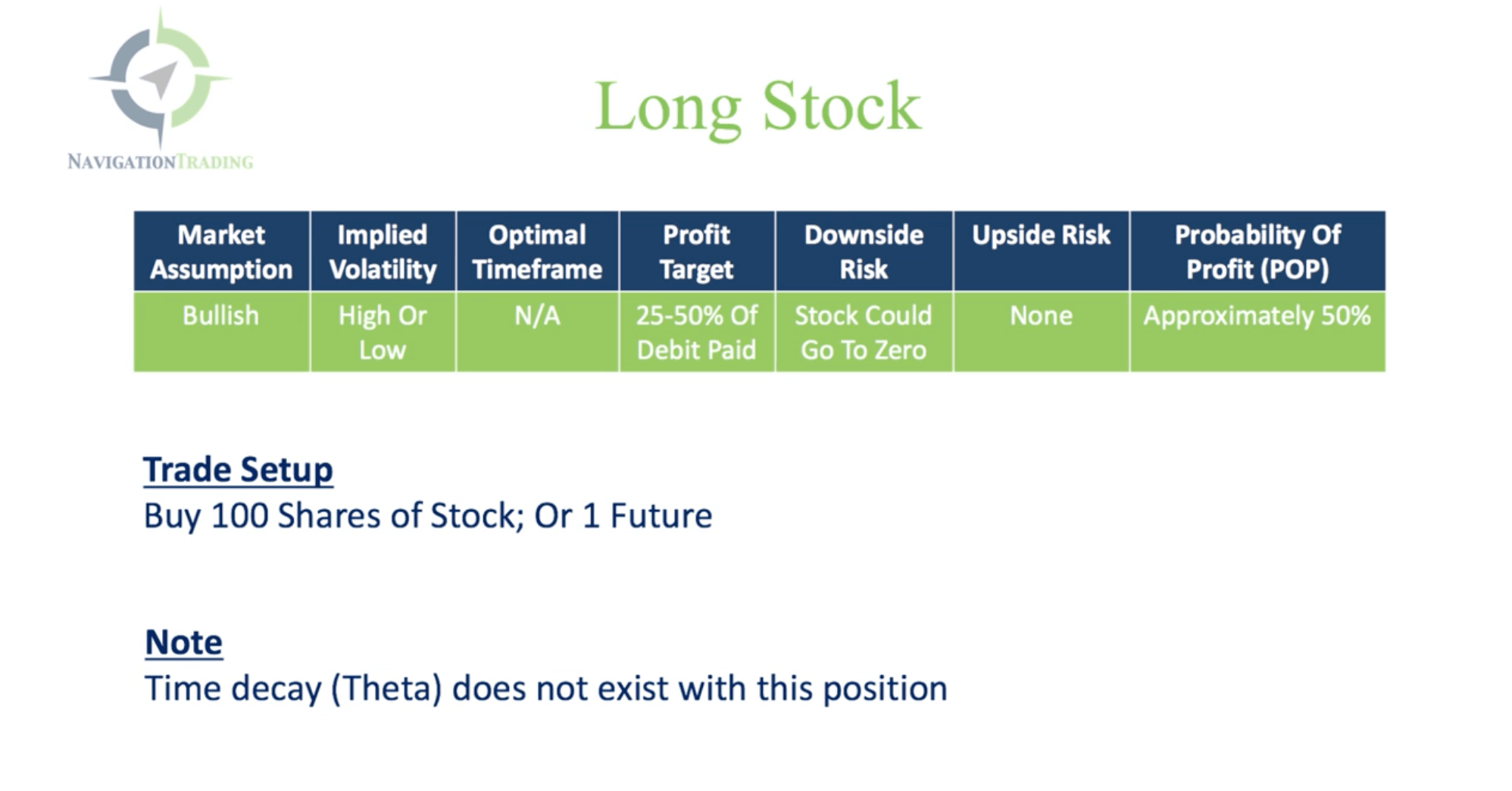

Long Stock Specs

-

- The market assumption is bullish. You want it to go up if you buy it.

-

- Implied volatility doesn’t matter because we are not trading options in this case. It can be either high or low.

-

- There’s no optimal timeframe for Long Stock, because if you buy stock it doesn’t have an expiration date like an option.

-

- We like to manage our winners, so we look at a profit target of 25-50% of the debit paid, so what you bought the stock for.

-

- Downside risk is that the stock could essentially go to zero if the company were to go bankrupt.

-

- The upside risk is none, because you’re making money if the stock is going up.

- The probability of profit is approximately 50%.

For the trade setup, you would just buy 100 shares of stock, or however many shares that you’re looking to buy. In the case of futures, you could buy one future contract or a number of futures contracts.

Theta does not exist with this position. There is no time decay because there is no expiration date.

I know most of you understand how to buy and sell stock, so that’s not what this lesson is about. The lesson is about the probabilities of buying stock and why it’s an inefficient use of capital, as well as just an inefficient way to take a directional assumption on a position.

Platform Example

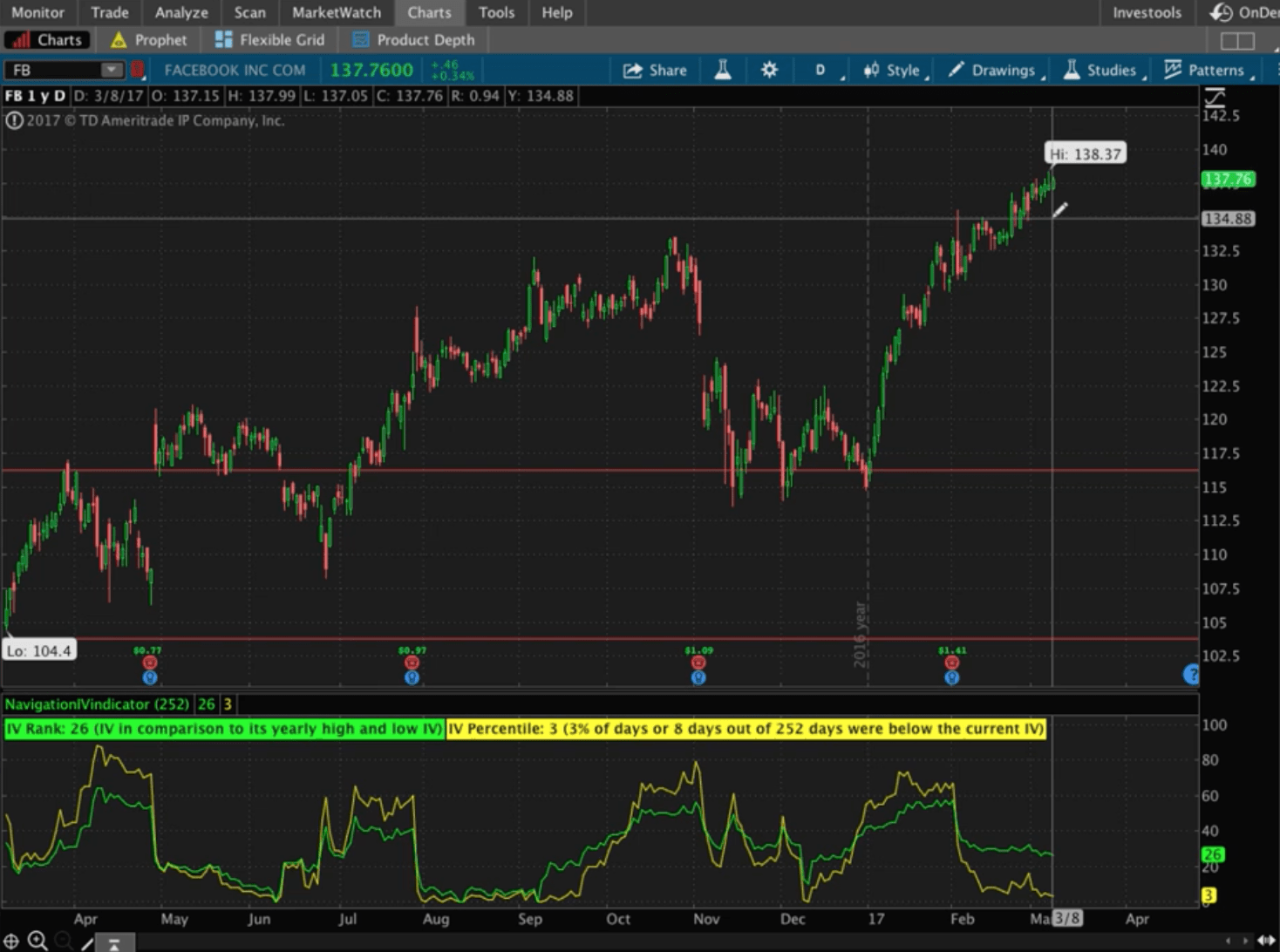

Let’s look at Facebook, a very widely traded stock. If we go to Charts tab in thinkorswim, you can see where Facebook is trading. Let’s say you said “I really think that Facebook is going to continue its upward move. It’s a strong stock, with good financials. They’ve got a lot of good things going on right now.” Whatever the reason is, you decide that you want to buy Facebook.

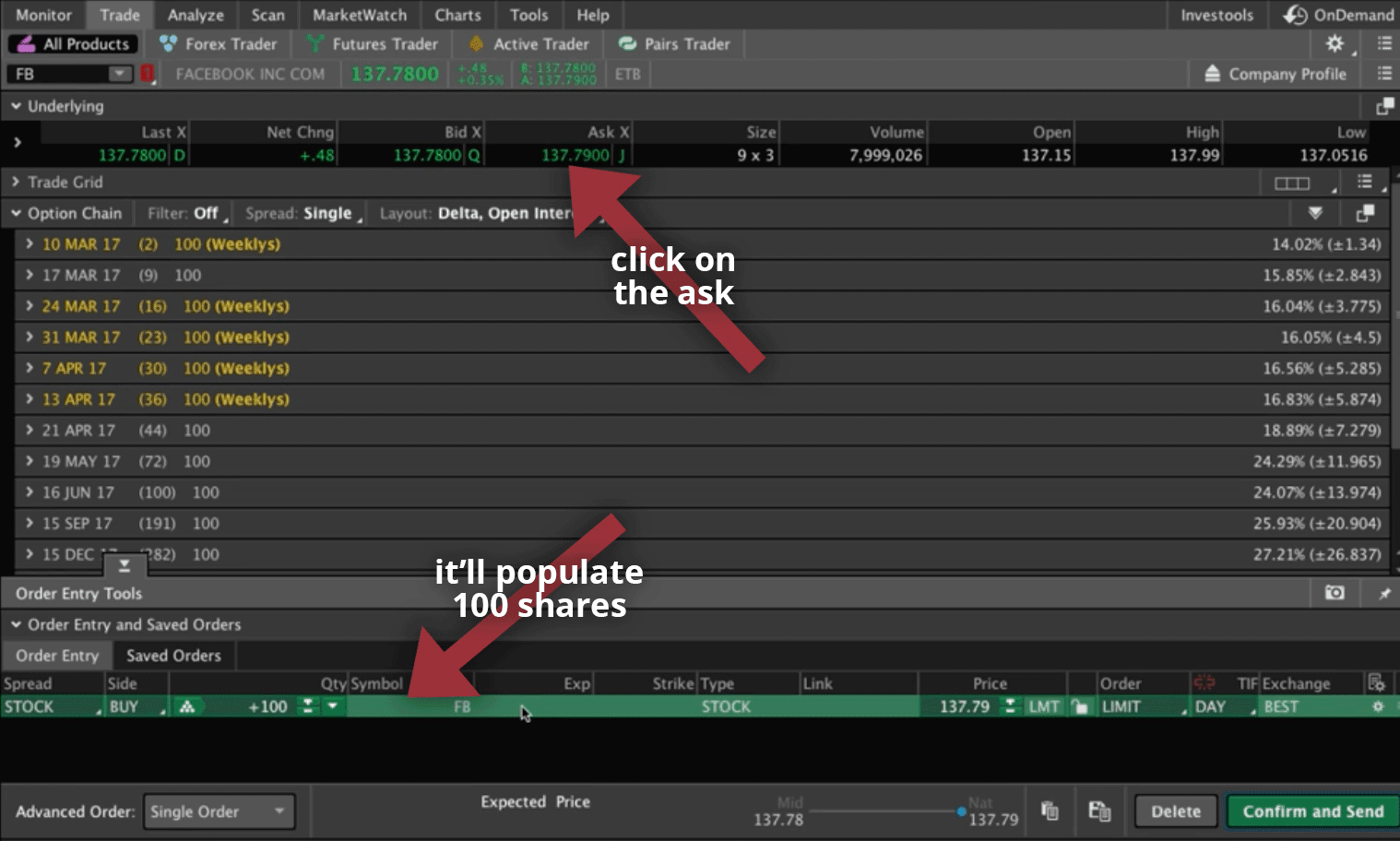

If we go to the Trade tab, find the Ask and just click on it, that’ll populate 100 shares of Facebook stock.

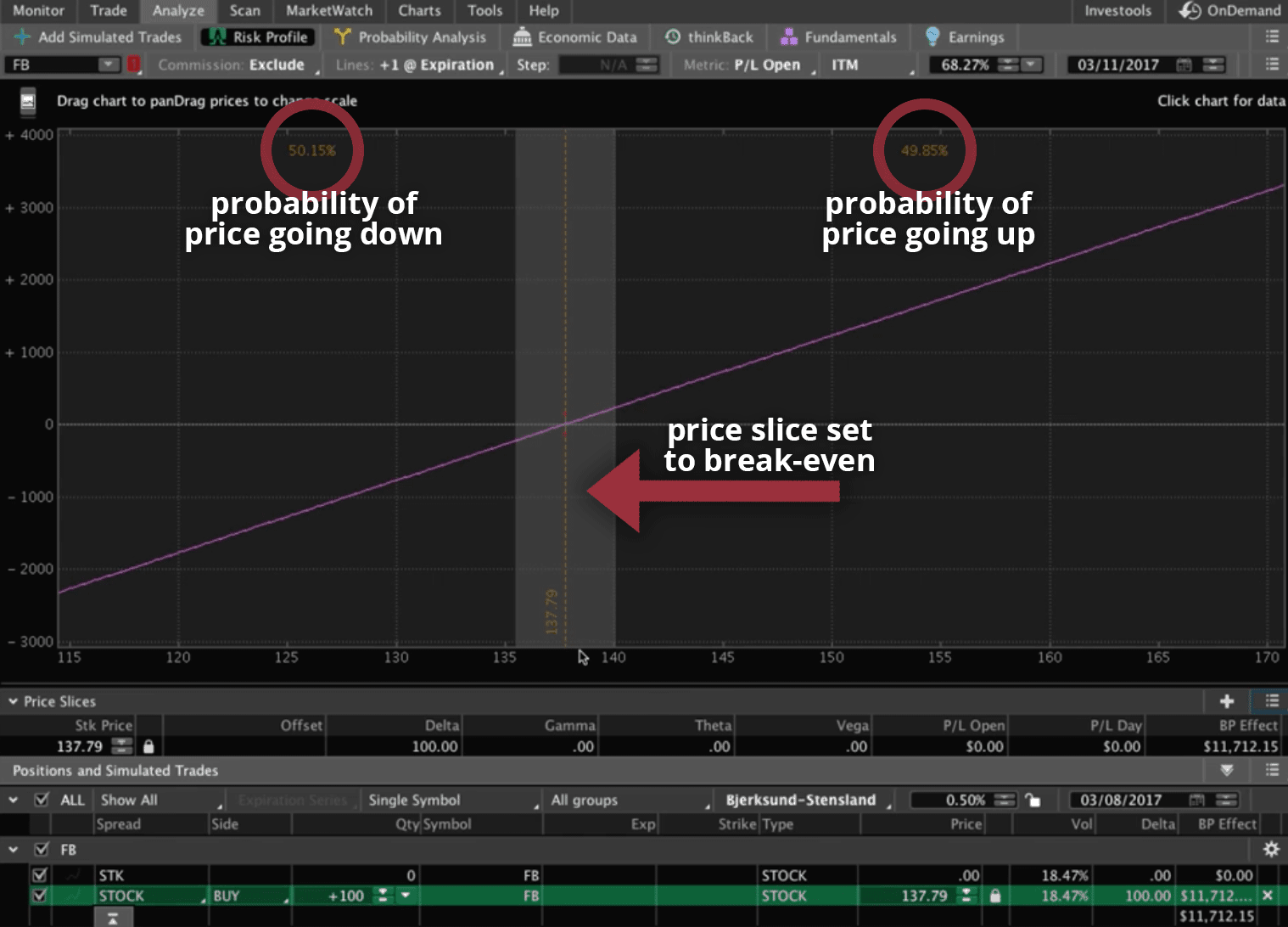

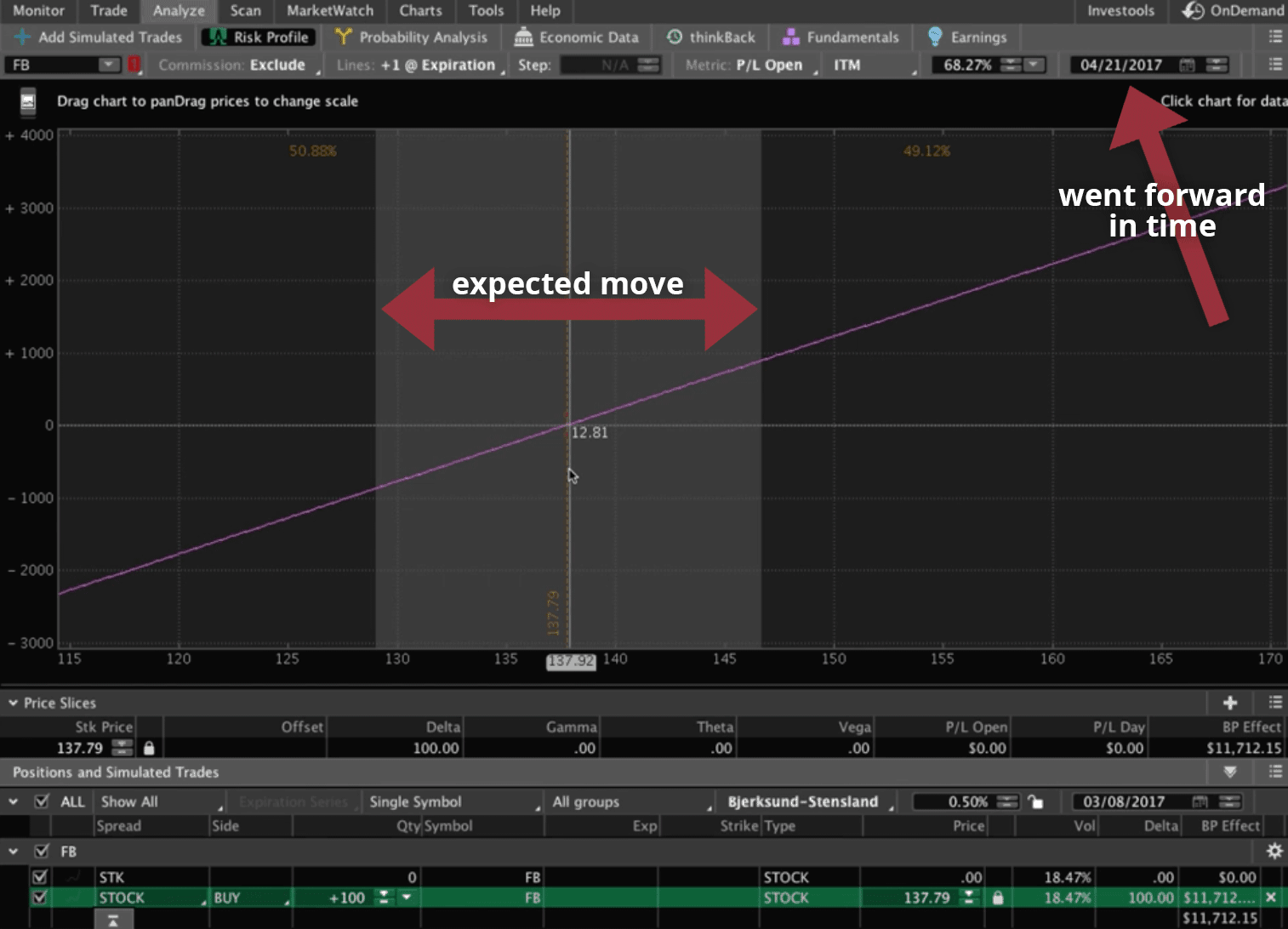

If we right-click on that order and select “Analyze trade”, a graph of buying Facebook stock pops up. We set our price slice to break-even like we always do with our options trades.

Now, look at what the probabilities are if the stock were to go up…and what the probabilities are that the stock will trade lower.

Then, we can pick a specific date in the future. Today is March 8th. Most of our trades are in that 30-60 day range, so let’s pick a day out in the future. Let’s go with April 21st, that’s about a month and-a-half away. The gray area in the graph represents the expected move over that time frame.

The way that stocks and options are priced, is based around volatility and the amount of time that passes.

What you’ll see is that anytime you buy a stock, it’s a 50/50 bet.

I don’t care what “magic indicator” you think you’re using, or trend lines or support and resistance…The bottom line is this…it’s a 50/50 bet.

By looking at this graphic visual, this is what really gave me the epiphany that, “Oh my gosh, no wonder I could never make money consistently by just being directional with my trades”. That’s the whole reason that options are so valuable, because it adds in the volatility component. It adds in the time decay component, which is theta that gives us that daily paycheck.

You can do this on any stock, Netflix, Google, Facebook, it doesn’t matter. When you buy it, it’s a 50/50 bet whether it’s going to go up or down.

These numbers hold true time after time after time over a large number of occurrences and over a long period of time. You may get lucky if you do 10 trades. You may get seven out of 10 right and think, “Oh, that’s a 70% probability”. But, if you do this over and over again, what you’ll realize is that is really just a 50/50 bet.

Again, that gray area represents the expected move, and that one standard deviation move. Almost 70% of the time this stock is going to stay in the gray range. In Facebook’s case, it’s currently at $137.79. So 70% of the time that you do this trade, it’s going to stay in the gray range. It might trade up to $146+, or down to $129, approximately. These models and their pricing is so accurate that over time, that is going to play out over and over and over again.

If you want to buy the stock because you just want to own it for the long-term, and then you can utilize options and other things all around it, that’s fine. But, just buying a stock takes up a lot of capital, and you don’t have any real theoretical edge with volatility or theta decay.

That wraps up the lesson. Stock buying isn’t bad, but if you do own stock, you need to utilize some of the other strategies around that stock that we teach at NavigationTrading, like Covered Calls, Covered Puts. That’s where you’re really going to get the value in owning stock overall.

I hope that this lesson was helpful for you guys.

Happy Trading!

-The NavigationTrading Team

Follow