Hey NavigationTraders!

In this video lesson, we’ll be going over how to set up a Short Naked Put.

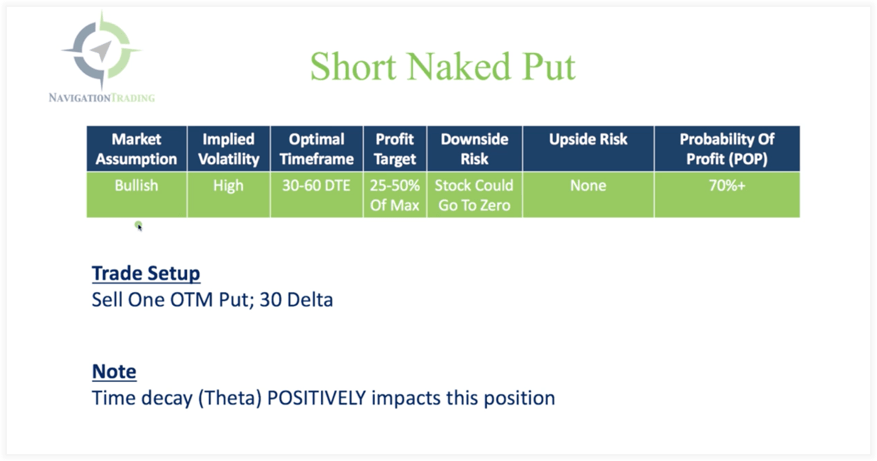

Short Naked Put Trade Setup

We want to do a Short Naked Put when our market assumption is bullish. We want the underlying stock/future/ETF to go up.

We want implied volatility to be high, because we’re a net seller of options.

Our optimal timeframe is 30-60 days left to expiration.

We’re looking for a profit target of between 25%-50% of max profit.

Our downside risk is that the stock could go to zero. That’s the ultimate risk. Obviously, it doesn’t happen very often, but you’ve got to look at it from an ultimate risk standpoint.

There is no upside risk, because if the stock goes up, we will be making money.

The probability of profit will be at 70% or more when we initiate the trade.

And for the trade setup, we’re simply going to sell one out-of-the-money Put. We’re going to do that right around the 30 delta.

Time decay (theta) positively impacts this position, just like in an Iron Condor or a Strangle. You can think of the Short Naked Put as just the Put side of a Strangle.

Platform Example

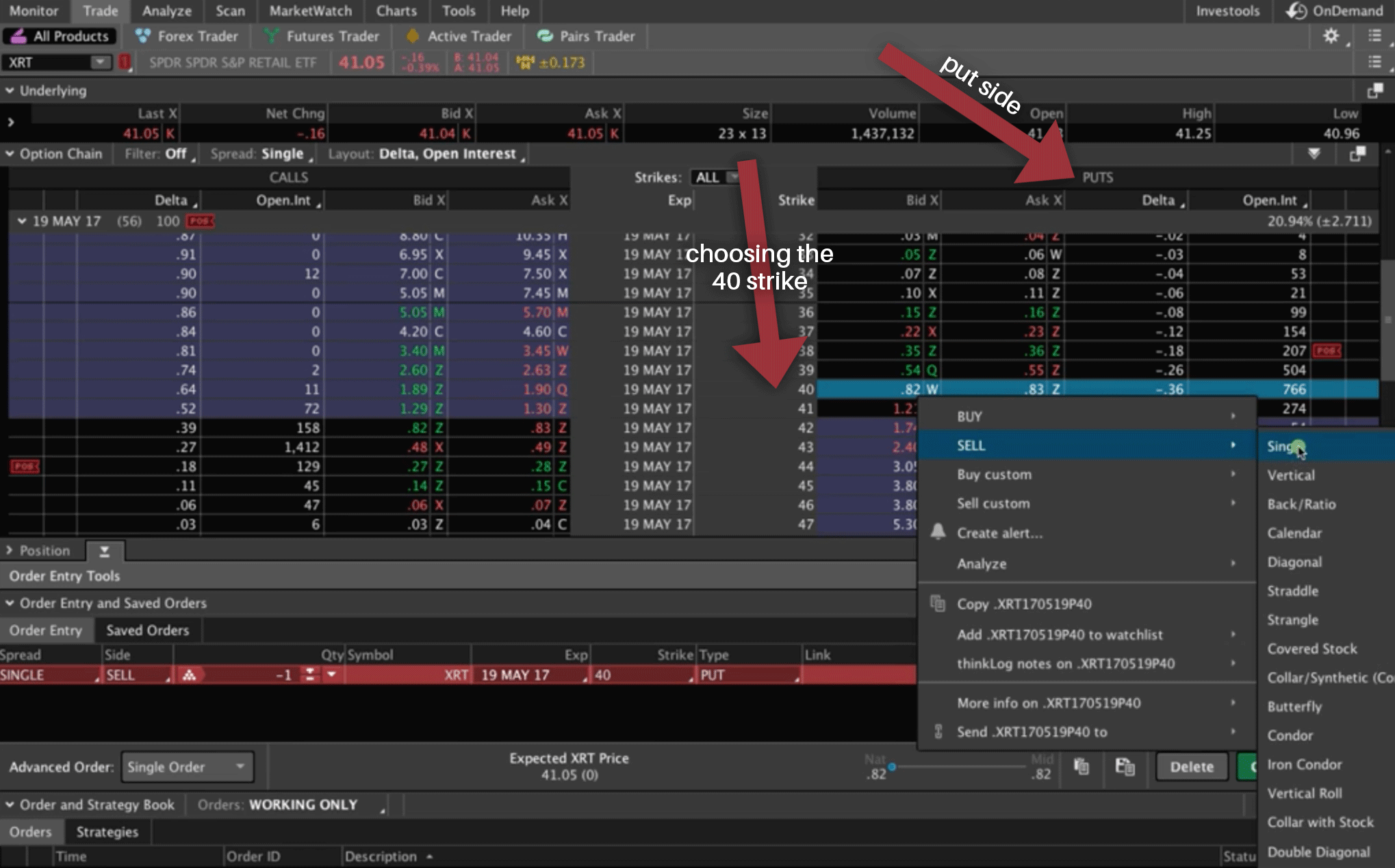

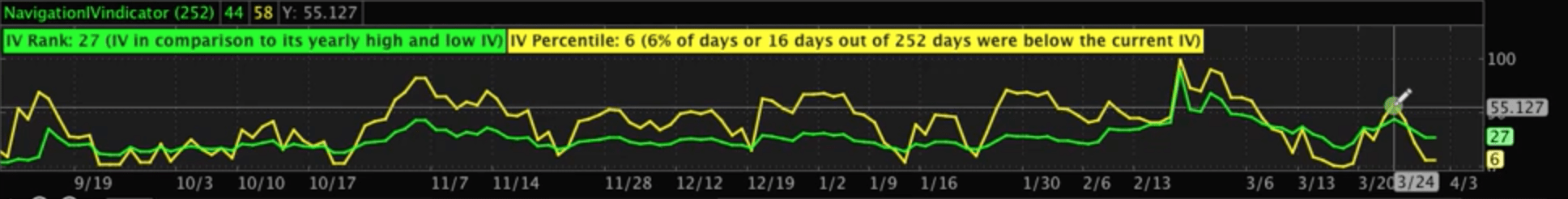

Let’s go to the platform and take a look at an example. We’re looking at XRT, which is the retail ETF. You can see we’ve got an IV percentile of 52. It’s above 50, so we can consider that high implied volatility. It’s one of the few high implied volatility vehicles that have to choose from right now.

But the other thing that I like about this as far as putting on and selling a Short Naked Put, is look at this massive down move it’s had.

I don’t like to get bullish on things when they’re already hitting new all-time highs. I like to get bullish on things when they’ve had somewhat of a down move. Now, it could be just a short term down move, or it could be a significant down move like we’ve seen here. But either way, we’ve got high IV. The probabilities are going to play out over time. So, let’s go to the trade tab and put this on.

Setting Up the Trade

We’re just going to go to the Put side and look for the 30 delta Put. As you can see, with XRT, we’ve got a 26 delta and we’ve got a 36. Which one do I choose? I always like to default to the higher delta. It’s going to give you more premium. You’ve got 82 cents versus 54 cents.

The only downside, is you won’t have quite as high of a probability of success. If you’re looking for a little bit more high probability, you could go for the 26 delta. If you’re looking for more premium to collect, you can go for the 36. It’s really just a preference.

There is a bit of a variance between these two strikes as far as having to choose the 39 with 26 delta, or choosing the 40 and having to go all the way to 36 delta. There’s a difference of 10. But, a lot of times you’re splitting hairs as far as which one to choose. Let’s go ahead and choose the 40. We’re just going to right click, select “SELL” and then select “Single”.

Analyzing The Trade

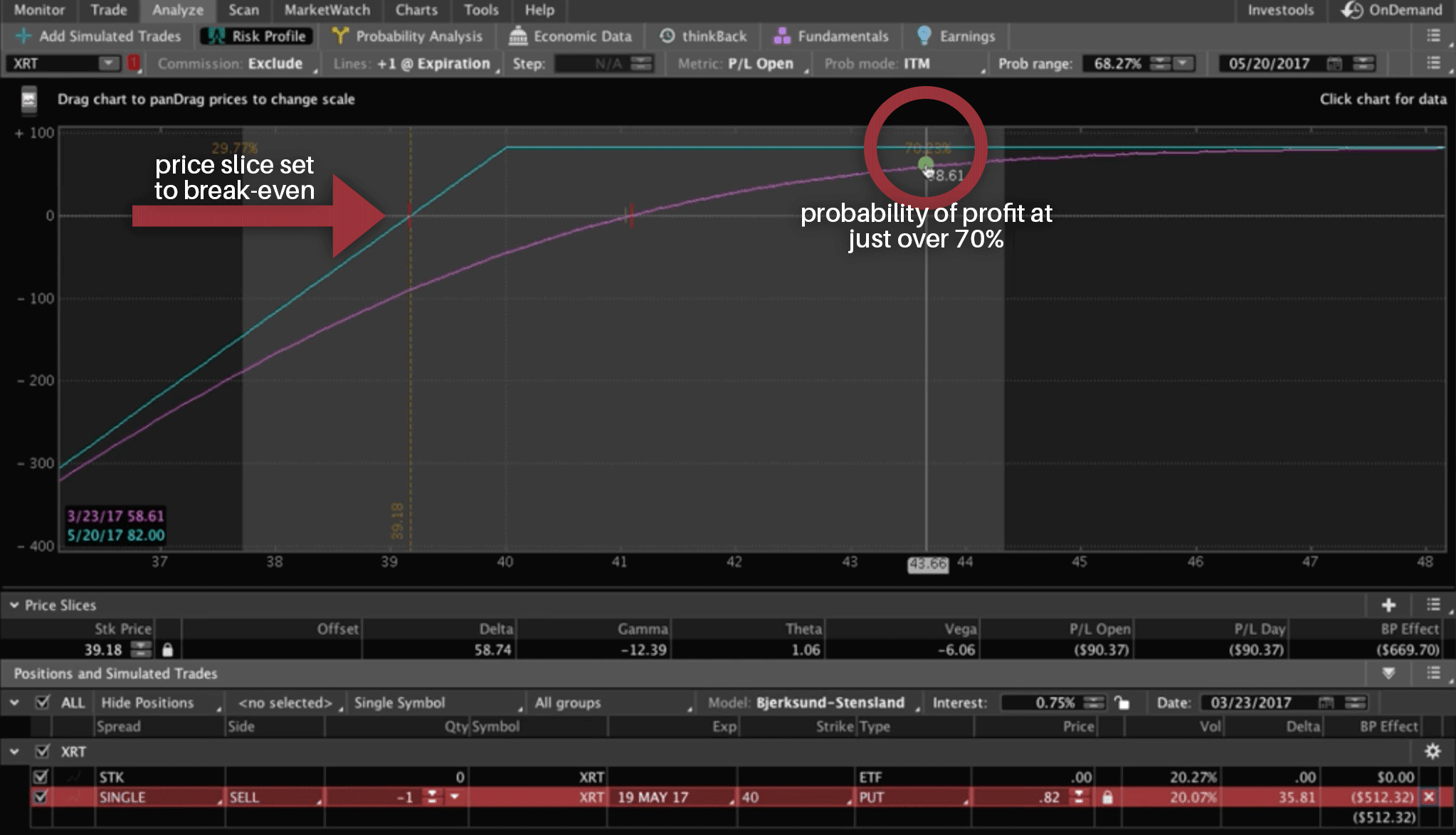

That’s going to populate down at the bottom in the Order Entry area. We want to take this to the Analyze tab, and to do that, just right click and select “Analyze trade”.

A graph will populate representing the trade. Make sure the date is set to the expiration date, which in this case is 5/17. Then we’ll set our price slice to the break-even point.

What you’ll see is that we’ve got a probability of profit of just over 70%. Remember, when we manage these trades and exit at a percentage of max profit, our winning percentage is going to be much higher than 70%. It’s going to be closer to 80, 85%, maybe even a little higher. But 70% is just our initial probability of profit if we held it all the way to expiration.

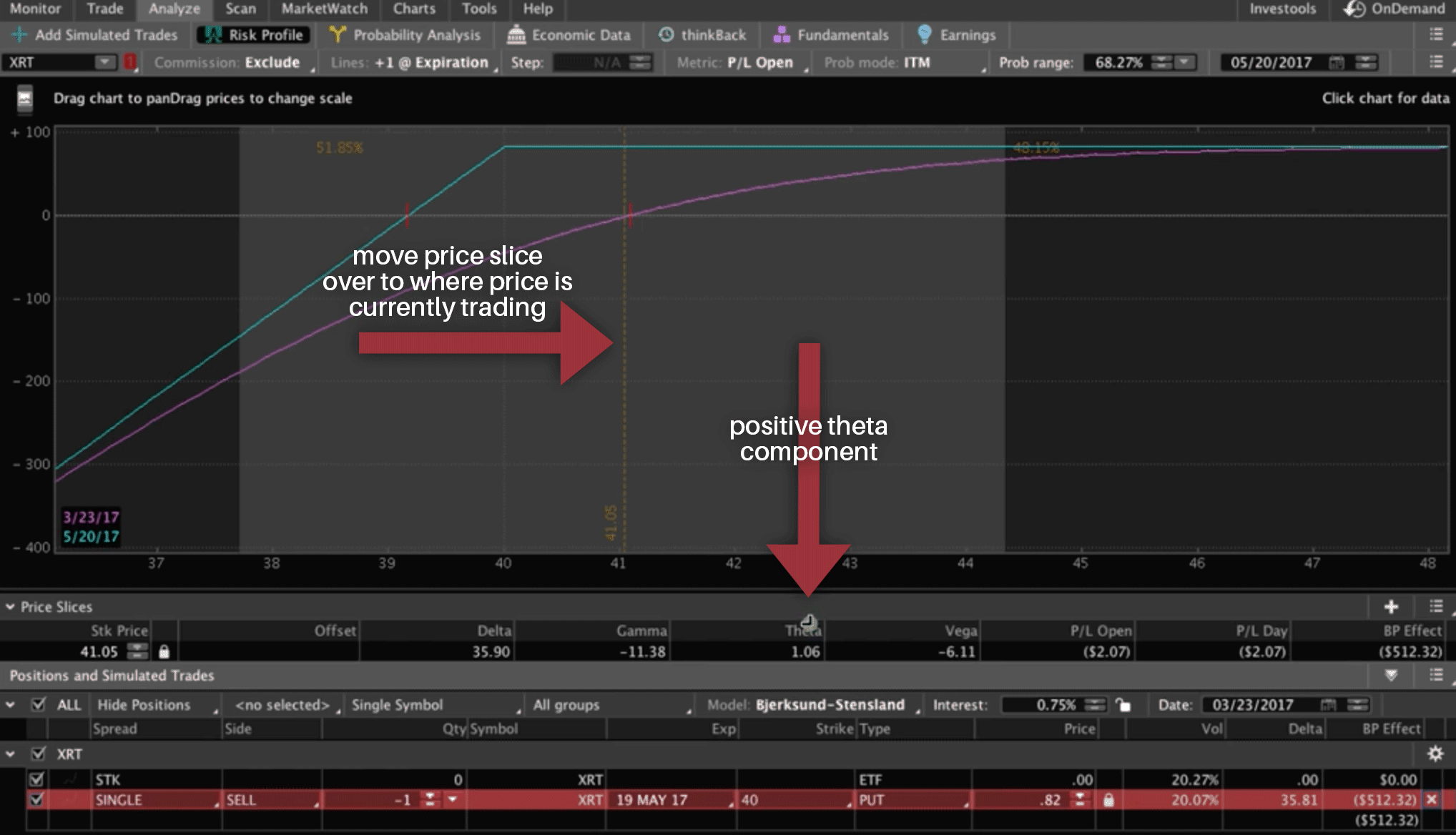

Theta

If you move the price slice to where price is currently trading, you can see there’s a positive theta component. Remember when we were looking at our trade setup, a Short Naked Put has a positive theta component to it. If price stayed right where price is currently trading between now and expiration, that would allow us to make money on this trade. We always want to have that theta component when we’re selling options if possible.

Getting Filled

Just to recap, we’ve got about a 70% probability of profit. This trade is neutral to bullish. We call this a bullish strategy, because ultimately, we will profit if price goes up quicker.

I’m going to go ahead and get this filled. I’ll only be doing one contract for this example. Just right click, and then select “Confirm and send”, and click the green “Send” button. And we got filled right at 82 cents.

6 Days After Entering the XRT Trade

I thought I’d come back to show you guys what was happening in XRT just a few days after entering the XRT trade. We entered that trade on March 24th. Today is March 30th, six days later, and price has moved up nicely for us. We got in when price was about $41. It’s moved up to a little over $42.

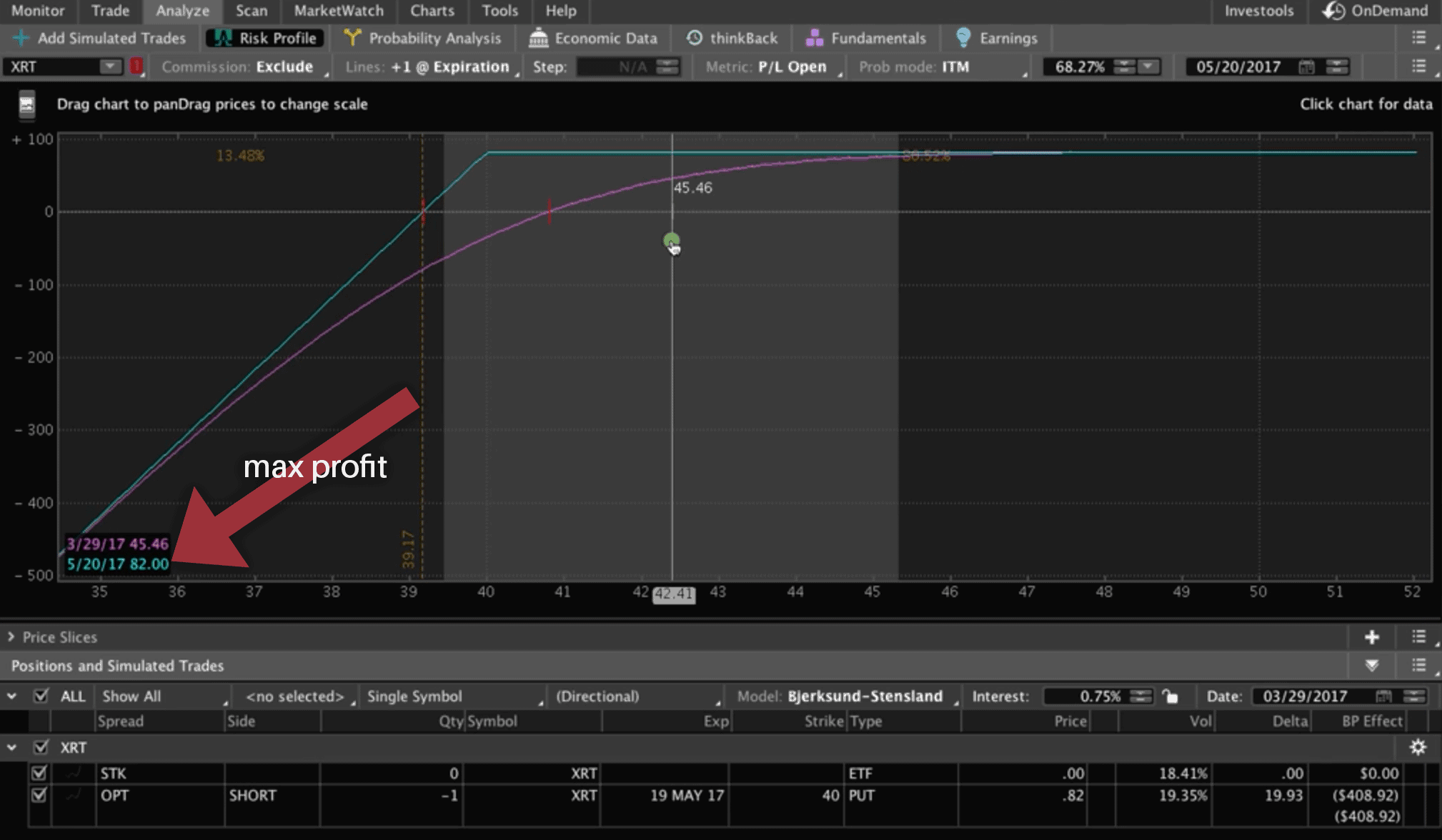

Analyze Tab

If we go to the Analyze tab, you can see we are now in the profit of a little over $45. Our max profit for this trade is $82. That’s over 50% of max profit. This was caused by that move upward shown above.

Also look at what’s happened to implied volatility since we put this trade on. It’s just gotten crushed. So, the move up in price, and the move down on implied volatility both helped our position.

This is a quick profit that we took in just six days. For this example, we only did one contract. We’re making a profit of around $45. But, you want to look at this from a percentage perspective. Because if you have a small account, this is going to be a bigger percentage of your account. If you have a larger account, obviously you do more than just one contract.

This was a great trade. We were able to take the trade off quickly, making over 50% of max profit in just six days. We’ll take these kind of trades all day long.

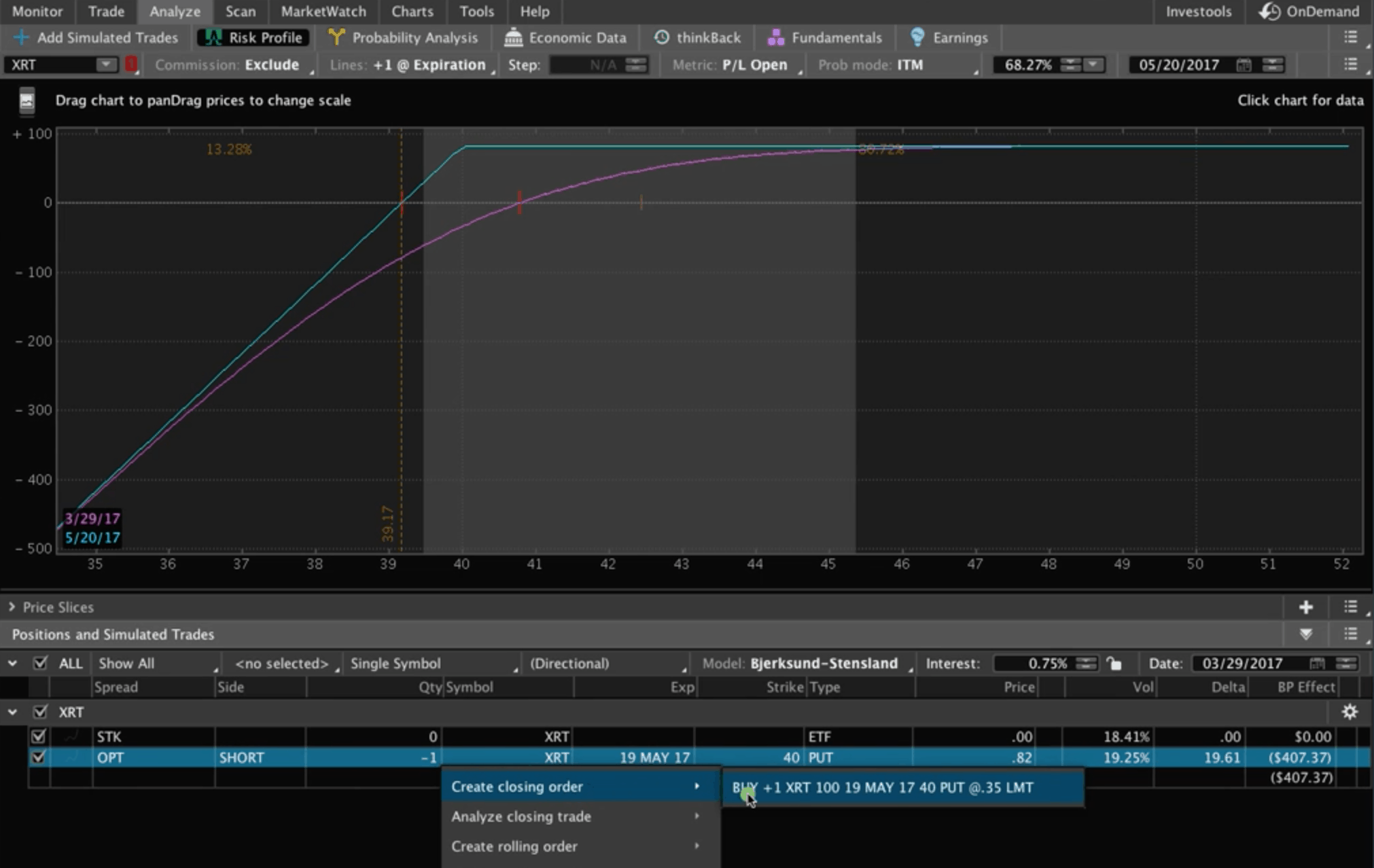

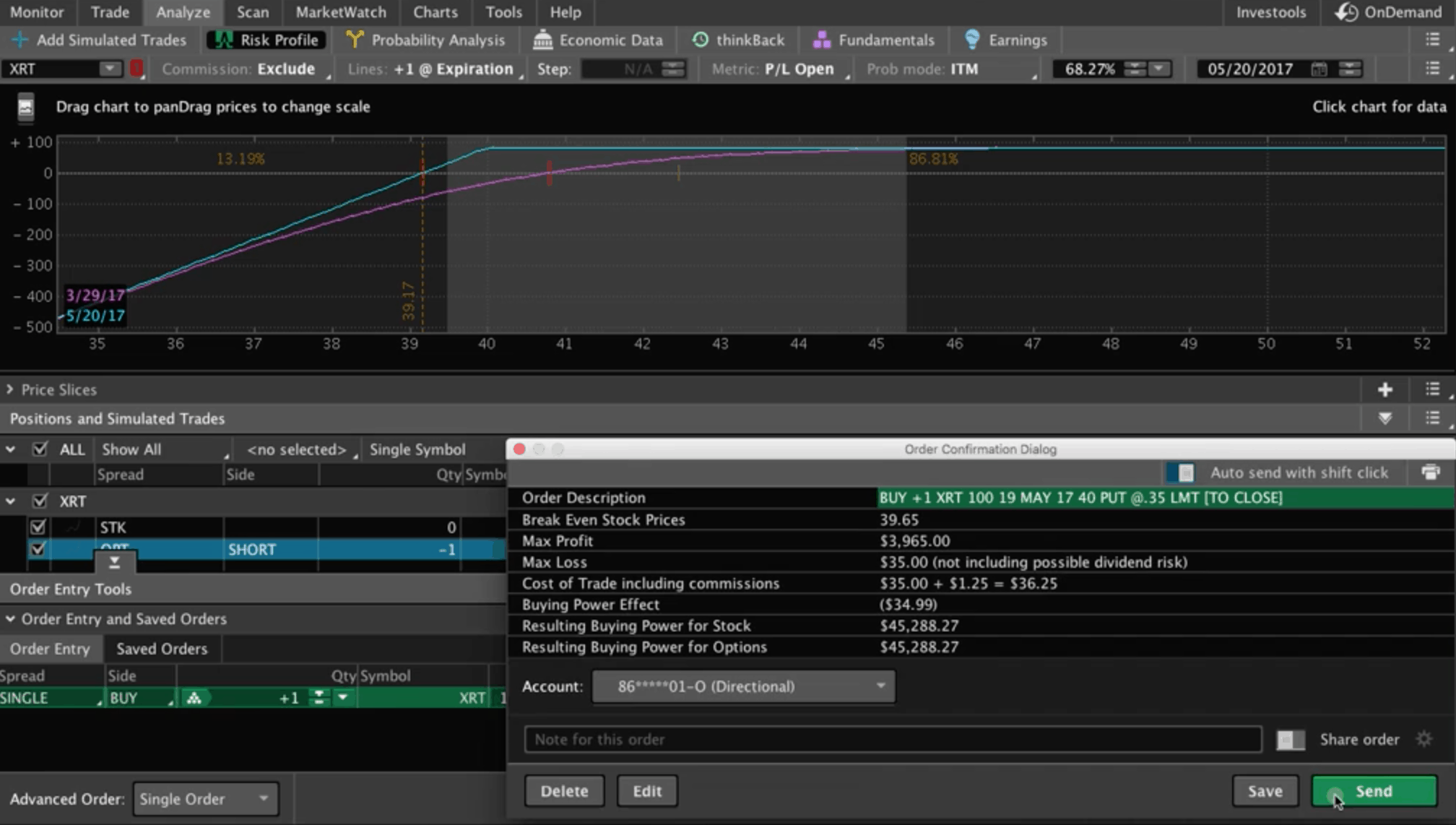

Closing The Trade

To close out this trade in XRT, just right click, select “Create closing order”, and then select the buy option.

We’re trading at .35 cents. We’ll hit the green “Confirm and send” button, then the green “Send” button, and then we’re out of the trade.

I’m not going to show the closing trades in all of our tutorials, but I wanted to show this one because it’s a perfect example of how quickly some of these trades can move in our favor with price and implied volatility.

I hope that tutorial was helpful!

Happy Trading!

-The NavigationTrading Team

Follow