Hello NavigationTraders!

In this lesson, I want to answer a question that I get from new traders who are aspiring to be professional traders.

The question is this: “How much money do I need to trade options for a living?”.

That’s a tough question, because obviously everybody’s lifestyle is a little bit different. What I need to live on, might be totally different than what you need or what you want to live on.

However, there are 3 key variables that can help you calculate and project what you need to make a certain amount of income. Let’s jump in.

3 Key Variables

- Theta – Theta is the daily time decay that you get from the strategies that we teach of selling different types of option premium.

- Profit/Loss Targets – What are your profit and loss targets? This will help you calculate what your income is going to be on a monthly or annual basis.

- Winning Percentage – The winning percentage of the strategies that you trade.

Theta

Let’s start with theta. What is it? We’ve talked about this in courses and other lessons, but just to recap, theta is one of the four primary Option Greeks. It’s the theoretical value that refers to the decay of an option as time passes.

Think of theta as your daily paycheck. It’s the theoretical amount that you should make if price and volatility and all factors stay exactly the same. Theta is what you should collect on that time decay in your specific position.

Profit/Loss Targets

Next, we’re going to focus on the profit/loss targets of the four core strategies that we trade on a daily basis at NavigationTrading.

- Short Strangles – We target 50% of max profit

- Iron Condors – We target 40% of max profit

- Butterflies – We target 20% of max profit

- Short Straddles – We target 25% of max profit

Based on our research and trading experience, we know that managing those winners at a percentage of max profit, booking those profits, and redeploying that capital into high probability opportunities, gives you the best “bang for your buck”.

Winning Percentage

The third key variable is the winning percentage or Probability of Profit (POP). By managing your winners as stated above, these strategies have the following winning percentage.

- Short Strangles ~ 90% Probability of Profit

- Iron Condors ~ 85% Probability of Profit

- Butterflies ~ 75% Probability of Profit

- Short Straddles ~ 80% Probability of Profit

Sample Portfolio

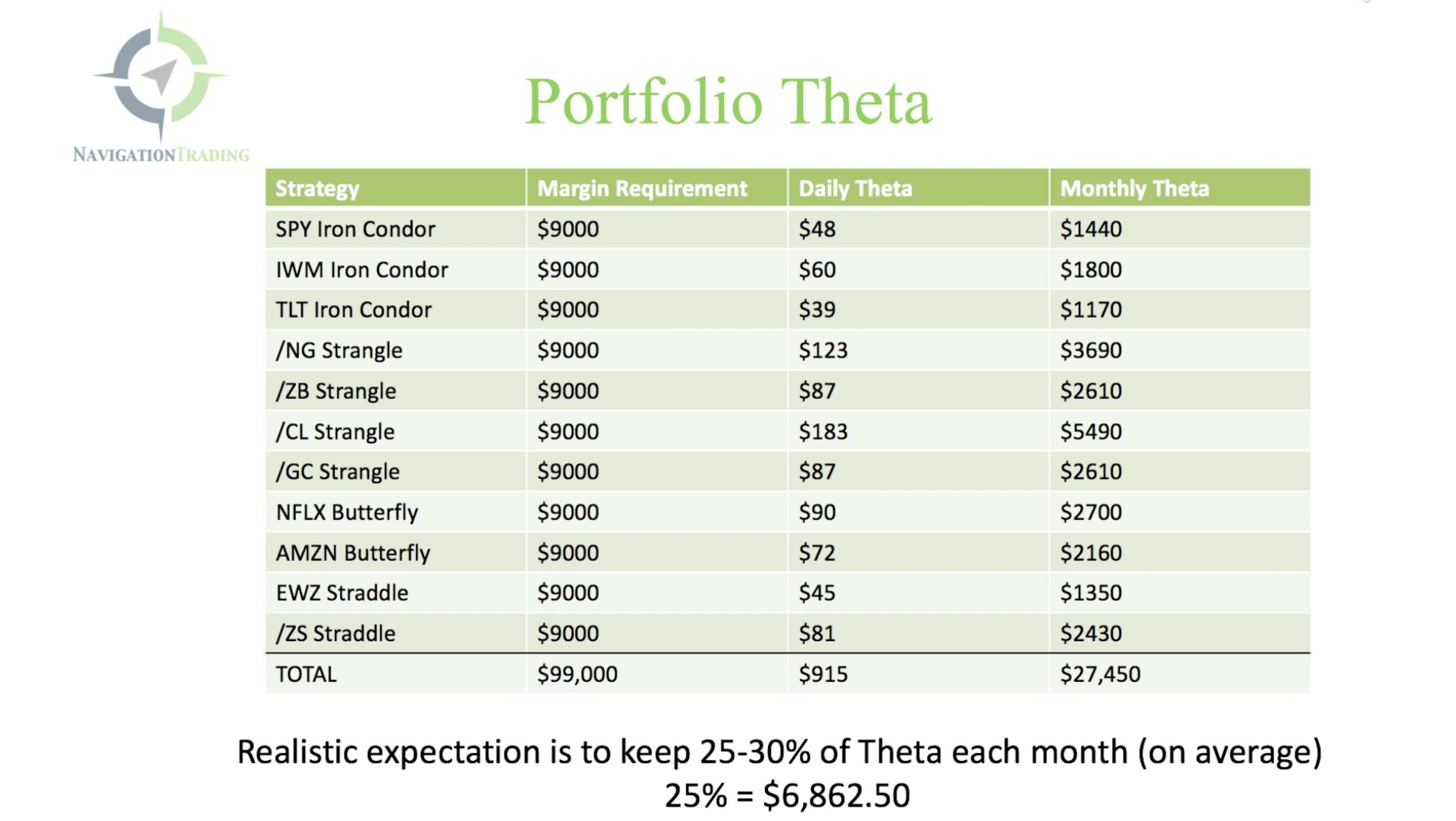

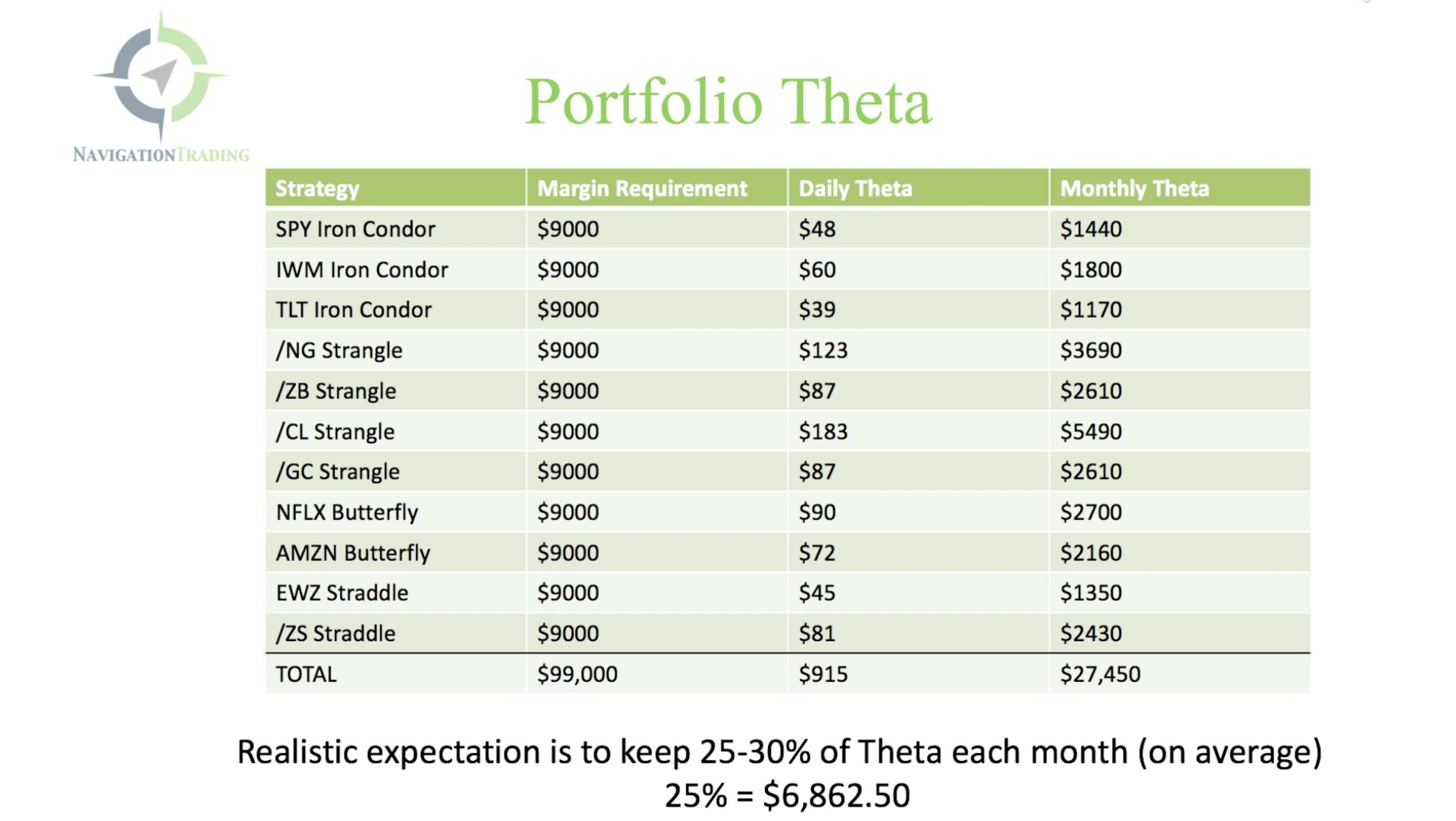

We put together a sample portfolio as an example.

As you can see from the portfolio, we traded three Iron Condors, four Short Strangles, two Butterflies and two Short Straddles.

There was no real strategy in choosing these symbols, it’s just a diversified portfolio with uncorrelated underlying symbols. We tried to keep the margin requirement right around $9,000. This is an average, so some of these are going to be a little over, some will be a little under. But, that’ll give you an idea for using total capital of just under $100,000.00 for this example.

Then, I went to our ThinkorSwim trading platform, and looked at each one of these and I said, “Okay, what’s the theta? What’s the daily income amount that I should expect from trading that particular symbol, and that particular strategy?”

Remember, we always enter these trades when there’s about 30-60 days left to expiration. Obviously, you’re going to collect more credit the further out in time you are, and less credit the closer to expiration you are.

As of today, there was 43 days until expiration. So, we are entering these theoretical trades right in between that 30-60 day range, which is optimal.

In the third column on the chart above, labeled “Monthly Theta”, I just took that daily theta number, and I multiplied it by 30. This is assuming there are 30 days in a month. That’s how I got the monthly theta amount. Keep in mind, your theta numbers will grow as you get closer to expiration, but for this example we simply multiplied the daily number times 30 to illustrate.

Platform Example

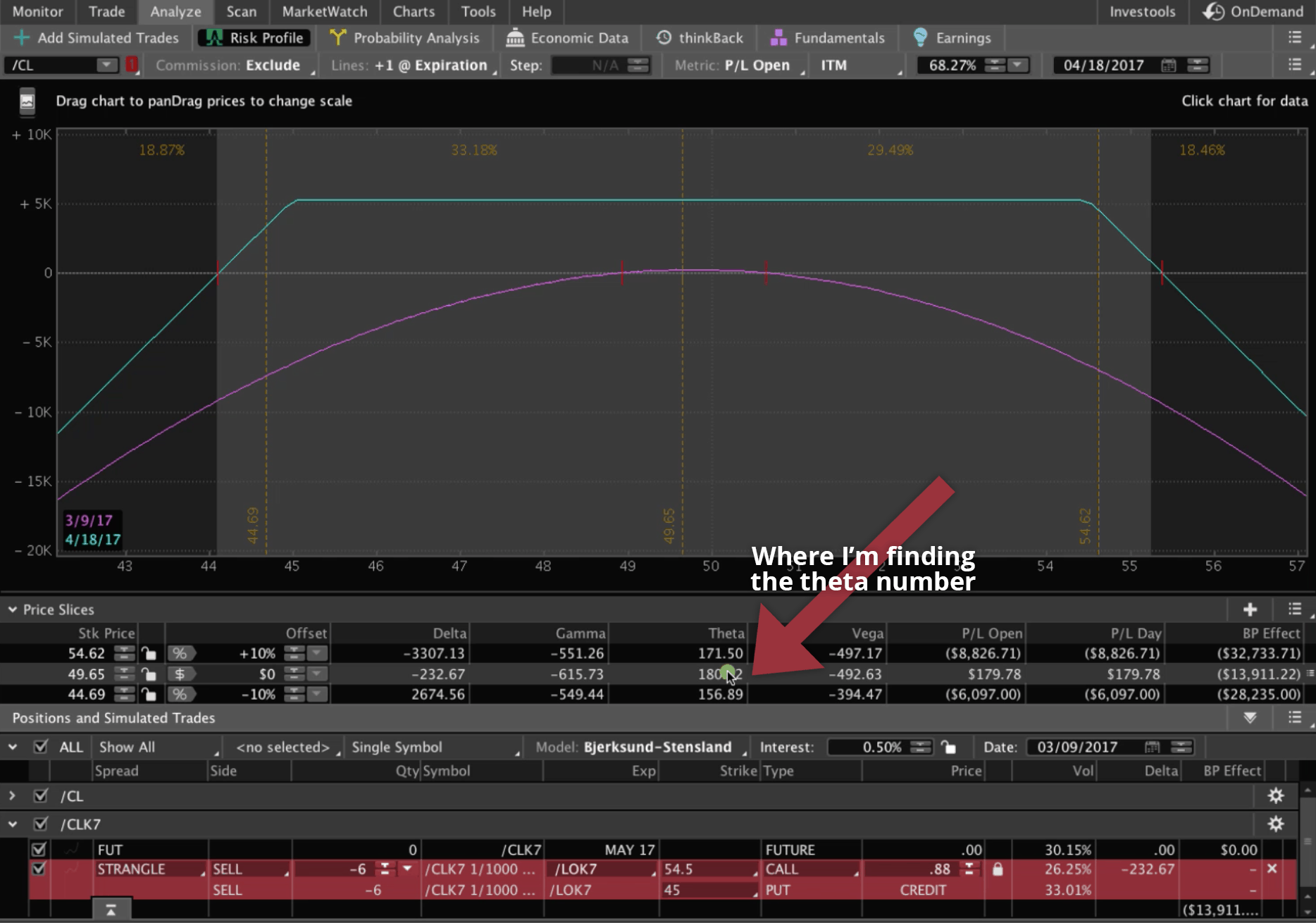

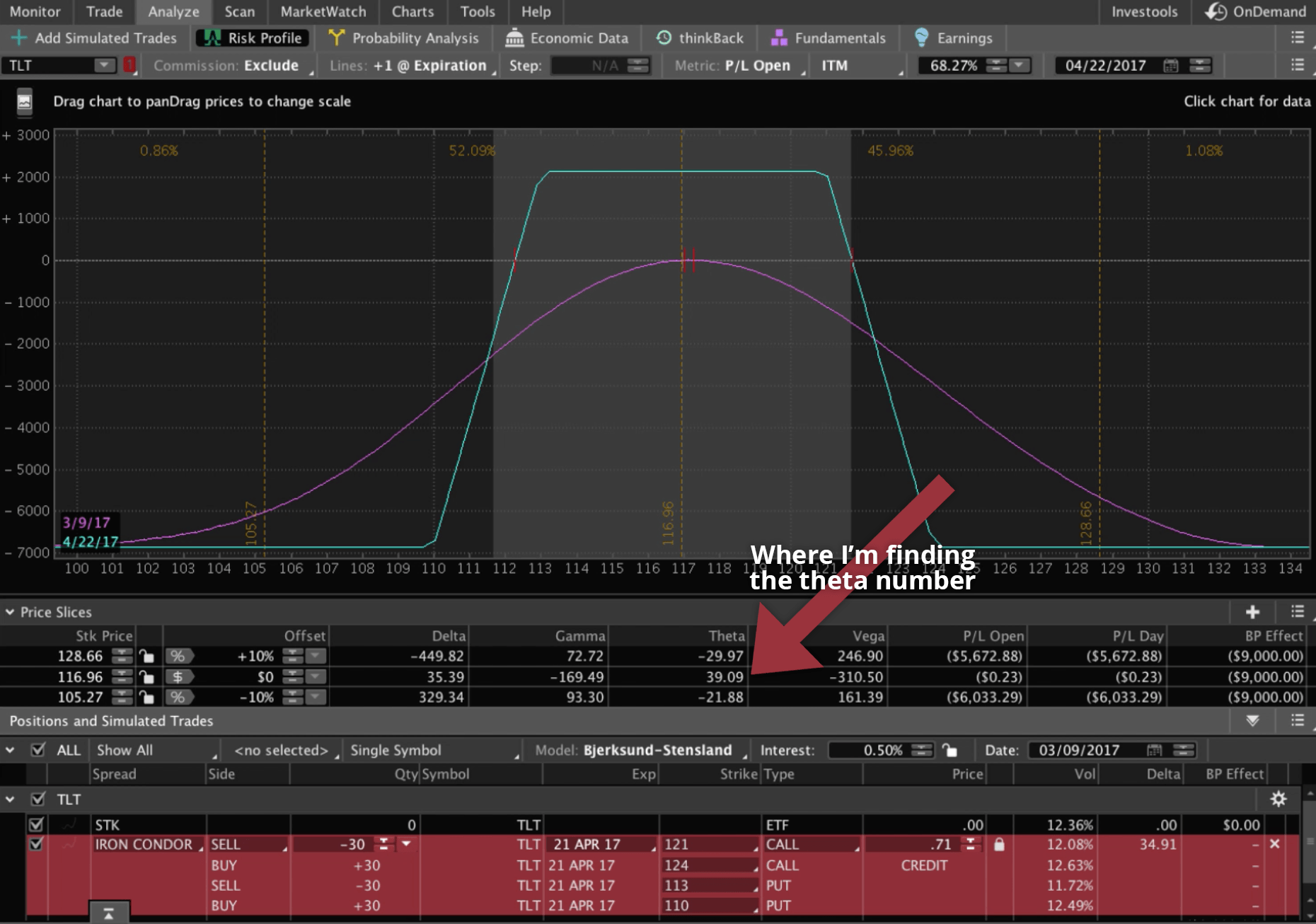

Let’s look at a couple examples on the ThinkorSwim platform, so you understand where these numbers are coming from.

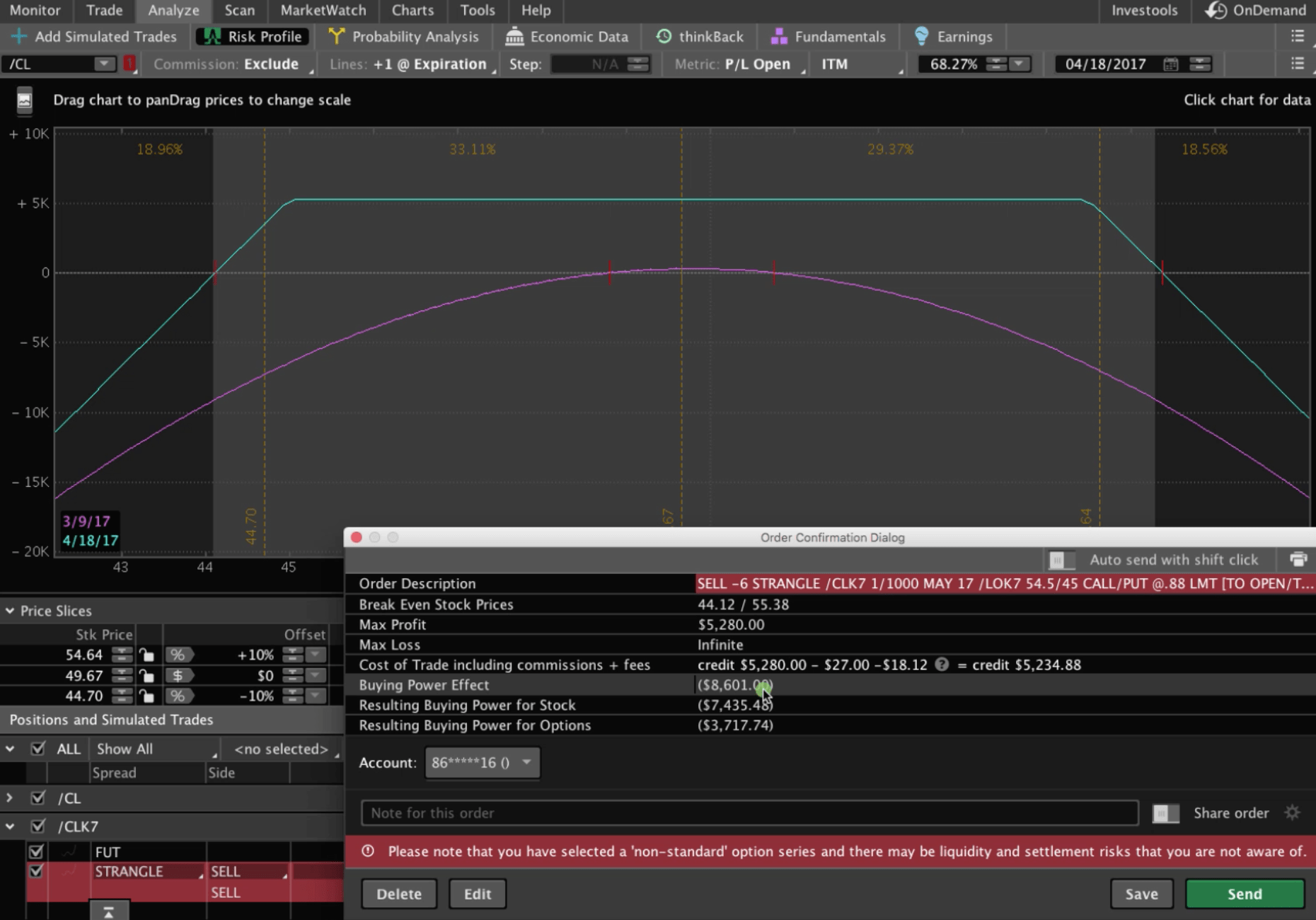

/CL Strangle

To find the theta number, you’re simply going to input your strategy. To use around $9,000 in buying capital, I’ve entered 6 contracts. If you right-click, and hit “Confirm and send”, you can see $8,601 is what the initial margin would be to put on this trade. So, that’s where I’m coming up with 6 contracts.

Then, you can move the hash mark to exactly where price is, and that’s going to give you your theta. So in this case, it’s 180.

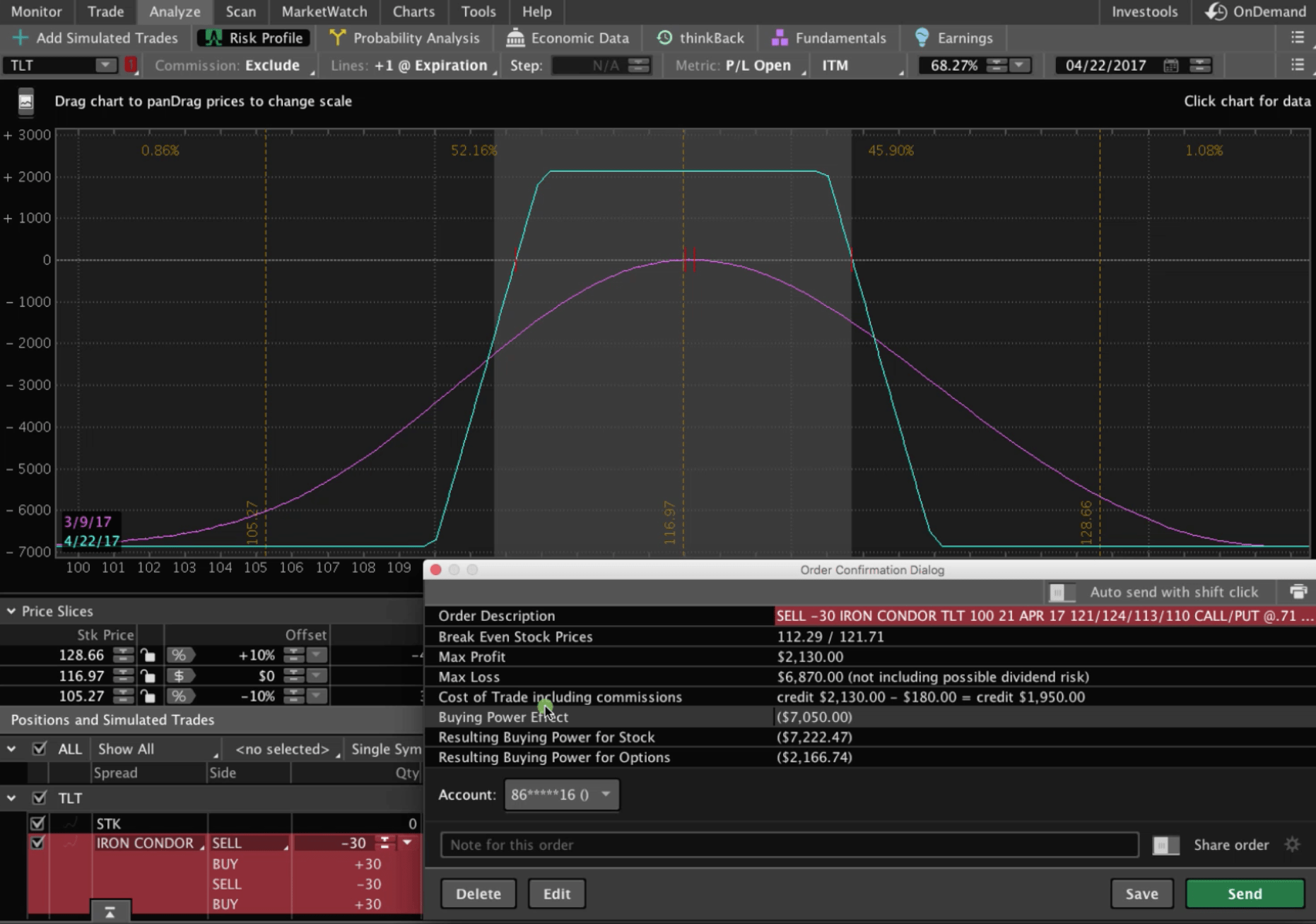

TLT Iron Condor

We can do the same thing with another example, like the TLT Iron Condor. I initially entered 30 contracts to get to that $9,000. If I right-click the order, and hit “Confirm and send”, it’s at $7,050. So, it’s a little bit under the $9,000 in margin requirement.

The theta is 39.

Again, some of these are a little bit over 9,000, and some are under. But, that theta number is what we’re focusing on.

Theta Isn’t a Static Number

And keep in mind, the theta number will change as price moves around. Depending on what volatility does, that’s going to fluctuate as well, which effects the theta.

Theta is not a static number. It’s a theoretical number based on where price is today, and where volatility is today. Obviously, theta is going to change.

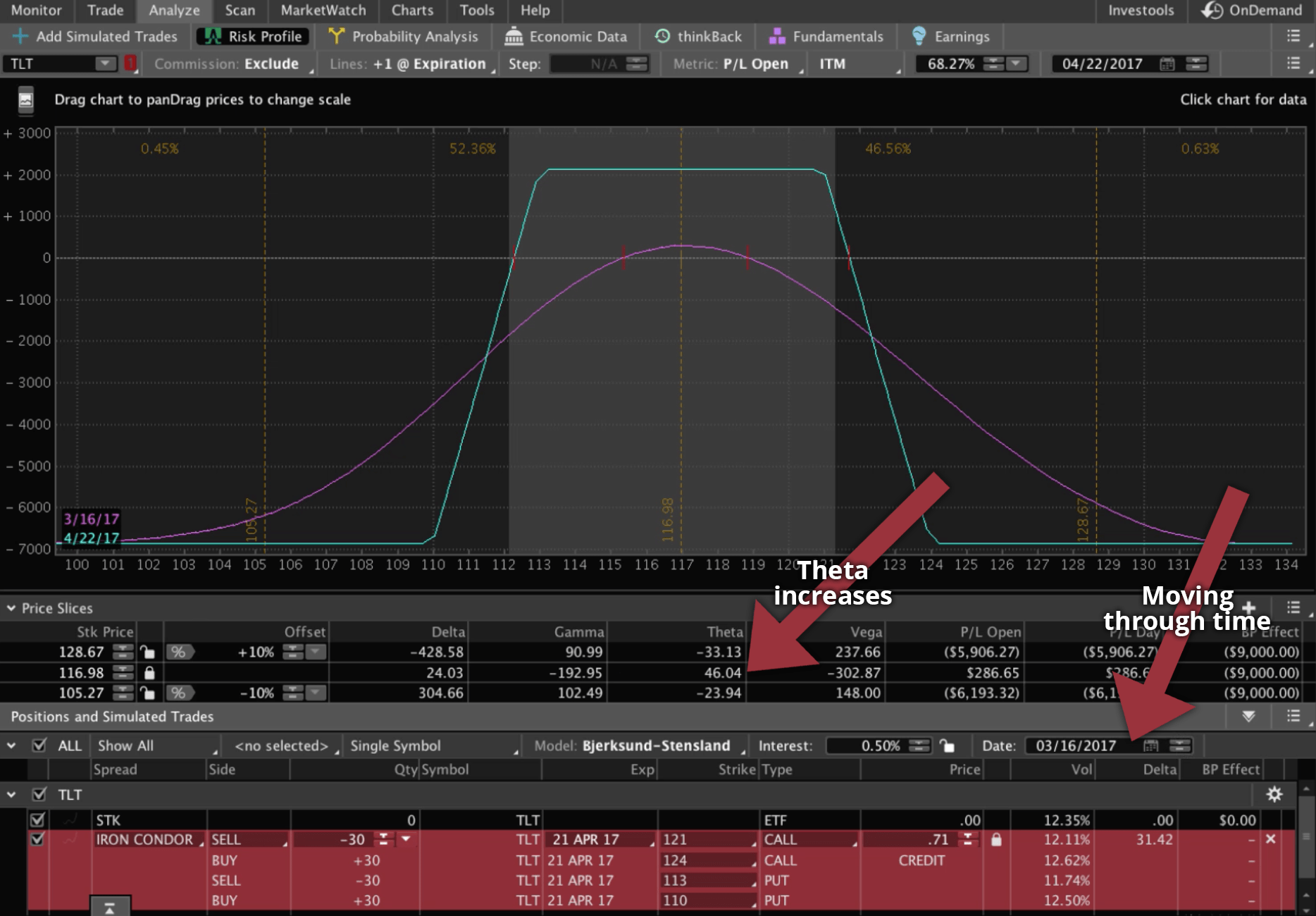

If we move this position through time, look at how the theta number increases.

The “Daily Theta” column is the initial theta that day. As you get closer and closer to expiration, that theta number, each day, is going to grow. That’s based on price and volatility staying unchanged.

That’s how the theta component works, and that’s how you can help project.

Once you have the daily theta. You’d multiple that times 30 to get the monthly theta number. If we add all monthly theta amounts, our total monthly theta amount is $27,450.

Not every trade is going to be a winner. We’re taking these trades off at a percent of max profit, and we’re redeploying that capital. What you’ll find over time, is that a realistic expectation is to keep 25-30% of that theta each month on average.

Conservatively, if I take 25% of $27,450, based on these assumptions, you could project to make about $6,862.50.

$6,862.50 times 12 months, and you’re looking at profits of $82,350 a year. You’ve got to do this kind of theoretical projection based on your portfolio size, and based on the amount of theta that you have going on at any given time.

If you look at your account, and you total up your total daily theta, then multiply that times 30, that’ll give you an idea of what your monthly theta is. Then, based on winning percentages and managing trades, you can get an idea that about 25-30% of that is what you’ll actually keep.

I hope this lesson has been helpful! I’m trying to be as realistic as possible, because there’s so much hype out there about how much money you can make trading options, and I’m all about giving you guys real value, real life situational expectations to help you become the best traders possible. If your dream is to become a professional trader, hopefully this helps in getting you to that place where you want to be.

If you’re interested in learning the strategies that we teach at NavigationTrading, sign up for our 14-day Pro Membership trial. You’ll get instant access to our VIP course training, NavigationALERTS, watch lists, indicators, and more.

We look forward to seeing you on the inside.

Happy Trading!

-The NavigationTrading Team

Follow