Hello and welcome to this lesson from NavigationTrading!

In this video, I want to show you how to trade a Short Straddle on the tastyworks platform.

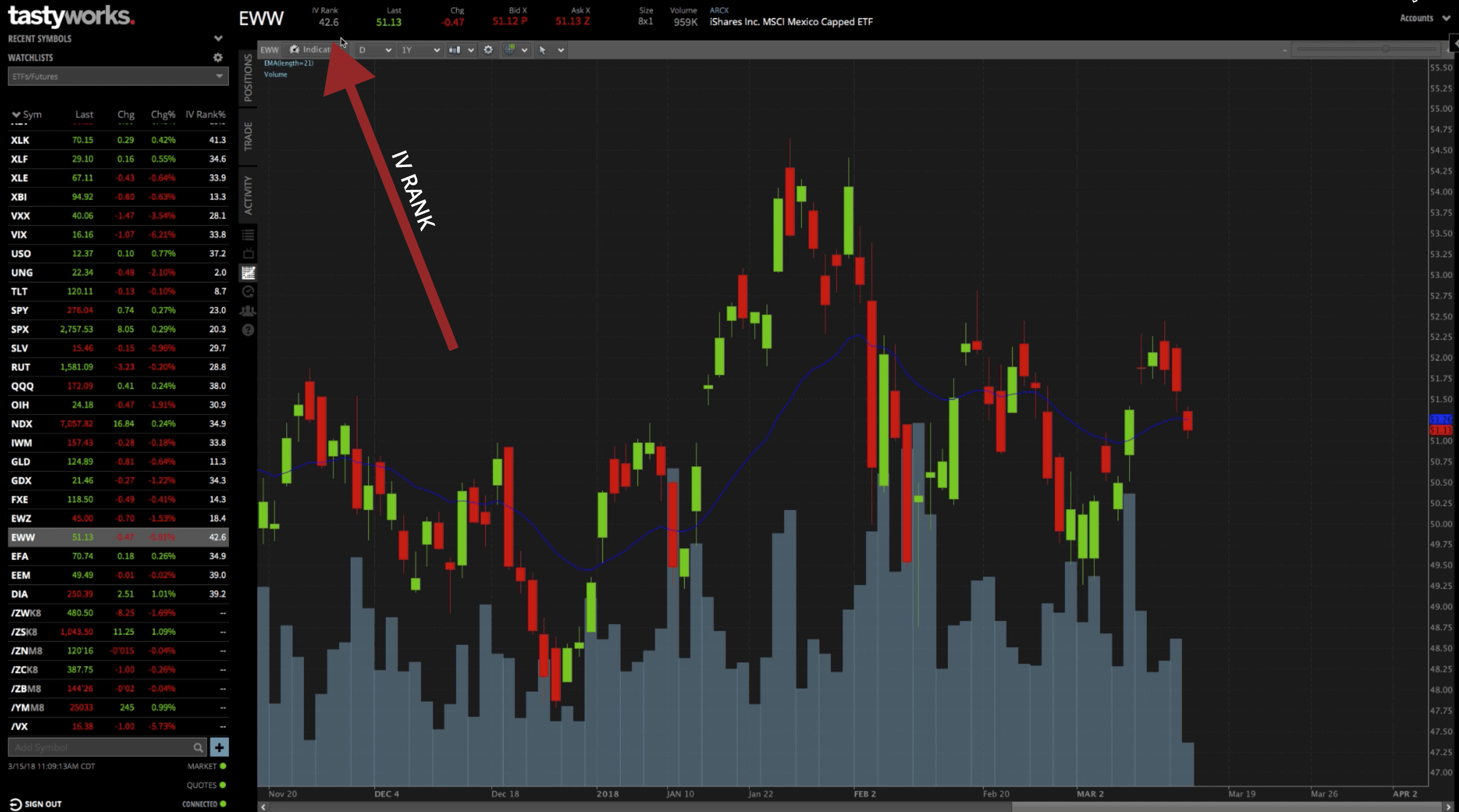

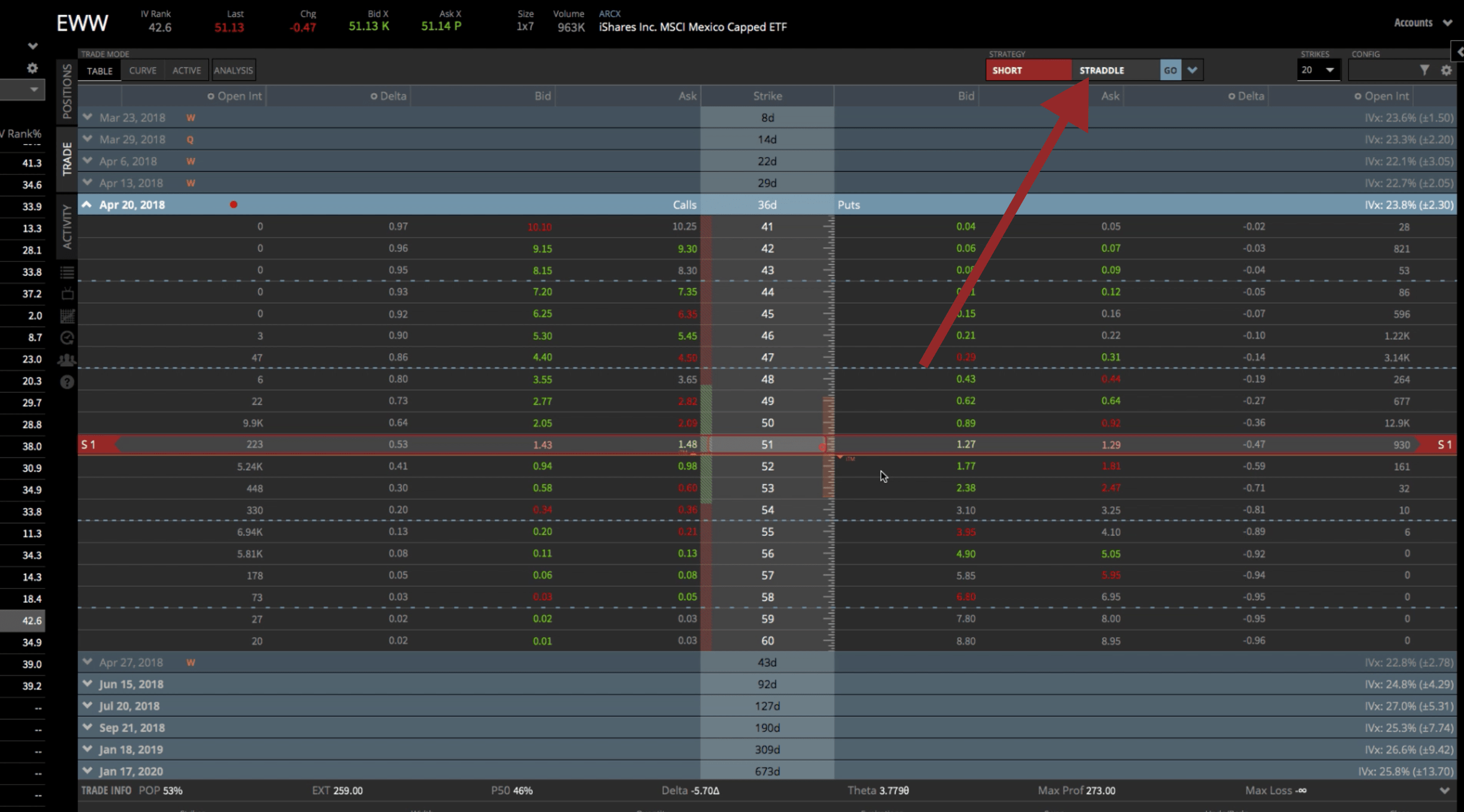

We’re looking at the EWW chart, which is the Mexican ETF.

You can see, the IV Rank is displayed up in the left hand corner at 42.6. It doesn’t display the IV percentile, but the IV percentile is over 80.

The options are expensive. They’re priced higher than they have been the last 52 weeks, and because of that, this is a good time to put on a Short Straddle.

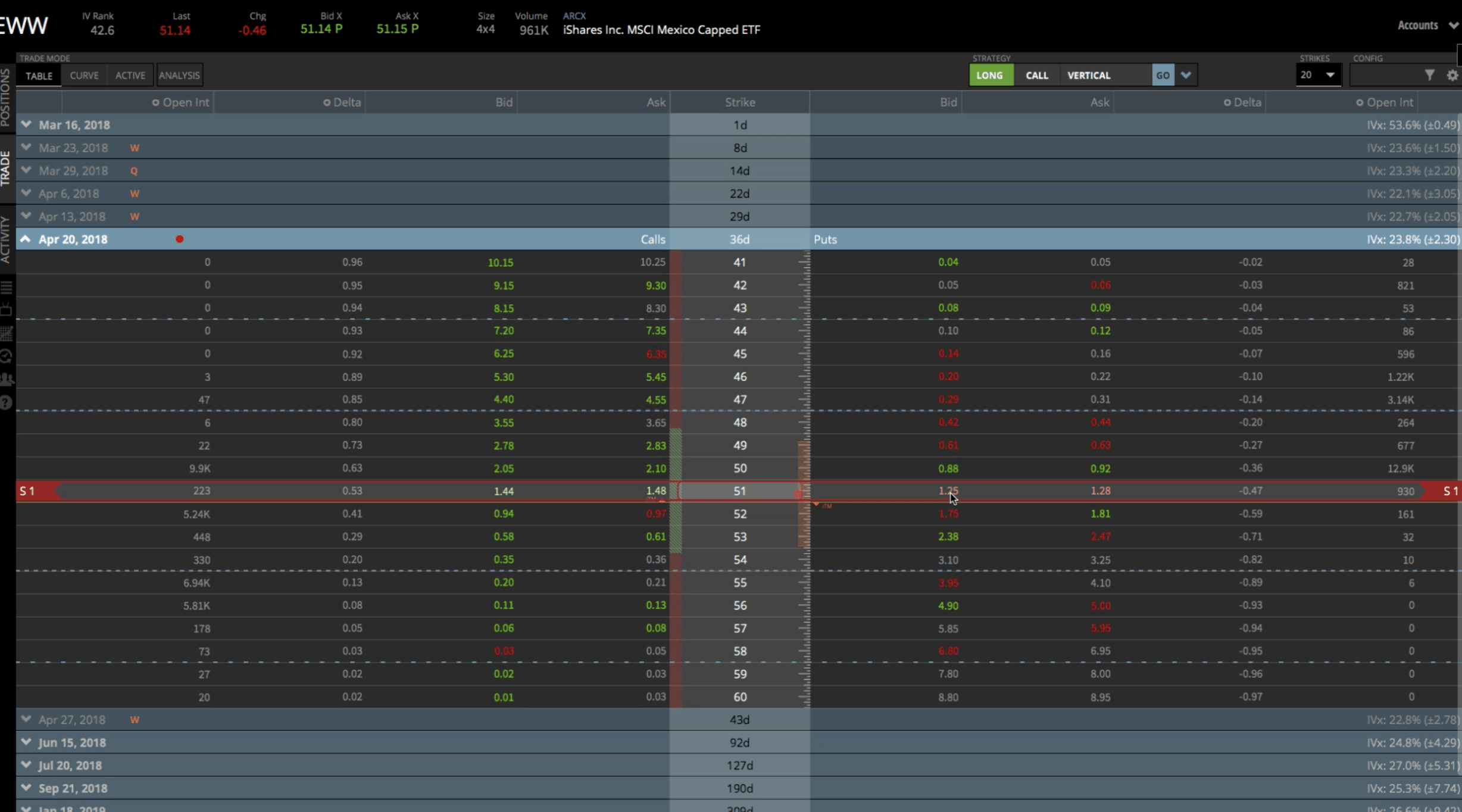

If we open up those option chains, you’re going to see the different strikes pop up.

A Straddle is just selling a put and a call, both right at the money.

At the time of this tutorial, EWW is trading right around $51. We would go to the 51 strike and sell the calls and puts. You can do that by clicking on the call bid and the put bid.

When the strike is outlined in red, that’s when you know you’re selling.

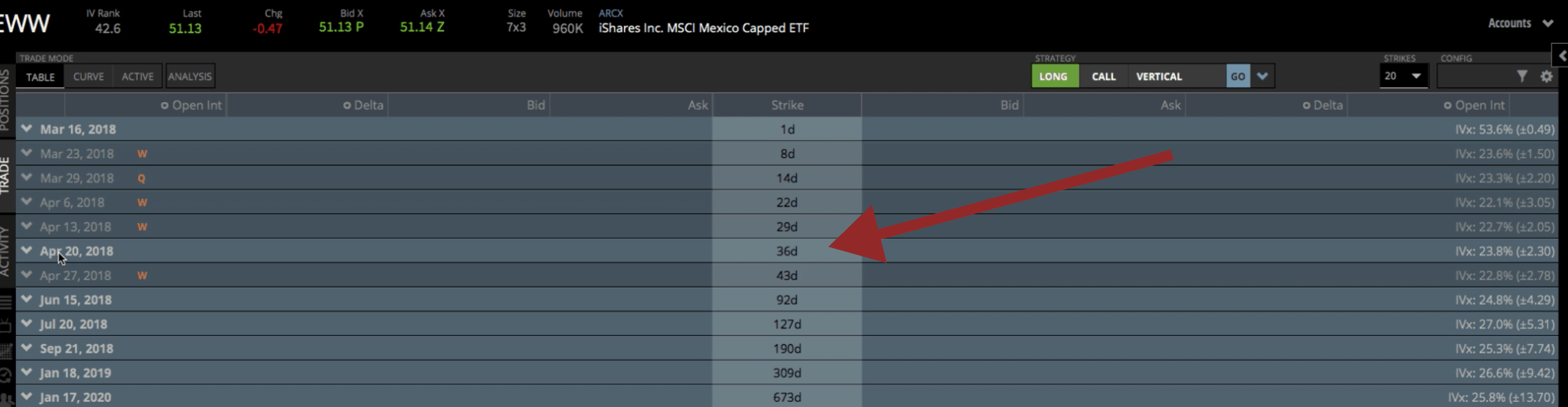

Let’s go to the Trade tab and open up the option chains that we want to trade.

In this case, we like to enter between 30-60 days left to expiration. We like to stay in the monthly cycles.

In tastyworks, monthlies are indicated by the bolded white. Weeklies and quarterlies are grayed out.

We want to stick to the monthlies and enter between 30-60 days left to expiration. We have 36 days left in the April monthly cycle, so that’s perfect.

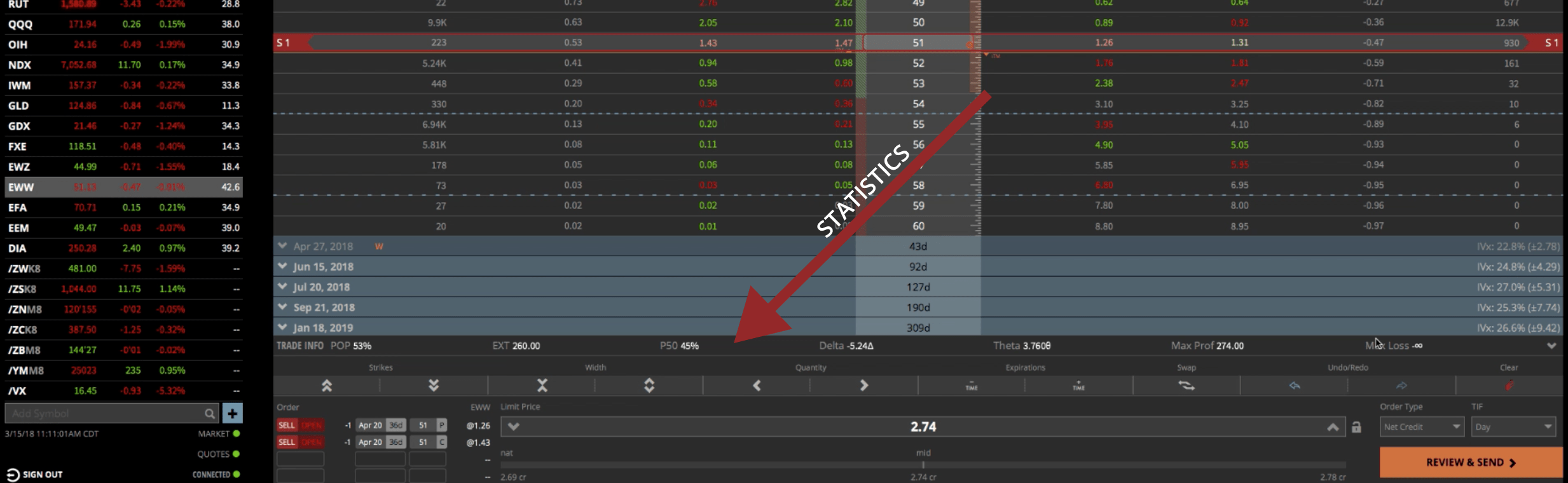

You can see the statistics down below. Probability of profit is at 53%. Probability of making 50% on this trade is about 45%. You can see the delta, the theta, and the max profit. We’re using undefined risk, so you won’t see a defined number on the max loss column.

If you’re ready to go, you can just hit “Review & Send”.

Using The Strategy Dropdown Menu

You can also use the Strategy dropdown option to set up the Straddle on the platform.

Go ahead and hit clear in the bottom right hand corner.

Remember we’re selling, so we’re shorting the strategy. Make sure you toggle to “Short” on the menu. Click on “Straddle” from the dropdown and it populates exactly the same way.

Whatever your preference, you can just click on the different bids to sell those options, or you can utilize the strategy dropdown. As you can see, all the statistics are exactly the same.

Analysis Tab

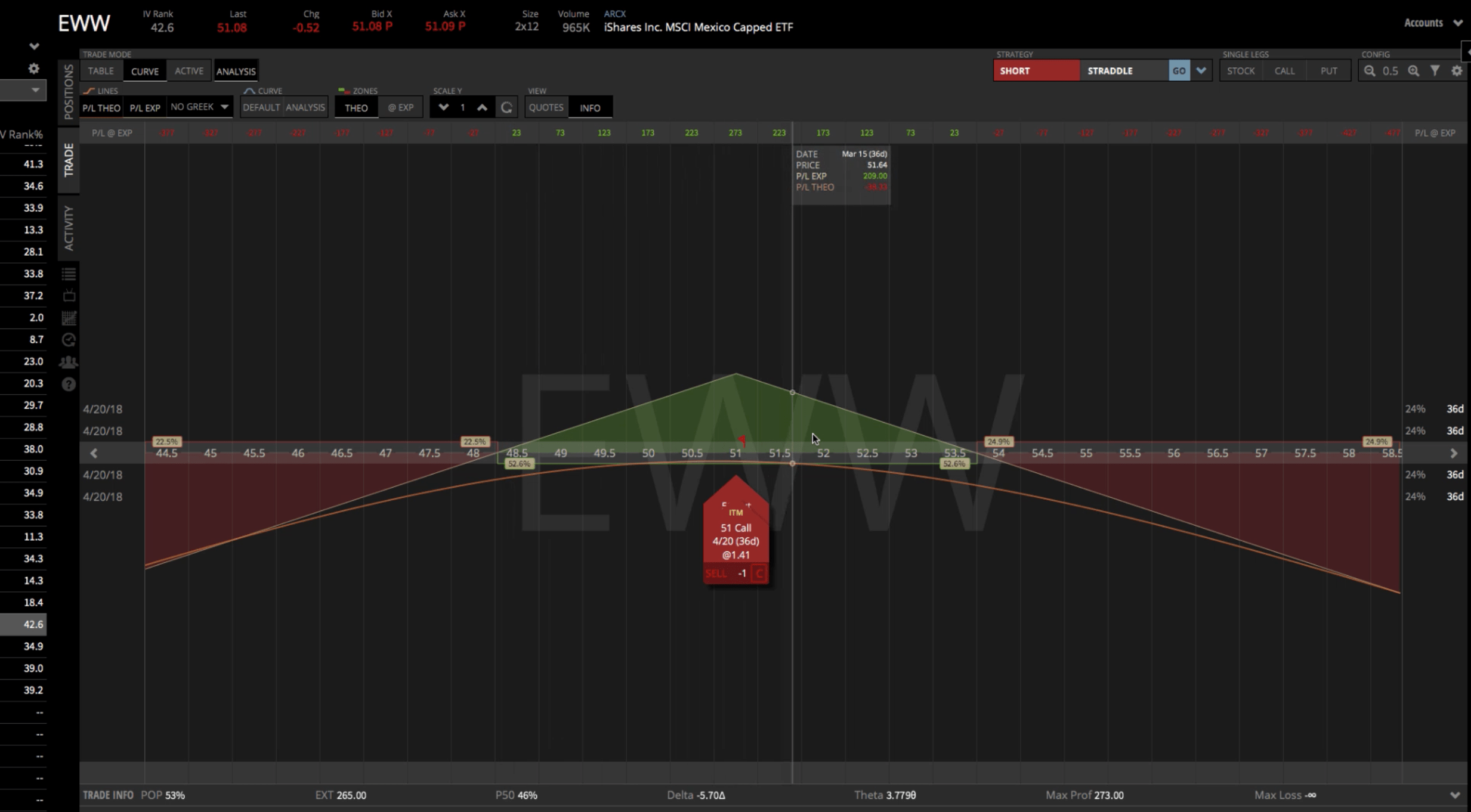

I like to go over to the “Analysis” tab to confirm the trade because I’m a visual trader. If you click on the “Curve” tab, making sure you also click on the “Analysis” tab, this is going to bring up the visual representation of the trade. You can maximize the graph to make it look bigger.

Being able to see the graph gives you an idea of where your break-evens are.

The green portion of the graph is where you’ll be making money at expiration.

The red portion is where you’ll be losing money.

All the statistics are still down below. If you hover your mouse over the graph, you can see a little flag up at the top of the platform. The information displayed on the flag gives you an idea of the profit and loss at expiration, depending on where price is.

The curved line in the graph represents the profit and loss theoretical. It will move as theta decays and as you get closer to expiration.

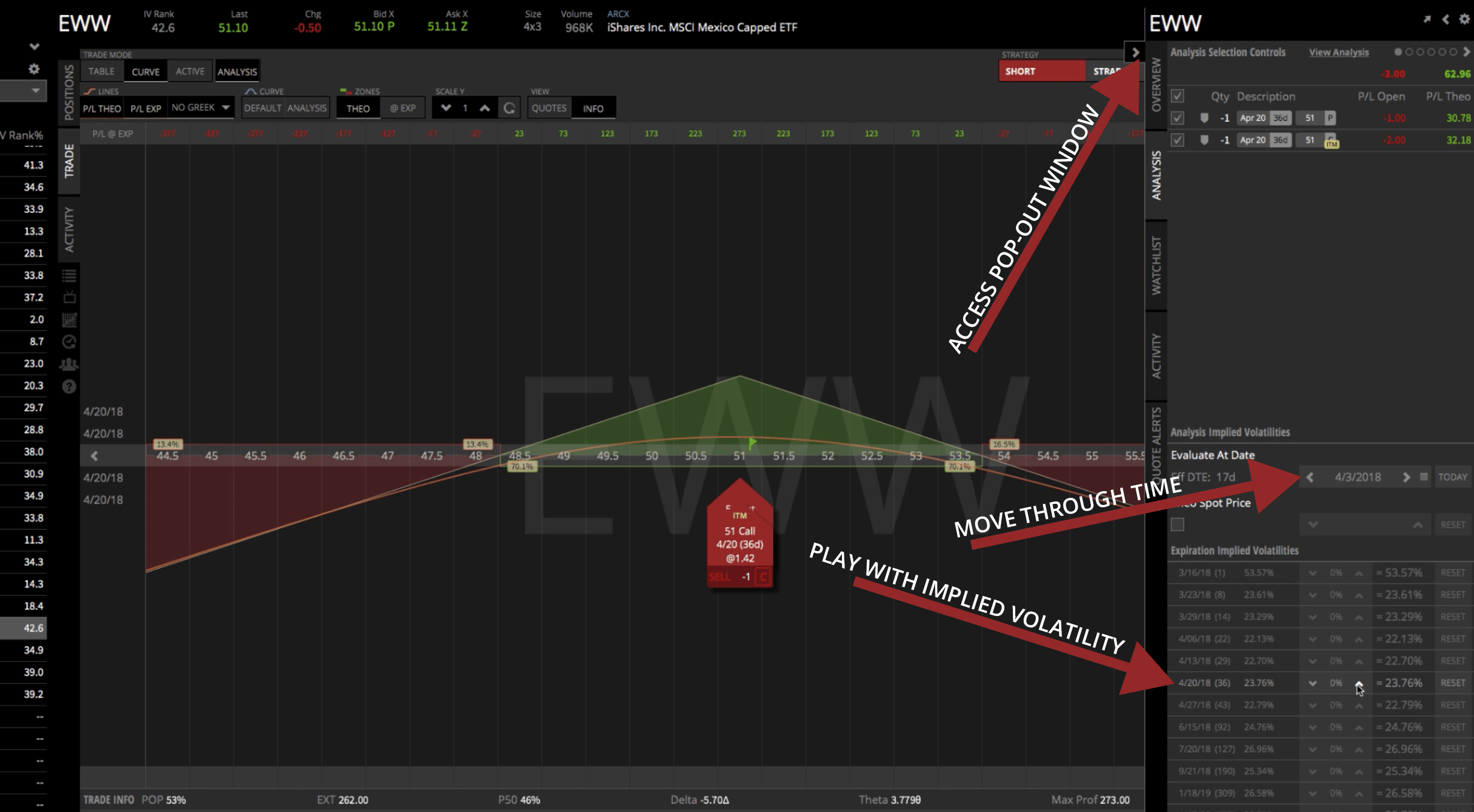

Theoretical Prices

If you want to play with theoretical prices, you can pop out the window on the right side of the platform.

Today is March 15th. If you wanted to move through time, you could click the arrow buttons in the box under the “Evaluate At Date” heading. You can see that the profit line continues to grow as you’re getting closer and closer to expiration.

If you wanted to play with the implied volatility, you’d have to choose the options that have 36 days left to expiration, since that’s where our trade is at. You can move the implied volatility up. Obviously, that makes our profit line go down.

When we sell a Straddle, we’re anticipating a contraction or a downward move in implied volatility.

You can kind of see what different implied volatility levels will do to the trade when you’re in this pop-out window. Plus, you can play around to get an idea of how a trade works.

Once you’re ready to go, hit “Review and Send” to send that into the broker. Once you get filled, you’ll be in the trade and ready to go.

I hope this was helpful in showing you how to set up a Short Straddle in tastyworks!

To learn more go to https://navigationtrading.com/tastyworks

Happy trading!

Follow